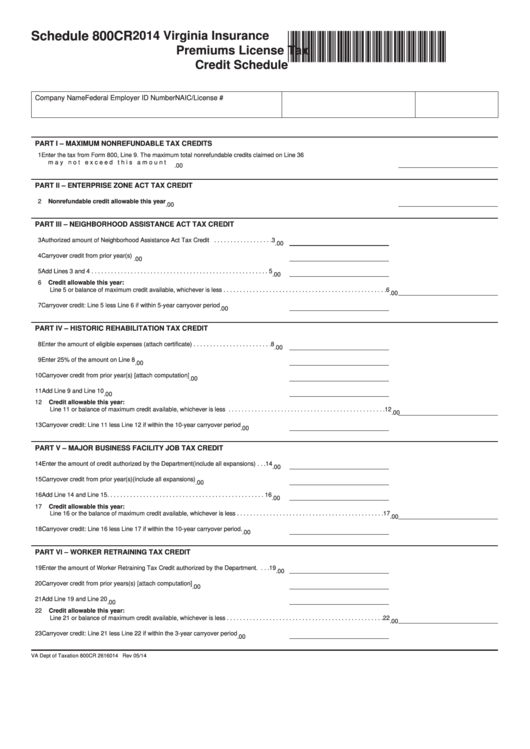

Schedule 800CR

2014 Virginia Insurance

*VA80CR114888*

Premiums License Tax

Credit Schedule

Company Name

Federal Employer ID Number

NAIC/License #

PART I – MAXIMUM NONREFUNDABLE TAX CREDITS

1

Enter the tax from Form 800, Line 9. The maximum total nonrefundable credits claimed on Line 36

may not exceed this amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1

.00

PART II – ENTERPRISE ZONE ACT TAX CREDIT

2

Nonrefundable credit allowable this year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2

.00

PART III – NEIGHBORHOOD ASSISTANCE ACT TAX CREDIT

3

Authorized amount of Neighborhood Assistance Act Tax Credit . . . . . . . . . . . . . . . . . . 3

.00

4

Carryover credit from prior year(s) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

.00

5

Add Lines 3 and 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

.00

6

Credit allowable this year:

Line 5 or balance of maximum credit available, whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6

.00

7

Carryover credit: Line 5 less Line 6 if within 5-year carryover period . . . . . . . . . . . . . . . 7

.00

PART IV – HISTORIC REHABILITATION TAX CREDIT

8

Enter the amount of eligible expenses (attach certificate) . . . . . . . . . . . . . . . . . . . . . . . . 8

.00

9

Enter 25% of the amount on Line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

.00

10

Carryover credit from prior year(s) [attach computation] . . . . . . . . . . . . . . . . . . . . . . . . 10

.00

11

Add Line 9 and Line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

.00

12

Credit allowable this year:

Line 11 or balance of maximum credit available, whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .12

.00

13

Carryover credit: Line 11 less Line 12 if within the 10-year carryover period . . . . . . . . 13

.00

PART V – MAJOR BUSINESS FACILITY JOB TAX CREDIT

14

Enter the amount of credit authorized by the Department (include all expansions) . . . 14

.00

15

Carryover credit from prior year(s) (include all expansions) . . . . . . . . . . . . . . . . . . . . . 15

.00

16

Add Line 14 and Line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

.00

17

Credit allowable this year:

Line 16 or the balance of maximum credit available, whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .17

.00

18

Carryover credit: Line 16 less Line 17 if within the 10-year carryover period. . . . . . . . . 18

.00

PART VI – WORKER RETRAINING TAX CREDIT

19

Enter the amount of Worker Retraining Tax Credit authorized by the Department. . . . 19

.00

20

Carryover credit from prior years(s) [attach computation] . . . . . . . . . . . . . . . . . . . . . . . 20

.00

21

Add Line 19 and Line 20 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

.00

22

Credit allowable this year:

Line 21 or balance of maximum credit available, whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .22

.00

23

Carryover credit: Line 21 less Line 22 if within the 3-year carryover period . . . . . . . . . 23

.00

VA Dept of Taxation 800CR 2616014 Rev 05/14

1

1 2

2