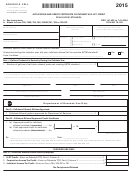

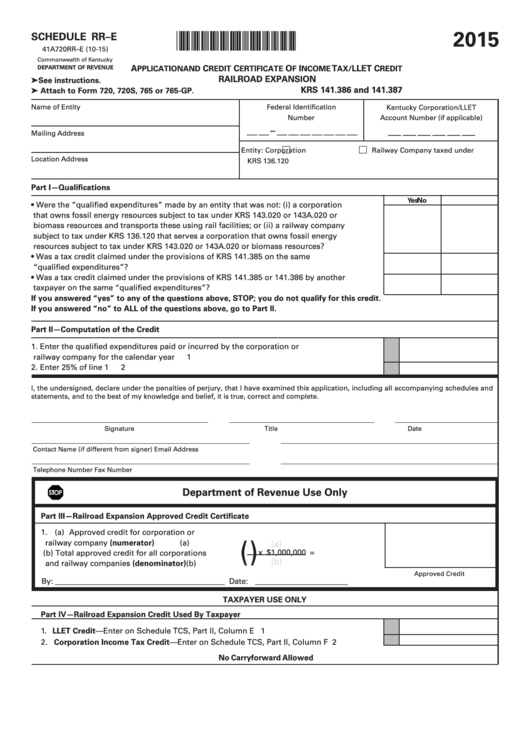

2015

SCHEDULE RR–E

*1500030317*

41A720RR–E (10-15)

Commonwealth of Kentucky

A

C

C

O

I

T

LLET C

DEPARTMENT OF REVENUE

PPLICATION AND

REDIT

ERTIFICATE

F

NCOME

AX/

REDIT

RAILROAD EXPANSION

➤ See instructions.

KRS 141.386 and 141.387

➤ Attach to Form 720, 720S, 765 or 765-GP .

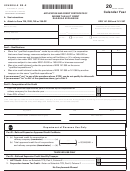

Name of Entity

Federal Identification

Kentucky Corporation/LLET

Number

Account Number (if applicable)

__ __ __ __ __ __

__ __ – __ __ __ __ __ __ __

Mailing Address

Entity:

Corporation

Railway Company taxed under

Location Address

KRS 136.120

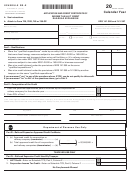

Part I—Qualifications

Yes

No

•

Were the “qualified expenditures” made by an entity that was not: (i) a corporation

that owns fossil energy resources subject to tax under KRS 143.020 or 143A.020 or

biomass resources and transports these using rail facilities; or (ii) a railway company

subject to tax under KRS 136.120 that serves a corporation that owns fossil energy

resources subject to tax under KRS 143.020 or 143A.020 or biomass resources?

•

Was a tax credit claimed under the provisions of KRS 141.385 on the same

“qualified expenditures”?

•

Was a tax credit claimed under the provisions of KRS 141.385 or 141.386 by another

taxpayer on the same “qualified expenditures”?

If you answered “yes” to any of the questions above, STOP; you do not qualify for this credit.

If you answered “no” to ALL of the questions above, go to Part II.

Part II—Computation of the Credit

1. Enter the qualified expenditures paid or incurred by the corporation or

railway company for the calendar year ........................................................................................

1

2. Enter 25% of line 1 ..........................................................................................................................

2

I, the undersigned, declare under the penalties of perjury, that I have examined this application, including all accompanying schedules and

statements, and to the best of my knowledge and belief, it is true, correct and complete.

Signature

Title

Date

Contact Name (if different from signer)

Email Address

Telephone Number

Fax Number

Department of Revenue Use Only

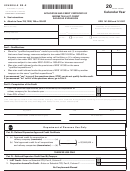

Part III—Railroad Expansion Approved Credit Certificate

1. (a) Approved credit for corporation or

(

)

railway company (numerator) ..................... (a)

(a)

x $1,000,000 =

(b) Total approved credit for all corporations

(b)

and railway companies (denominator) ....... (b)

Approved Credit

By: ____________________________________________ Date: ________________________

TAXPAYER USE ONLY

Part IV—Railroad Expansion Credit Used By Taxpayer

1. LLET Credit—Enter on Schedule TCS, Part II, Column E .........................................................

1

2. Corporation Income Tax Credit—Enter on Schedule TCS, Part II, Column F .........................

2

No Carryforward Allowed

1

1 2

2