Schedule M1wfc - Minnesota Working Family Credit - 2014

ADVERTISEMENT

20

1444

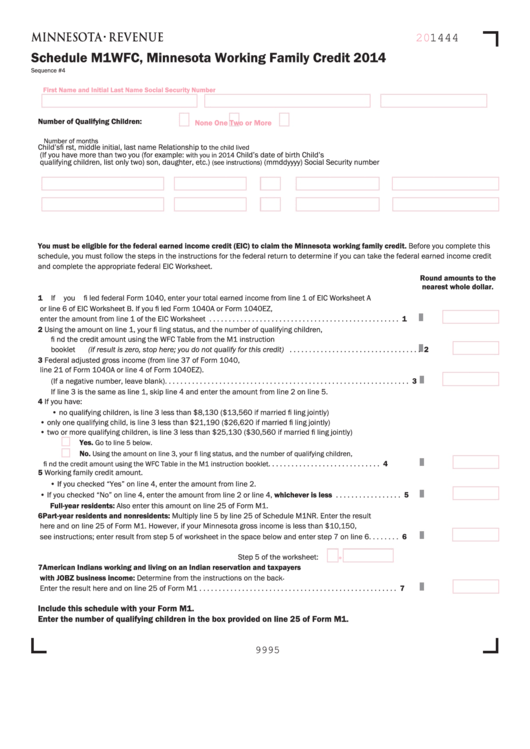

Schedule M1WFC, Minnesota Working Family Credit 2014

Sequence #4

First Name and Initial

Last Name

Social Security Number

Number of Qualifying Children:

None

One

Two or More

Number of months

Child’s fi rst, middle initial, last name

Relationship to

the child lived

(If you have more than two

you (for example:

Child’s date of birth

Child’s

with you in 2014

qualifying children, list only two)

son, daughter, etc.)

(mmddyyyy)

Social Security number

(see instructions)

You must be eligible for the federal earned income credit (EIC) to claim the Minnesota working family credit. Before you complete this

schedule, you must follow the steps in the instructions for the federal return to determine if you can take the federal earned income credit

and complete the appropriate federal EIC Worksheet.

If you were required to fi le Schedule M1NC.

Round amounts to the

nearest whole dollar.

1

If you fi led federal Form 1040, enter your total earned income from line 1 of EIC Worksheet A

or line 6 of EIC Worksheet B. If you fi led Form 1040A or Form 1040EZ,

enter the amount from line 1 of the EIC Worksheet . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2

Using the amount on line 1, your fi ling status, and the number of qualifying children,

fi nd the credit amount using the WFC Table from the M1 instruction

booklet (if result is zero, stop here; you do not qualify for this credit) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3

Federal adjusted gross income (from line 37 of Form 1040,

line 21 of Form 1040A or line 4 of Form 1040EZ).

(If a negative number, leave blank). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

If line 3 is the same as line 1, skip line 4 and enter the amount from line 2 on line 5.

4

If you have:

• no qualifying children, is line 3 less than $8,130 ($13,560 if married fi ling jointly)

• only one qualifying child, is line 3 less than $21,190 ($26,620 if married fi ling jointly)

• two or more qualifying children, is line 3 less than $25,130 ($30,560 if married fi ling jointly)

Yes.

Go to line 5 below.

No.

Using the amount on line 3, your fi ling status, and the number of qualifying children,

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

fi nd the credit amount using the WFC Table in the M1 instruction booklet

5 Working family credit amount.

• If you checked “Yes” on line 4, enter the amount from line 2.

• If you checked “No” on line 4, enter the amount from line 2 or line 4, whichever is less . . . . . . . . . . . . . . . . . 5

Full-year residents: Also enter this amount on line 25 of Form M1.

6 Part-year residents and nonresidents: Multiply line 5 by line 25 of Schedule M1NR. Enter the result

here and on line 25 of Form M1. However, if your Minnesota gross income is less than $10,150,

see instructions; enter result from step 5 of worksheet in the space below and enter step 7 on line 6 . . . . . . . . 6

.

Step 5 of the worksheet:

7

American Indians working and living on an Indian reservation and taxpayers

with JOBZ business income: Determine from the instructions on the back .

Enter the result here and on line 25 of Form M1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Include this schedule with your Form M1.

Enter the number of qualifying children in the box provided on line 25 of Form M1.

9995

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2