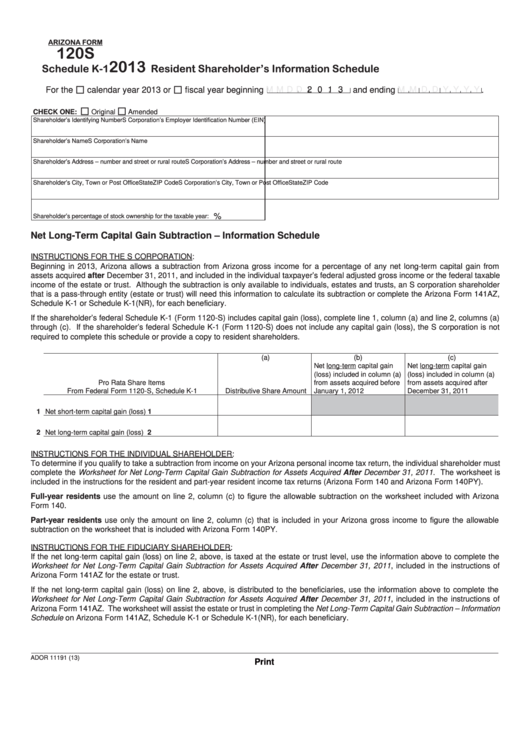

ARIZONA FORM

120S

2013

Schedule K-1

Resident Shareholder’s Information Schedule

M M D D

2 0 1 3 and ending

M M D D Y Y Y Y

For the

calendar year 2013 or

fiscal year beginning

.

CHECK ONE:

Original

Amended

Shareholder’s Identifying Number

S Corporation’s Employer Identification Number (EIN)

Shareholder’s Name

S Corporation’s Name

Shareholder’s Address – number and street or rural route

S Corporation’s Address – number and street or rural route

Shareholder’s City, Town or Post Office

State ZIP Code

S Corporation’s City, Town or Post Office

State ZIP Code

%

Shareholder’s percentage of stock ownership for the taxable year:

Net Long-Term Capital Gain Subtraction – Information Schedule

INSTRUCTIONS FOR THE S CORPORATION:

Beginning in 2013, Arizona allows a subtraction from Arizona gross income for a percentage of any net long-term capital gain from

assets acquired after December 31, 2011, and included in the individual taxpayer’s federal adjusted gross income or the federal taxable

income of the estate or trust. Although the subtraction is only available to individuals, estates and trusts, an S corporation shareholder

that is a pass-through entity (estate or trust) will need this information to calculate its subtraction or complete the Arizona Form 141AZ,

Schedule K-1 or Schedule K-1(NR), for each beneficiary.

If the shareholder’s federal Schedule K-1 (Form 1120-S) includes capital gain (loss), complete line 1, column (a) and line 2, columns (a)

through (c). If the shareholder’s federal Schedule K-1 (Form 1120-S) does not include any capital gain (loss), the S corporation is not

required to complete this schedule or provide a copy to resident shareholders.

(a)

(b)

(c)

Net long-term capital gain

Net long-term capital gain

(loss) included in column (a)

(loss) included in column (a)

Pro Rata Share Items

from assets acquired before

from assets acquired after

From Federal Form 1120-S, Schedule K-1

Distributive Share Amount

January 1, 2012

December 31, 2011

1 Net short-term capital gain (loss)................................ 1

2 Net long-term capital gain (loss) ................................. 2

INSTRUCTIONS FOR THE INDIVIDUAL SHAREHOLDER:

To determine if you qualify to take a subtraction from income on your Arizona personal income tax return, the individual shareholder must

complete the Worksheet for Net Long-Term Capital Gain Subtraction for Assets Acquired After December 31, 2011. The worksheet is

included in the instructions for the resident and part-year resident income tax returns (Arizona Form 140 and Arizona Form 140PY).

Full-year residents use the amount on line 2, column (c) to figure the allowable subtraction on the worksheet included with Arizona

Form 140.

Part-year residents use only the amount on line 2, column (c) that is included in your Arizona gross income to figure the allowable

subtraction on the worksheet that is included with Arizona Form 140PY.

INSTRUCTIONS FOR THE FIDUCIARY SHAREHOLDER:

If the net long-term capital gain (loss) on line 2, above, is taxed at the estate or trust level, use the information above to complete the

Worksheet for Net Long-Term Capital Gain Subtraction for Assets Acquired After December 31, 2011, included in the instructions of

Arizona Form 141AZ for the estate or trust.

If the net long-term capital gain (loss) on line 2, above, is distributed to the beneficiaries, use the information above to complete the

Worksheet for Net Long-Term Capital Gain Subtraction for Assets Acquired After December 31, 2011, included in the instructions of

Arizona Form 141AZ. The worksheet will assist the estate or trust in completing the Net Long-Term Capital Gain Subtraction – Information

Schedule on Arizona Form 141AZ, Schedule K-1 or Schedule K-1(NR), for each beneficiary.

ADOR 11191 (13)

Print

1

1