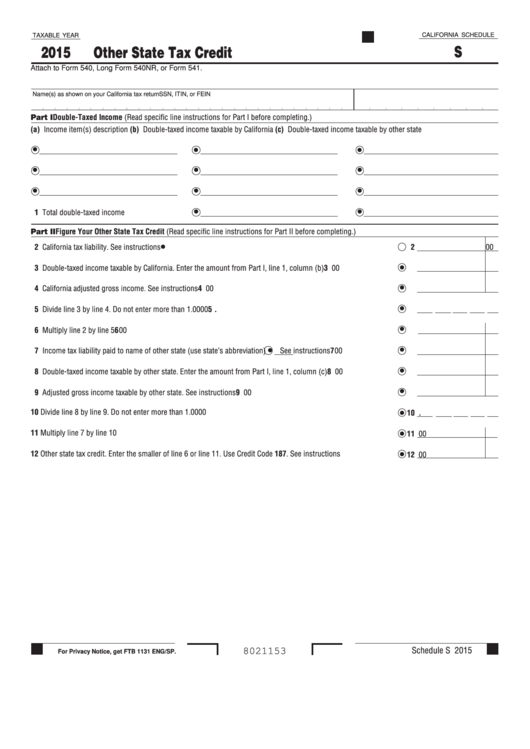

CALIFORNIA SCHEDULE

TAXABLE YEAR

S

2015

Other State Tax Credit

Attach to Form 540, Long Form 540NR, or Form 541.

Name(s) as shown on your California tax return

SSN, ITIN, or FEIN

Part I Double-Taxed Income (Read specific line instructions for Part I before completing.)

(a) Income item(s) description

(b) Double-taxed income taxable by California

(c) Double-taxed income taxable by other state

1 Total double-taxed income

Part II Figure Your Other State Tax Credit (Read specific line instructions for Part II before completing.)

2 California tax liability. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

3 Double-taxed income taxable by California. Enter the amount from Part I, line 1, column (b). . . . . . . . . . . . . . . . . . . .

3

00

4 California adjusted gross income. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

00

5 Divide line 3 by line 4. Do not enter more than 1.0000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

.

6 Multiply line 2 by line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

7 Income tax liability paid to name of other state (use state’s abbreviation)

See instructions . . . . . . . . . . . . .

7

00

8 Double-taxed income taxable by other state. Enter the amount from Part I, line 1, column (c) . . . . . . . . . . . . . . . . . . .

8

00

9 Adjusted gross income taxable by other state. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

00

10 Divide line 8 by line 9. Do not enter more than 1.0000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

.

11 Multiply line 7 by line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

00

12 Other state tax credit. Enter the smaller of line 6 or line 11. Use Credit Code 187. See instructions . . . . . . . . . . . . . . .

12

00

Schedule S 2015

8021153

For Privacy Notice, get FTB 1131 ENG/SP.

1

1 2

2 3

3