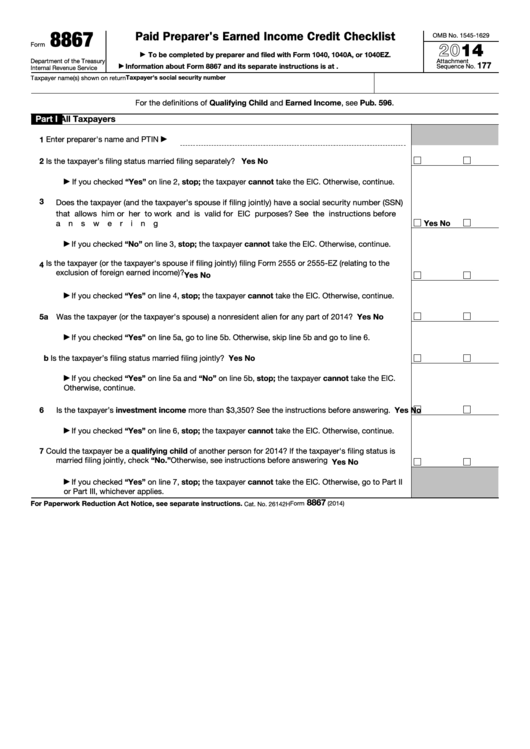

8867

Paid Preparer's Earned Income Credit Checklist

OMB No. 1545-1629

2014

Form

To be completed by preparer and filed with Form 1040, 1040A, or 1040EZ.

▶

Department of the Treasury

Attachment

177

Information about Form 8867 and its separate instructions is at

Sequence No.

▶

Internal Revenue Service

Taxpayer's social security number

Taxpayer name(s) shown on return

For the definitions of Qualifying Child and Earned Income, see Pub. 596.

Part I

All Taxpayers

Enter preparer's name and PTIN

1

▶

2

Is the taxpayer’s filing status married filing separately? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

If you checked “Yes” on line 2, stop; the taxpayer cannot take the EIC. Otherwise, continue.

▶

3

Does the taxpayer (and the taxpayer’s spouse if filing jointly) have a social security number (SSN)

that allows him or her to work and is valid for EIC purposes? See the instructions before

Yes

No

answering

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If you checked “No” on line 3, stop; the taxpayer cannot take the EIC. Otherwise, continue.

▶

Is the taxpayer (or the taxpayer's spouse if filing jointly) filing Form 2555 or 2555-EZ (relating to the

4

exclusion of foreign earned income)? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

If you checked “Yes” on line 4, stop; the taxpayer cannot take the EIC. Otherwise, continue.

▶

5a Was the taxpayer (or the taxpayer's spouse) a nonresident alien for any part of 2014?

.

.

.

.

Yes

No

If you checked “Yes” on line 5a, go to line 5b. Otherwise, skip line 5b and go to line 6.

▶

b Is the taxpayer’s filing status married filing jointly?

Yes

No

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

If you checked “Yes” on line 5a and “No” on line 5b, stop; the taxpayer cannot take the EIC.

▶

Otherwise, continue.

6

Is the taxpayer’s investment income more than $3,350? See the instructions before answering.

Yes

No

If you checked “Yes” on line 6, stop; the taxpayer cannot take the EIC. Otherwise, continue.

▶

7

Could the taxpayer be a qualifying child of another person for 2014? If the taxpayer's filing status is

married filing jointly, check “No.” Otherwise, see instructions before answering .

.

.

.

.

.

.

Yes

No

If you checked “Yes” on line 7, stop; the taxpayer cannot take the EIC. Otherwise, go to Part II

▶

or Part III, whichever applies.

8867

For Paperwork Reduction Act Notice, see separate instructions.

Form

(2014)

Cat. No. 26142H

1

1 2

2 3

3 4

4