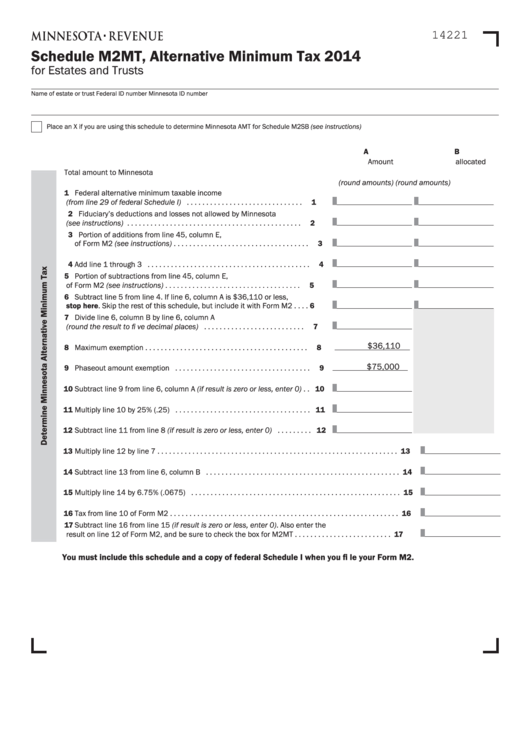

14221

Schedule M2MT, Alternative Minimum Tax 2014

for Estates and Trusts

Name of estate or trust

Federal ID number

Minnesota ID number

Place an X if you are using this schedule to determine Minnesota AMT for Schedule M2SB (see instructions)

A

B

Amount allocated

Total amount

to Minnesota

(round amounts)

(round amounts)

1 Federal alternative minimum taxable income

(from line 29 of federal Schedule I) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Fiduciary’s deductions and losses not allowed by Minnesota

(see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Portion of additions from line 45, column E,

of Form M2 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Add line 1 through 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 Portion of subtractions from line 45, column E,

of Form M2 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Subtract line 5 from line 4. If line 6, column A is $36,110 or less,

stop here. Skip the rest of this schedule, but include it with Form M2 . . . . 6

7 Divide line 6, column B by line 6, column A

(round the result to fi ve decimal places) . . . . . . . . . . . . . . . . . . . . . . . . . .

7

$36,110

8 Maximum exemption . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

$75,000

9 Phaseout amount exemption . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 Subtract line 9 from line 6, column A (if result is zero or less, enter 0) . . 10

11 Multiply line 10 by 25% (.25) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Subtract line 11 from line 8 (if result is zero or less, enter 0) . . . . . . . . . 12

13 Multiply line 12 by line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Subtract line 13 from line 6, column B . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Multiply line 14 by 6.75% (.0675) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Tax from line 10 of Form M2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Subtract line 16 from line 15 (if result is zero or less, enter 0). Also enter the

result on line 12 of Form M2, and be sure to check the box for M2MT . . . . . . . . . . . . . . . . . . . . . . . . . 17

You must include this schedule and a copy of federal Schedule I when you fi le your Form M2.

1

1 2

2