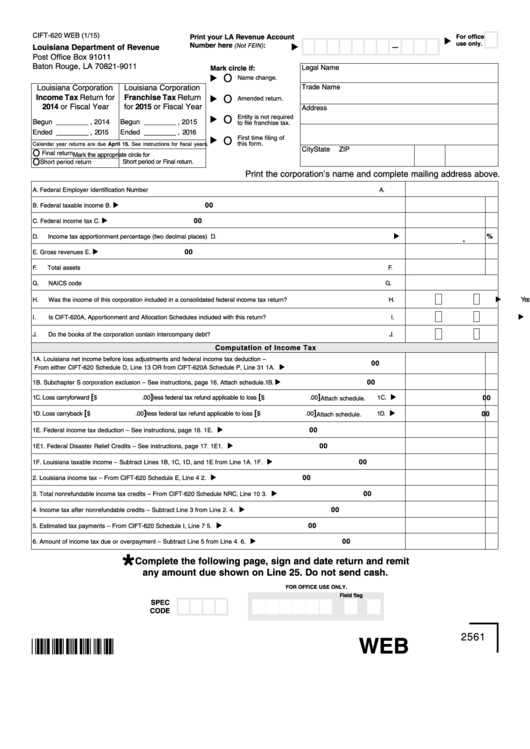

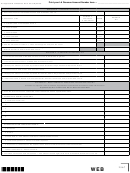

CIFT-620 WEB (1/15)

Print your LA Revenue Account

For office

u

use only.

Number here

:

–

(Not FEIN)

u

Louisiana Department of Revenue

Post Office Box 91011

Baton Rouge, LA 70821-9011

Legal Name

Mark circle if:

O

u

Name change.

Louisiana Corporation

Louisiana Corporation

Trade Name

Address change.

Income Tax Return for

Franchise Tax Return

O

u

Amended return.

2014 or Fiscal Year

for 2015 or Fiscal Year

Address

O

Entity is not required

u

Begun _________ , 2014

Begun _________ , 2015

to file franchise tax.

Ended _________ , 2015

Ended _________ , 2016

O

First time filing of

u

this form.

Calendar year returns are due April 15. See instructions for fiscal years.

City

State

ZIP

O

Final return

Mark the appropriate circle for

O

Short period or Final return.

Short period return

Print the corporation’s name and complete mailing address above.

u

A.

Federal Employer Identification Number

A.

00

u

B.

Federal taxable income

B.

00

u

C.

Federal income tax

C.

%

u

D.

Income tax apportionment percentage (two decimal places)

D.

.

00

u

E.

Gross revenues

E.

00

u

F.

Total assets

F.

u

G.

NAICS code

G.

u

Yes

No

H.

Was the income of this corporation included in a consolidated federal income tax return?

H.

u

Yes

No

I.

Is CIFT-620A, Apportionment and Allocation Schedules included with this return?

I.

u

Yes

No

J.

Do the books of the corporation contain intercompany debt?

J.

Computation of Income Tax

1A.

Louisiana net income before loss adjustments and federal income tax deduction –

00

u

From either CIFT-620 Schedule D, Line 13 OR from CIFT-620A Schedule P, Line 31

1A.

00

u

1B.

Subchapter S corporation exclusion – See instructions, page 16. Attach schedule.

1B.

[

]

[

]

u

00

1C. Loss carryforward

$

.00

less federal tax refund applicable to loss

$

.00

1C.

Attach schedule.

[

]

[

]

u

1D.

Loss carryback

$

.00

less federal tax refund applicable to loss

$

.00

1D.

00

Attach schedule.

00

u

1E.

Federal income tax deduction – See instructions, page 16.

1E.

00

u

1E1. Federal Disaster Relief Credits – See instructions, page 17.

1E1.

00

u

1F.

Louisiana taxable income – Subtract Lines 1B, 1C, 1D, and 1E from Line 1A.

1F.

00

u

2.

Louisiana income tax – From CIFT-620 Schedule E, Line 4

2.

00

u

3.

Total nonrefundable income tax credits – From CIFT-620 Schedule NRC, Line 10

3.

00

u

4.

Income tax after nonrefundable credits – Subtract Line 3 from Line 2.

4.

00

u

5.

Estimated tax payments – From CIFT-620 Schedule I, Line 7

5.

00

u

6.

Amount of income tax due or overpayment – Subtract Line 5 from Line 4.

6.

*

Complete the following page, sign and date return and remit

any amount due shown on Line 25. Do not send cash.

FOR OFFICE USE ONLY.

Field flag

SPEC

CODE

2561

WEB

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10