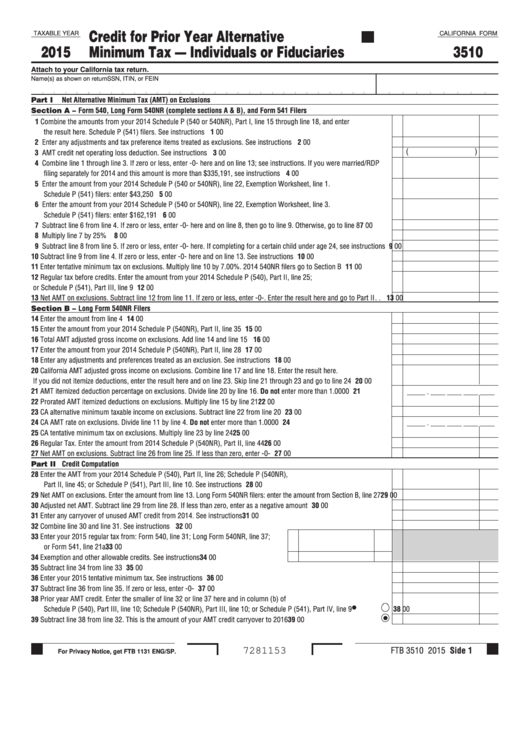

Credit for Prior Year Alternative

TAXABLE YEAR

CALIFORNIA FORM

2015

Minimum Tax — Individuals or Fiduciaries

3510

Attach to your California tax return.

Name(s) as shown on return

SSN, ITIN, or FEIN

Part I

Net Alternative Minimum Tax (AMT) on Exclusions

Section A – Form 540, Long Form 540NR (complete sections A & B), and Form 541 Filers

1 Combine the amounts from your 2014 Schedule P (540 or 540NR), Part I, line 15 through line 18, and enter

the result here. Schedule P (541) filers. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

00

2 Enter any adjustments and tax preference items treated as exclusions. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . 2

00

(

)

3 AMT credit net operating loss deduction. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

00

4 Combine line 1 through line 3. If zero or less, enter -0- here and on line 13; see instructions. If you were married/RDP

filing separately for 2014 and this amount is more than $335,191, see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

00

5 Enter the amount from your 2014 Schedule P (540 or 540NR), line 22, Exemption Worksheet, line 1.

Schedule P (541) filers: enter $43,250. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

00

6 Enter the amount from your 2014 Schedule P (540 or 540NR), line 22, Exemption Worksheet, line 3.

Schedule P (541) filers: enter $162,191. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

00

7 Subtract line 6 from line 4. If zero or less, enter -0- here and on line 8, then go to line 9. Otherwise, go to line 8 . . . . . . 7

00

8 Multiply line 7 by 25% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

00

9 Subtract line 8 from line 5. If zero or less, enter -0- here. If completing for a certain child under age 24, see instructions 9

00

10 Subtract line 9 from line 4. If zero or less, enter -0- here and on line 13. See instructions . . . . . . . . . . . . . . . . . . . . . . . . 10

00

11 Enter tentative minimum tax on exclusions. Multiply line 10 by 7.00%. 2014 540NR filers go to Section B . . . . . . . . . . . 11

00

12 Regular tax before credits. Enter the amount from your 2014 Schedule P (540), Part II, line 25;

or Schedule P (541), Part III, line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

00

13 Net AMT on exclusions. Subtract line 12 from line 11. If zero or less, enter -0-. Enter the result here and go to Part II . . 13

00

Section B – Long Form 540NR Filers

14 Enter the amount from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

00

15 Enter the amount from your 2014 Schedule P (540NR), Part II, line 35. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

00

16 Total AMT adjusted gross income on exclusions. Add line 14 and line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

00

17 Enter the amount from your 2014 Schedule P (540NR), Part II, line 28. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

00

18 Enter any adjustments and preferences treated as an exclusion. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

00

20 California AMT adjusted gross income on exclusions. Combine line 17 and line 18. Enter the result here.

If you did not itemize deductions, enter the result here and on line 23. Skip line 21 through 23 and go to line 24 . . . . . . 20

00

21 AMT itemized deduction percentage on exclusions. Divide line 20 by line 16. Do not enter more than 1.0000 . . . . . . . . . 21

_____ . ____ ____ ____ ____

22 Prorated AMT itemized deductions on exclusions. Multiply line 15 by line 21 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

00

23 CA alternative minimum taxable income on exclusions. Subtract line 22 from line 20. . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

00

24 CA AMT rate on exclusions. Divide line 11 by line 4. Do not enter more than 1.0000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

_____ . ____ ____ ____ ____

25 CA tentative minimum tax on exclusions. Multiply line 23 by line 24 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

00

26 Regular Tax. Enter the amount from 2014 Schedule P (540NR), Part II, line 44 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

00

27 Net AMT on exclusions. Subtract line 26 from line 25. If less than zero, enter -0-. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

00

Part II Credit Computation

28 Enter the AMT from your 2014 Schedule P (540), Part II, line 26; Schedule P (540NR),

Part II, line 45; or Schedule P (541), Part III, line 10. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

00

29 Net AMT on exclusions. Enter the amount from line 13. Long Form 540NR filers: enter the amount from Section B, line 27 29

00

30 Adjusted net AMT. Subtract line 29 from line 28. If less than zero, enter as a negative amount. . . . . . . . . . . . . . . . . . . . . 30

00

31 Enter any carryover of unused AMT credit from 2014. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

00

32 Combine line 30 and line 31. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

00

33 Enter your 2015 regular tax from: Form 540, line 31; Long Form 540NR, line 37;

or Form 541, line 21a. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

33

00

34 Exemption and other allowable credits. See instructions . . . . . . . . . . . . . . . . . . . . .

34

00

35 Subtract line 34 from line 33 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

00

36 Enter your 2015 tentative minimum tax. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36

00

37 Subtract line 36 from line 35. If zero or less, enter -0-. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

00

38 Prior year AMT credit. Enter the smaller of line 32 or line 37 here and in column (b) of

Schedule P (540), Part III, line 10; Schedule P (540NR), Part III, line 10; or Schedule P (541), Part IV, line 9 . . . . . . .

38

00

39 Subtract line 38 from line 32. This is the amount of your AMT credit carryover to 2016 . . . . . . . . . . . . . . . . . . . . . . . .

39

00

FTB 3510 2015 Side 1

7281153

For Privacy Notice, get FTB 1131 ENG/SP.

1

1 2

2 3

3