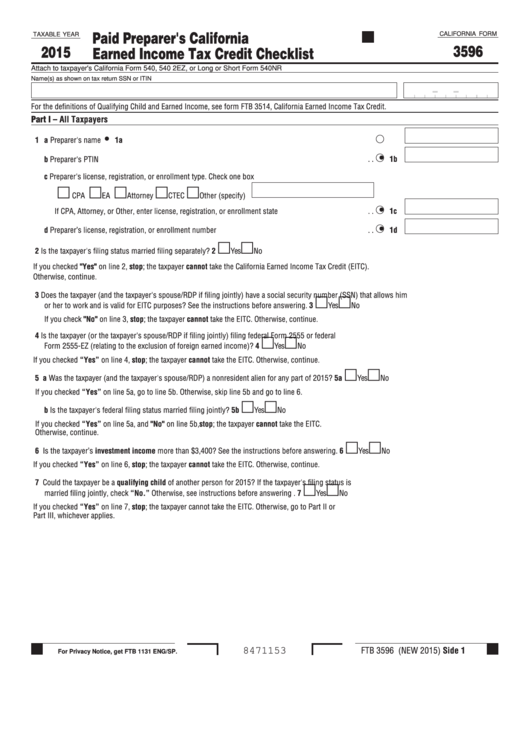

Form 3596 - Paid Preparer'S California Earned Income Tax Credit Checklist - 2015

ADVERTISEMENT

Paid Preparer's California

CALIFORNIA FORM

TAXABLE YEAR

3596

2015

Earned Income Tax Credit Checklist

Attach to taxpayer's California Form 540, 540 2EZ, or Long or Short Form 540NR

Name(s) as shown on tax return

SSN or ITIN

For the definitions of Qualifying Child and Earned Income, see form FTB 3514, California Earned Income Tax Credit.

Part I – All Taxpayers

1 a Preparer's name . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1a

b Preparer's PTIN . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. .

1b

c Preparer's license, registration, or enrollment type. Check one box

m

m

m

m

m

CPA

EA

Attorney

CTEC

Other (specify)

If CPA, Attorney, or Other, enter license, registration, or enrollment state . . . . . . . . . . . . . . . . . . . . . . .

. .

1c

d Preparer’s license, registration, or enrollment number . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. .

1d

m

m

2 Is the taxpayer's filing status married filing separately?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

Yes

No

If you checked "Yes" on line 2, stop; the taxpayer cannot take the California Earned Income Tax Credit (EITC).

Otherwise, continue.

3 Does the taxpayer (and the taxpayer's spouse/RDP if filing jointly) have a social security number (SSN) that allows him

m

m

or her to work and is valid for EITC purposes? See the instructions before answering.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Yes

No

If you check "No" on line 3, stop; the taxpayer cannot take the EITC. Otherwise, continue.

4 Is the taxpayer (or the taxpayer's spouse/RDP if filing jointly) filing federal Form 2555 or federal

m

m

Form 2555-EZ (relating to the exclusion of foreign earned income)?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

Yes

No

If you checked “Yes” on line 4, stop; the taxpayer cannot take the EITC. Otherwise, continue.

m

m

5 a Was the taxpayer (and the taxpayer's spouse/RDP) a nonresident alien for any part of 2015? . . . . . . . . . . . . . . . . . . . . . 5a

Yes

No

If you checked “Yes” on line 5a, go to line 5b. Otherwise, skip line 5b and go to line 6.

m

m

b Is the taxpayer's federal filing status married filing jointly? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5b

Yes

No

If you checked “Yes” on line 5a, and "No" on line 5b,stop; the taxpayer cannot take the EITC.

Otherwise, continue.

m

m

6 Is the taxpayer’s investment income more than $3,400? See the instructions before answering.. . . . . . . . . . . . . . . . . . . . . . 6

Yes

No

If you checked “Yes” on line 6, stop; the taxpayer cannot take the EITC. Otherwise, continue.

7 Could the taxpayer be a qualifying child of another person for 2015? If the taxpayer's filing status is

m

m

married filing jointly, check “No.” Otherwise, see instructions before answering . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Yes

No

If you checked “Yes” on line 7, stop; the taxpayer cannot take the EITC. Otherwise, go to Part II or

Part III, whichever applies.

FTB 3596 (NEW 2015) Side 1

8471153

For Privacy Notice, get FTB 1131 ENG/SP.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8