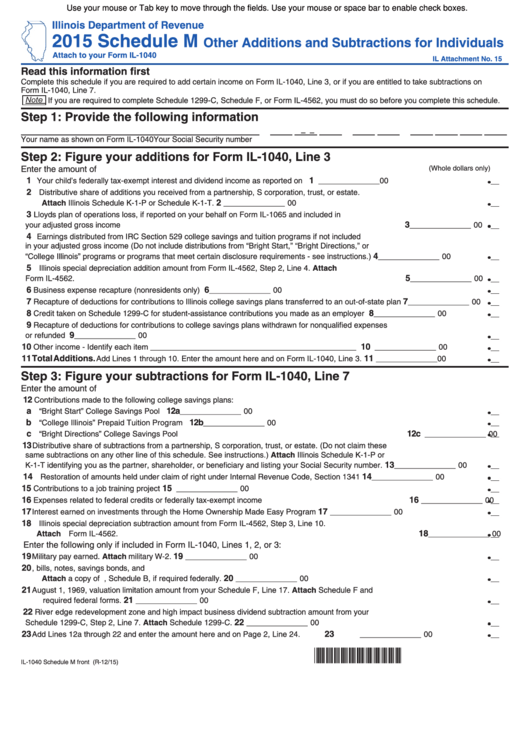

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

2015 Schedule M

Other Additions and Subtractions for Individuals

Attach to your Form IL-1040

IL Attachment No. 15

Read this information first

Complete this schedule if you are required to add certain income on Form IL-1040, Line 3, or if you are entitled to take subtractions on

Form IL-1040, Line 7.

If you are required to complete Schedule 1299-C, Schedule F, or Form IL-4562, you must do so before you complete this schedule.

Step 1: Provide the following information

–

–

Your name as shown on Form IL-1040

Your Social Security number

Step 2: Figure your additions for Form IL-1040, Line 3

Enter the amount of

(Whole dollars only)

1

1

Your child’s federally tax-exempt interest and dividend income as reported on U.S. Form 8814

______________ 00

2

Distributive share of additions you received from a partnership, S corporation, trust, or estate.

2

Attach Illinois Schedule K-1-P or Schedule K-1-T.

______________ 00

3

Lloyds plan of operations loss, if reported on your behalf on Form IL-1065 and included in

3

your adjusted gross income

______________ 00

4

Earnings distributed from IRC Section 529 college savings and tuition programs if not included

in your adjusted gross income (Do not include distributions from “Bright Start,” “Bright Directions,” or

4

“College Illinois” programs or programs that meet certain disclosure requirements - see instructions.)

______________ 00

5

Illinois special depreciation addition amount from Form IL-4562, Step 2, Line 4. Attach

5

Form IL-4562.

______________ 00

6

6

Business expense recapture (nonresidents only)

______________ 00

7

7

Recapture of deductions for contributions to Illinois college savings plans transferred to an out-of-state plan

______________ 00

8

8

Credit taken on Schedule 1299-C for student-assistance contributions you made as an employer

______________ 00

9

Recapture of deductions for contributions to college savings plans withdrawn for nonqualified expenses

9

or refunded

______________ 00

10

10

Other income - Identify each item _______________________________________________

______________ 00

11 Total Additions.

11

Add Lines 1 through 10. Enter the amount here and on Form IL-1040, Line 3.

______________ 00

Step 3: Figure your subtractions for Form IL-1040, Line 7

Enter the amount of

12

Contributions made to the following college savings plans:

a

12a

“Bright Start” College Savings Pool

______________ 00

b

12b

“College Illinois” Prepaid Tuition Program

______________ 00

c

12c

“Bright Directions” College Savings Pool

______________ 00

13

Distributive share of subtractions from a partnership, S corporation, trust, or estate. (Do not claim these

same subtractions on any other line of this schedule. See instructions.) Attach Illinois Schedule K-1-P or

13

K-1-T identifying you as the partner, shareholder, or beneficiary and listing your Social Security number.

______________ 00

14

14

Restoration of amounts held under claim of right under Internal Revenue Code, Section 1341

______________ 00

15

15

Contributions to a job training project

______________ 00

16

16

Expenses related to federal credits or federally tax-exempt income

______________ 00

17

17

Interest earned on investments through the Home Ownership Made Easy Program

______________ 00

18

Illinois special depreciation subtraction amount from Form IL-4562, Step 3, Line 10.

18

Attach Form IL-4562.

______________ 00

Enter the following only if included in Form IL-1040, Lines 1, 2, or 3:

19

19

Military pay earned. Attach military W-2.

______________ 00

20

U.S. Treasury bonds, bills, notes, savings bonds, and U.S. agency interest from U.S. 1040A or 1040.

20

Attach a copy of U.S. 1040A or 1040, Schedule B, if required federally.

______________ 00

21

August 1, 1969, valuation limitation amount from your Schedule F, Line 17. Attach Schedule F and

21

required federal forms.

______________ 00

22

River edge redevelopment zone and high impact business dividend subtraction amount from your

22

Schedule 1299-C, Step 2, Line 7. Attach Schedule 1299-C.

______________ 00

23

23

Add Lines 12a through 22 and enter the amount here and on Page 2, Line 24.

______________ 00

*560401110*

IL-1040 Schedule M front (R-12/15)

1

1 2

2