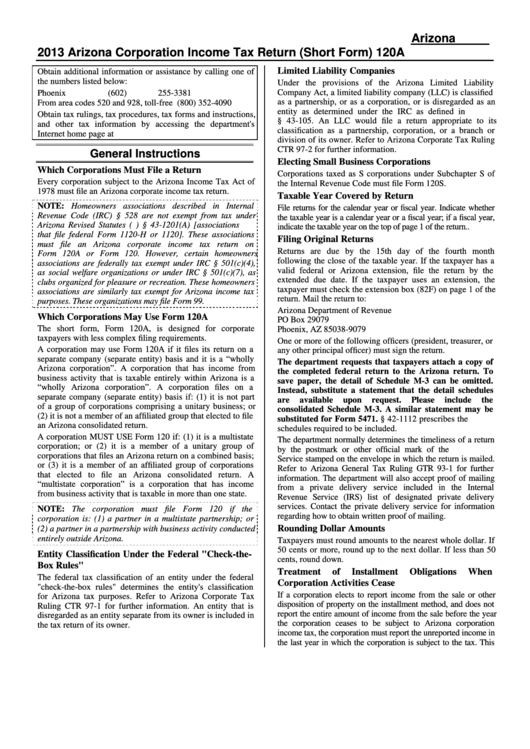

Instructions For Form 120a - Arizona Corporation Income Tax Return (Short Form) - 2013

ADVERTISEMENT

Arizona Form

2013 Arizona Corporation Income Tax Return (Short Form)

120A

Limited Liability Companies

Obtain additional information or assistance by calling one of

the numbers listed below:

Under the provisions of the Arizona Limited Liability

Company Act, a limited liability company (LLC) is classified

Phoenix

(602) 255-3381

as a partnership, or as a corporation, or is disregarded as an

From area codes 520 and 928, toll-free

(800) 352-4090

entity as determined under the IRC as defined in A.R.S.

Obtain tax rulings, tax procedures, tax forms and instructions,

§ 43-105. An LLC would file a return appropriate to its

and other tax information by accessing the department's

classification as a partnership, corporation, or a branch or

Internet home page at

division of its owner. Refer to Arizona Corporate Tax Ruling

CTR 97-2 for further information.

General Instructions

Electing Small Business Corporations

Which Corporations Must File a Return

Corporations taxed as S corporations under Subchapter S of

Every corporation subject to the Arizona Income Tax Act of

the Internal Revenue Code must file Form 120S.

1978 must file an Arizona corporate income tax return.

Taxable Year Covered by Return

NOTE: Homeowners associations described in Internal

File returns for the calendar year or fiscal year. Indicate whether

Revenue Code (IRC) § 528 are not exempt from tax under

the taxable year is a calendar year or a fiscal year; if a fiscal year,

Arizona Revised Statutes (A.R.S.) § 43-1201(A) [associations

indicate the taxable year on the top of page 1 of the return..

that file federal Form 1120-H or 1120]. These associations

Filing Original Returns

must file an Arizona corporate income tax return on

Returns are due by the 15th day of the fourth month

Form 120A or Form 120. However, certain homeowners

following the close of the taxable year. If the taxpayer has a

associations are federally tax exempt under IRC § 501(c)(4),

valid federal or Arizona extension, file the return by the

as social welfare organizations or under IRC § 501(c)(7), as

extended due date. If the taxpayer uses an extension, the

clubs organized for pleasure or recreation. These homeowners

taxpayer must check the extension box (82F) on page 1 of the

associations are similarly tax exempt for Arizona income tax

return. Mail the return to:

purposes. These organizations may file Form 99.

Arizona Department of Revenue

Which Corporations May Use Form 120A

PO Box 29079

The short form, Form 120A, is designed for corporate

Phoenix, AZ 85038-9079

taxpayers with less complex filing requirements.

One or more of the following officers (president, treasurer, or

A corporation may use Form 120A if it files its return on a

any other principal officer) must sign the return.

separate company (separate entity) basis and it is a “wholly

The department requests that taxpayers attach a copy of

Arizona corporation”. A corporation that has income from

the completed federal return to the Arizona return. To

business activity that is taxable entirely within Arizona is a

save paper, the detail of Schedule M-3 can be omitted.

“wholly Arizona corporation”. A corporation files on a

Instead, substitute a statement that the detail schedules

separate company (separate entity) basis if: (1) it is not part

are

available

upon

request.

Please

include

the

of a group of corporations comprising a unitary business; or

consolidated Schedule M-3. A similar statement may be

(2) it is not a member of an affiliated group that elected to file

substituted for Form 5471. A.R.S. § 42-1112 prescribes the

an Arizona consolidated return.

schedules required to be included.

A corporation MUST USE Form 120 if: (1) it is a multistate

The department normally determines the timeliness of a return

corporation; or (2) it is a member of a unitary group of

by the postmark or other official mark of the U.S. Postal

corporations that files an Arizona return on a combined basis;

Service stamped on the envelope in which the return is mailed.

or (3) it is a member of an affiliated group of corporations

Refer to Arizona General Tax Ruling GTR 93-1 for further

that elected to file an Arizona consolidated return. A

information. The department will also accept proof of mailing

“multistate corporation” is a corporation that has income

from a private delivery service included in the Internal

from business activity that is taxable in more than one state.

Revenue Service (IRS) list of designated private delivery

services. Contact the private delivery service for information

NOTE: The corporation must file Form 120 if the

regarding how to obtain written proof of mailing.

corporation is: (1) a partner in a multistate partnership; or

Rounding Dollar Amounts

(2) a partner in a partnership with business activity conducted

entirely outside Arizona.

Taxpayers must round amounts to the nearest whole dollar. If

50 cents or more, round up to the next dollar. If less than 50

Entity Classification Under the Federal "Check-the-

cents, round down.

Box Rules"

Treatment

of

Installment

Obligations

When

The federal tax classification of an entity under the federal

Corporation Activities Cease

"check-the-box rules" determines the entity's classification

If a corporation elects to report income from the sale or other

for Arizona tax purposes. Refer to Arizona Corporate Tax

disposition of property on the installment method, and does not

Ruling CTR 97-1 for further information. An entity that is

report the entire amount of income from the sale before the year

disregarded as an entity separate from its owner is included in

the corporation ceases to be subject to Arizona corporation

the tax return of its owner.

income tax, the corporation must report the unreported income in

the last year in which the corporation is subject to the tax. This

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11