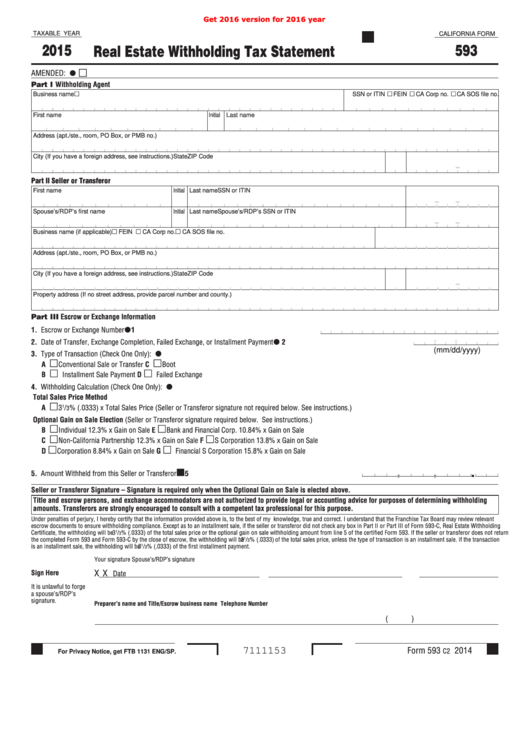

Get 2016 version for 2016 year

TAXABLE YEAR

CALIFORNIA FORM

2015

593

Real Estate Withholding Tax Statement

I

AMENDED:

Part I Withholding Agent

SSN or ITIN FEIN CA Corp no . CA SOS file no .

Business name

First name

Initial Last name

Address (apt ./ste ., room, PO Box, or PMB no .)

City (If you have a foreign address, see instructions .)

State

ZIP Code

-

Part II Seller or Transferor

First name

Initial Last name

SSN or ITIN

- -

Spouse’s/RDP’s first name

Initial Last name

Spouse’s/RDP’s SSN or ITIN

- -

FEIN

CA Corp no . CA SOS file no .

Business name (if applicable)

Address (apt ./ste ., room, PO Box, or PMB no .)

City (If you have a foreign address, see instructions .)

State

ZIP Code

-

Property address (If no street address, provide parcel number and county .)

Part III Escrow or Exchange Information

I

1. Escrow or Exchange Number . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

I

2. Date of Transfer, Exchange Completion, Failed Exchange, or Installment Payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

I

(mm/dd/yyyy)

3. Type of Transaction (Check One Only):

A

Conventional Sale or Transfer

C

Boot

B

Installment Sale Payment

D

Failed Exchange

I

4. Withholding Calculation (Check One Only):

Total Sales Price Method

A

3

/

% (.0333) x Total Sales Price (Seller or Transferor signature not required below. See instructions.)

1

3

Optional Gain on Sale Election (Seller or Transferor signature required below. See instructions.)

B

Individual 12.3% x Gain on Sale

E

Bank and Financial Corp. 10.84% x Gain on Sale

C

Non-California Partnership 12.3% x Gain on Sale

F

S Corporation 13.8% x Gain on Sale

D

Corporation 8.84% x Gain on Sale

G

Financial S Corporation 15.8% x Gain on Sale

.

,

,

5. Amount Withheld from this Seller or Transferor . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

Seller or Transferor Signature – Signature is required only when the Optional Gain on Sale is elected above.

Title and escrow persons, and exchange accommodators are not authorized to provide legal or accounting advice for purposes of determining withholding

amounts. Transferors are strongly encouraged to consult with a competent tax professional for this purpose.

Under penalties of perjury, I hereby certify that the information provided above is, to the best of my knowledge, true and correct. I understand that the Franchise Tax Board may review relevant

escrow documents to ensure withholding compliance. Except as to an installment sale, if the seller or transferor did not check any box in Part II or Part III of Form 593-C, Real Estate Withholding

Certificate, the withholding will be 3

/

% (.0333) of the total sales price or the optional gain on sale withholding amount from line 5 of the certified Form 593. If the seller or transferor does not return

1

3

the completed Form 593 and Form 593-C by the close of escrow, the withholding will be 3

/

% (.0333) of the total sales price, unless the type of transaction is an installment sale. If the transaction

1

3

is an installment sale, the withholding will be 3

/

% (.0333) of the first installment payment.

1

3

Your signature

Spouse’s/RDP’s signature

X

X

Sign Here

Date

It is unlawful to forge

a spouse’s/RDP’s

signature.

Preparer’s name and Title/Escrow business name

Telephone Number

(

)

Form 593

2014

C2

7111153

For Privacy Notice, get FTB 1131 ENG/SP.

1

1 2

2 3

3 4

4 5

5