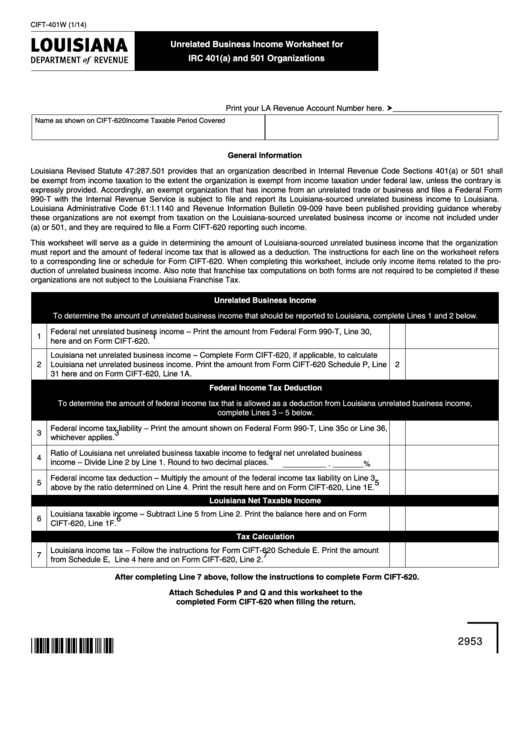

CIFT-401W (1/14)

Unrelated Business Income Worksheet for

IRC 401(a) and 501 Organizations

Print your LA Revenue Account Number here. _________________________

Name as shown on CIFT-620

Income Taxable Period Covered

General Information

Louisiana Revised Statute 47:287.501 provides that an organization described in Internal Revenue Code Sections 401(a) or 501 shall

be exempt from income taxation to the extent the organization is exempt from income taxation under federal law, unless the contrary is

expressly provided. Accordingly, an exempt organization that has income from an unrelated trade or business and files a Federal Form

990-T with the Internal Revenue Service is subject to file and report its Louisiana-sourced unrelated business income to Louisiana.

Louisiana Administrative Code 61:I.1140 and Revenue Information Bulletin 09-009 have been published providing guidance whereby

these organizations are not exempt from taxation on the Louisiana-sourced unrelated business income or income not included under

I.R.C. Sections 401(a) or 501, and they are required to file a Form CIFT-620 reporting such income.

This worksheet will serve as a guide in determining the amount of Louisiana-sourced unrelated business income that the organization

must report and the amount of federal income tax that is allowed as a deduction. The instructions for each line on the worksheet refers

to a corresponding line or schedule for Form CIFT-620. When completing this worksheet, include only income items related to the pro-

duction of unrelated business income. Also note that franchise tax computations on both forms are not required to be completed if these

organizations are not subject to the Louisiana Franchise Tax.

Unrelated Business Income

To determine the amount of unrelated business income that should be reported to Louisiana, complete Lines 1 and 2 below.

Federal net unrelated business income – Print the amount from Federal Form 990-T, Line 30,

1

1

here and on Form CIFT-620.

Louisiana net unrelated business income – Complete Form CIFT-620, if applicable, to calculate

2

Louisiana net unrelated business income. Print the amount from Form CIFT-620 Schedule P, Line

2

31 here and on Form CIFT-620, Line 1A.

Federal Income Tax Deduction

To determine the amount of federal income tax that is allowed as a deduction from Louisiana unrelated business income,

complete Lines 3 – 5 below.

Federal income tax liability – Print the amount shown on Federal Form 990-T, Line 35c or Line 36,

3

3

whichever applies.

Ratio of Louisiana net unrelated business taxable income to federal net unrelated business

4

4

income – Divide Line 2 by Line 1. Round to two decimal places.

__________ . _______%

Federal income tax deduction – Multiply the amount of the federal income tax liability on Line 3

5

5

above by the ratio determined on Line 4. Print the result here and on Form CIFT-620, Line 1E.

Louisiana Net Taxable Income

Louisiana taxable income – Subtract Line 5 from Line 2. Print the balance here and on Form

6

6

CIFT-620, Line 1F.

Tax Calculation

Louisiana income tax – Follow the instructions for Form CIFT-620 Schedule E. Print the amount

7

7

from Schedule E, Line 4 here and on Form CIFT-620, Line 2.

After completing Line 7 above, follow the instructions to complete Form CIFT-620.

Attach Schedules P and Q and this worksheet to the

completed Form CIFT-620 when filing the return.

2953

1

1