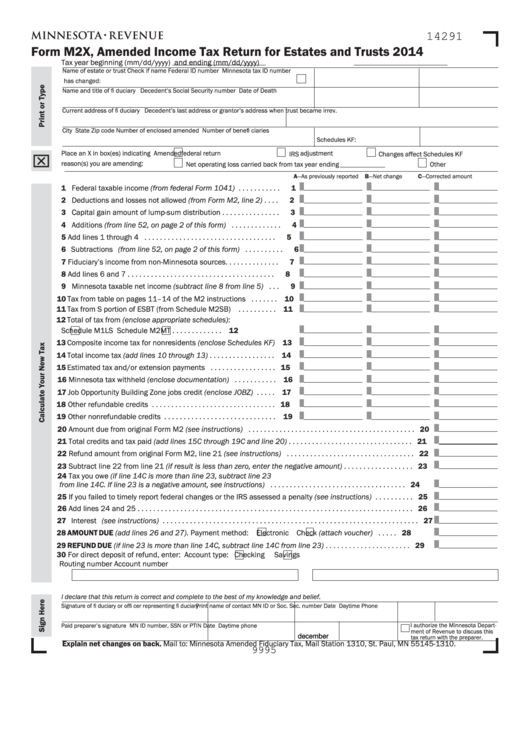

14291

Form M2X, Amended Income Tax Return for Estates and Trusts 2014

Tax year beginning (mm/dd/yyyy)

and ending (mm/dd/yyyy)

Name of estate or trust

Check if name

Federal ID number

Minnesota tax ID number

has changed:

Name and title of fi duciary

Decedent’s Social Security number

Date of Death

Current address of fi duciary

Decedent’s last address or grantor’s address when trust became irrev.

City

State

Zip code

Number of enclosed amended

Number of benefi ciaries

Schedules KF:

Place an X in box(es) indicating

Amended federal return

IRS adjustment

Changes affect Schedules KF

reason(s) you are amending:

Net operating loss carried back from tax year ending

Other

A—As previously reported

B—Net change

C—Corrected amount

1 Federal taxable income (from federal Form 1041) . . . . . . . . . . .

1

2 Deductions and losses not allowed (from Form M2, line 2) . . . .

2

3 Capital gain amount of lump-sum distribution . . . . . . . . . . . . . . .

3

4 Additions (from line 52, on page 2 of this form) . . . . . . . . . . . . .

4

5 Add lines 1 through 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Subtractions (from line 52, on page 2 of this form) . . . . . . . . . .

6

7 Fiduciary’s income from non-Minnesota sources. . . . . . . . . . . . . .

7

8 Add lines 6 and 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9 Minnesota taxable net income (subtract line 8 from line 5) . . .

9

10 Tax from table on pages 11–14 of the M2 instructions . . . . . . . 10

11 Tax from S portion of ESBT (from Schedule M2SB) . . . . . . . . . . 11

12 Total of tax from (enclose appropriate schedules):

Schedule M1LS

Schedule M2MT . . . . . . . . . . . . . 12

13 Composite income tax for nonresidents (enclose Schedules KF) 13

14 Total income tax (add lines 10 through 13) . . . . . . . . . . . . . . . . . 14

15 Estimated tax and/or extension payments . . . . . . . . . . . . . . . . . 15

16 Minnesota tax withheld (enclose documentation) . . . . . . . . . . . 16

17 Job Opportunity Building Zone jobs credit (enclose JOBZ) . . . . . 17

18 Other refundable credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Other nonrefundable credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

20 Amount due from original Form M2 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

21 Total credits and tax paid (add lines 15C through 19C and line 20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

22 Refund amount from original Form M2, line 21 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

23 Subtract line 22 from line 21 (if result is less than zero, enter the negative amount) . . . . . . . . . . . . . . . . . . 23

24 Tax you owe (if line 14C is more than line 23, subtract line 23

from line 14C. If line 23 is a negative amount, see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

25 If you failed to timely report federal changes or the IRS assessed a penalty (see instructions) . . . . . . . . . . 25

26 Add lines 24 and 25 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

27 Interest (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

28 AMOUNT DUE (add lines 26 and 27). Payment method:

Electronic

Check (attach voucher) . . . . . 28

29 REFUND DUE (if line 23 is more than line 14C, subtract line 14C from line 23) . . . . . . . . . . . . . . . . . . . . . . 29

30 For direct deposit of refund, enter: Account type:

Checking

Savings

Routing number

Account number

I declare that this return is correct and complete to the best of my knowledge and belief.

Signature of fi duciary or offi cer representing fi duciary

Print name of contact

MN ID or Soc. Sec. number

Date

Daytime Phone

I authorize the Minnesota Depart-

Paid preparer’s signature

MN ID number, SSN or PTIN

Date

Daytime phone

ment of Revenue to discuss this

tax return with the preparer.

Explain net changes on back. Mail to: Minnesota Amended Fiduciary Tax, Mail Station 1310, St. Paul, MN 55145-1310.

9995

1

1 2

2 3

3 4

4