Instructions For Form 340 - Arizona Credit For Donations To The Military Family Relief Fund - 2014

ADVERTISEMENT

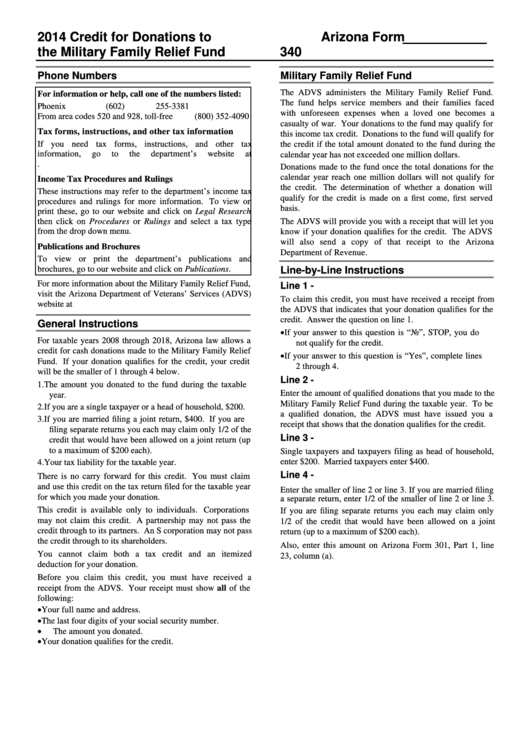

2014 Credit for Donations to

Arizona Form

the Military Family Relief Fund

340

Phone Numbers

Military Family Relief Fund

The ADVS administers the Military Family Relief Fund.

For information or help, call one of the numbers listed:

The fund helps service members and their families faced

Phoenix

(602) 255-3381

with unforeseen expenses when a loved one becomes a

From area codes 520 and 928, toll-free

(800) 352-4090

casualty of war. Your donations to the fund may qualify for

Tax forms, instructions, and other tax information

this income tax credit. Donations to the fund will qualify for

If you need tax forms, instructions, and other tax

the credit if the total amount donated to the fund during the

information,

go

to

the

department’s

website

at

calendar year has not exceeded one million dollars.

Donations made to the fund once the total donations for the

calendar year reach one million dollars will not qualify for

Income Tax Procedures and Rulings

the credit. The determination of whether a donation will

These instructions may refer to the department’s income tax

qualify for the credit is made on a first come, first served

procedures and rulings for more information. To view or

basis.

print these, go to our website and click on Legal Research

then click on Procedures or Rulings and select a tax type

The ADVS will provide you with a receipt that will let you

from the drop down menu.

know if your donation qualifies for the credit. The ADVS

will also send a copy of that receipt to the Arizona

Publications and Brochures

Department of Revenue.

To view or print the department’s publications and

brochures, go to our website and click on Publications.

Line-by-Line Instructions

For more information about the Military Family Relief Fund,

Line 1 -

visit the Arizona Department of Veterans’ Services (ADVS)

To claim this credit, you must have received a receipt from

website at

the ADVS that indicates that your donation qualifies for the

credit. Answer the question on line 1.

General Instructions

If your answer to this question is “No”, STOP, you do

For taxable years 2008 through 2018, Arizona law allows a

not qualify for the credit.

credit for cash donations made to the Military Family Relief

If your answer to this question is “Yes”, complete lines

Fund. If your donation qualifies for the credit, your credit

2 through 4.

will be the smaller of 1 through 4 below.

Line 2 -

1. The amount you donated to the fund during the taxable

Enter the amount of qualified donations that you made to the

year.

Military Family Relief Fund during the taxable year. To be

2. If you are a single taxpayer or a head of household, $200.

a qualified donation, the ADVS must have issued you a

3. If you are married filing a joint return, $400. If you are

receipt that shows that the donation qualifies for the credit.

filing separate returns you each may claim only 1/2 of the

Line 3 -

credit that would have been allowed on a joint return (up

to a maximum of $200 each).

Single taxpayers and taxpayers filing as head of household,

enter $200. Married taxpayers enter $400.

4. Your tax liability for the taxable year.

Line 4 -

There is no carry forward for this credit. You must claim

and use this credit on the tax return filed for the taxable year

Enter the smaller of line 2 or line 3. If you are married filing

for which you made your donation.

a separate return, enter 1/2 of the smaller of line 2 or line 3.

This credit is available only to individuals. Corporations

If you are filing separate returns you each may claim only

may not claim this credit. A partnership may not pass the

1/2 of the credit that would have been allowed on a joint

credit through to its partners. An S corporation may not pass

return (up to a maximum of $200 each).

the credit through to its shareholders.

Also, enter this amount on Arizona Form 301, Part 1, line

You cannot claim both a tax credit and an itemized

23, column (a).

deduction for your donation.

Before you claim this credit, you must have received a

receipt from the ADVS. Your receipt must show all of the

following:

Your full name and address.

The last four digits of your social security number.

The amount you donated.

Your donation qualifies for the credit.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1