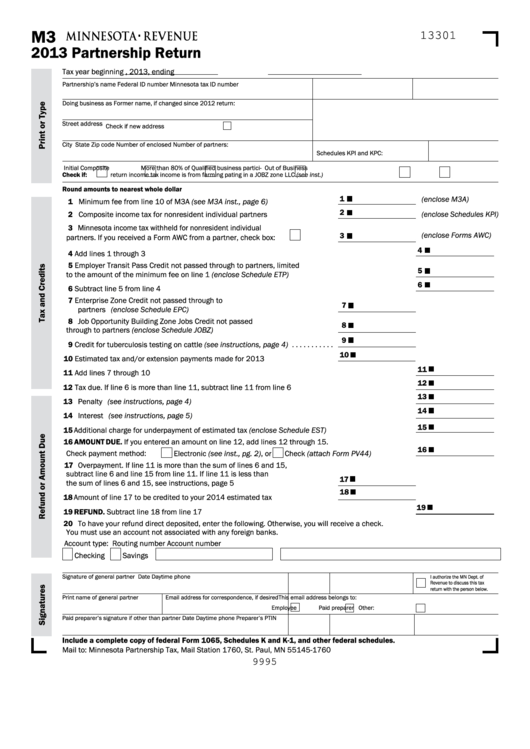

M3

13301

2013 Partnership Return

Tax year beginning

, 2013, ending

Partnership’s name

Federal ID number

Minnesota tax ID number

Doing business as

Former name, if changed since 2012 return:

Street address

Check if new address

City

State

Zip code

Number of enclosed

Number of partners:

Schedules KPI and KPC:

Initial

Composite

More than 80% of

Qualified business partici-

Out of Business

Check if:

return

income tax

income is from farming

pating in a JOBZ zone

LLC

(see inst.)

Round amounts to nearest whole dollar

1

(enclose M3A)

1 Minimum fee from line 10 of M3A (see M3A inst., page 6) . . . . . . . . . . . . . . . . .

2

(enclose Schedules KPI)

2 Composite income tax for nonresident individual partners . . . . . . . . . . . . . . . . .

3 Minnesota income tax withheld for nonresident individual

(enclose Forms AWC)

3

partners . If you received a Form AWC from a partner, check box:

. . . . . . . .

4

4 Add lines 1 through 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Employer Transit Pass Credit not passed through to partners, limited

5

to the amount of the minimum fee on line 1 (enclose Schedule ETP) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

6 Subtract line 5 from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 Enterprise Zone Credit not passed through to

7

partners (enclose Schedule EPC) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 Job Opportunity Building Zone Jobs Credit not passed

8

through to partners (enclose Schedule JOBZ) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

9 Credit for tuberculosis testing on cattle (see instructions, page 4) . . . . . . . . . . .

10

10 Estimated tax and/or extension payments made for 2013 . . . . . . . . . . . . . . . . .

11

11 Add lines 7 through 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

12 Tax due . If line 6 is more than line 11, subtract line 11 from line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

13 Penalty (see instructions, page 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

14 Interest (see instructions, page 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

15 Additional charge for underpayment of estimated tax (enclose Schedule EST) . . . . . . . . . . . . . . . . . . . . .

16 AMOUNT DUE. If you entered an amount on line 12, add lines 12 through 15 .

16

Check payment method:

Electronic (see inst., pg. 2), or

Check (attach Form PV44) . . . . . . . . . .

17 Overpayment. If line 11 is more than the sum of lines 6 and 15,

subtract line 6 and line 15 from line 11 . If line 11 is less than

17

the sum of lines 6 and 15, see instructions, page 5 . . . . . . . . . . . . . . . . . . . . . . .

18

18 Amount of line 17 to be credited to your 2014 estimated tax . . . . . . . . . . . . . . .

19

19 REFUND. Subtract line 18 from line 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20 To have your refund direct deposited, enter the following. Otherwise, you will receive a check.

You must use an account not associated with any foreign banks .

Account type:

Routing number

Account number

Checking

Savings

Signature of general partner

Date

Daytime phone

I authorize the MN Dept. of

Revenue to discuss this tax

return with the person below .

Print name of general partner

Email address for correspondence, if desired

This email address belongs to:

Employee

Paid preparer

Other:

Paid preparer’s signature if other than partner

Date

Daytime phone

Preparer’s PTIN

Include a complete copy of federal Form 1065, Schedules K and K-1, and other federal schedules.

Mail to: Minnesota Partnership Tax, Mail Station 1760, St. Paul, MN 55145-1760

9995

1

1 2

2