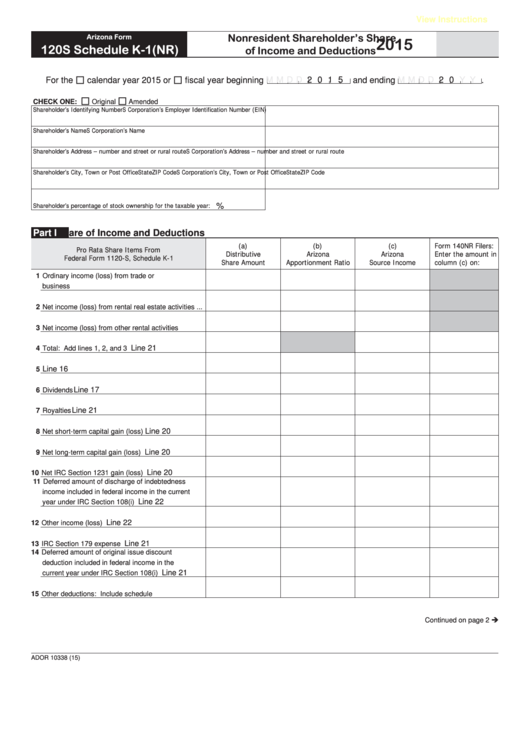

View Instructions

Nonresident Shareholder’s Share

Arizona Form

2015

120S Schedule K-1(NR)

of Income and Deductions

M M D D

2 0 1 5 and ending

M M D D

2 0

Y Y

For the

calendar year 2015 or

fiscal year beginning

.

CHECK ONE:

Original

Amended

Shareholder’s Identifying Number

S Corporation’s Employer Identification Number (EIN)

Shareholder’s Name

S Corporation’s Name

Shareholder’s Address – number and street or rural route

S Corporation’s Address – number and street or rural route

Shareholder’s City, Town or Post Office

State ZIP Code

S Corporation’s City, Town or Post Office

State ZIP Code

Shareholder’s percentage of stock ownership for the taxable year:

%

Part I

Share of Income and Deductions

(a)

(b)

(c)

Form 140NR Filers:

Pro Rata Share Items From

Distributive

Arizona

Arizona

Enter the amount in

Federal Form 1120-S, Schedule K-1

Share Amount

Apportionment Ratio

Source Income

column (c) on:

1 Ordinary income (loss) from trade or

business activities.....................................................

2 Net income (loss) from rental real estate activities ...

3 Net income (loss) from other rental activities ...........

Line 21

4 Total: Add lines 1, 2, and 3 ......................................

Line 16

5 Interest......................................................................

Line 17

6 Dividends ..................................................................

Line 21

7 Royalties ...................................................................

Line 20

8 Net short-term capital gain (loss)..............................

Line 20

9 Net long-term capital gain (loss) ...............................

Line 20

10 Net IRC Section 1231 gain (loss) .............................

11 Deferred amount of discharge of indebtedness

income included in federal income in the current

Line 22

year under IRC Section 108(i) ..................................

Line 22

12 Other income (loss) ..................................................

Line 21

13 IRC Section 179 expense .........................................

14 Deferred amount of original issue discount

deduction included in federal income in the

Line 21

current year under IRC Section 108(i) ......................

15 Other deductions: Include schedule ........................

Continued on page 2

ADOR 10338 (15)

1

1 2

2 3

3