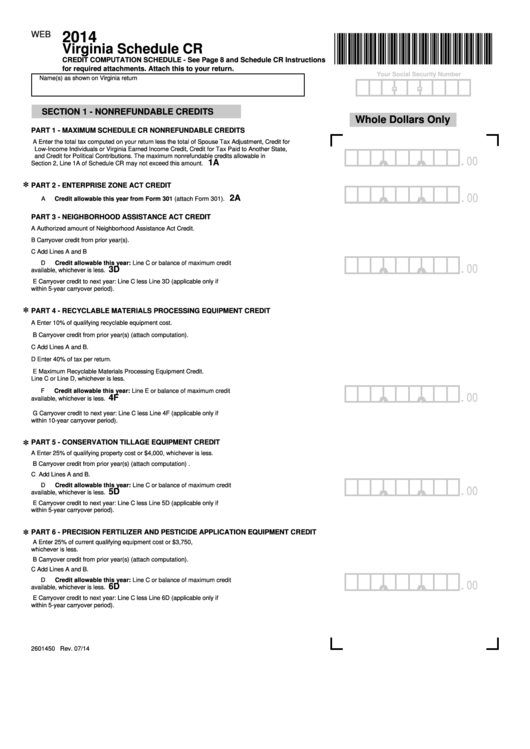

WEB

2014

Virginia Schedule CR

CREDIT COMPUTATION SCHEDULE - See Page 8 and Schedule CR Instructions

for required attachments. Attach this to your return.

Your Social Security Number

Name(s) as shown on Virginia return

-

-

SECTION 1 - NONREFUNDABLE CREDITS

Whole Dollars Only

PART 1 - MAXIMUM SCHEDULE CR NONREFUNDABLE CREDITS

A

Enter the total tax computed on your return less the total of Spouse Tax Adjustment, Credit for

Low-Income Individuals or Virginia Earned Income Credit, Credit for Tax Paid to Another State,

,

,

and Credit for Political Contributions. The maximum nonrefundable credits allowable in

00

.

1A

Section 2, Line 1A of Schedule CR may not exceed this amount. .............................................

*

PART 2 - ENTERPRISE ZONE ACT CREDIT

,

,

00

.

2A

A

Credit allowable this year from Form 301 (attach Form 301). ................................................

PART 3 - NEIGHBORHOOD ASSISTANCE ACT CREDIT

A

Authorized amount of Neighborhood Assistance Act Credit. .................... A __________________

B

Carryover credit from prior year(s). .......................................................... B __________________

C

Add Lines A and B ...................................................................................C __________________

D

Credit allowable this year: Line C or balance of maximum credit

,

,

00

.

3D

available, whichever is less. ........................................................................................................

E

Carryover credit to next year: Line C less Line 3D (applicable only if

within 5-year carryover period). ................................................................ E __________________

*

PART 4 - RECYCLABLE MATERIALS PROCESSING EQUIPMENT CREDIT

A

Enter 10% of qualifying recyclable equipment cost. ................................. A __________________

B

Carryover credit from prior year(s) (attach computation). ......................... B __________________

C

Add Lines A and B. ...................................................................................C __________________

D

Enter 40% of tax per return. .....................................................................D __________________

E

Maximum Recyclable Materials Processing Equipment Credit.

Line C or Line D, whichever is less. ......................................................... E __________________

F

Credit allowable this year: Line E or balance of maximum credit

,

,

00

4F

.

available, whichever is less. ........................................................................................................

G

Carryover credit to next year: Line C less Line 4F (applicable only if

within 10-year carryover period). ..............................................................G __________________

*

PART 5 - CONSERVATION TILLAGE EQUIPMENT CREDIT

A

Enter 25% of qualifying property cost or $4,000, whichever is less. ........ A __________________

B

Carryover credit from prior year(s) (attach computation) . ........................ B __________________

C

Add Lines A and B. ...................................................................................C __________________

D

Credit allowable this year: Line C or balance of maximum credit

,

,

00

.

5D

available, whichever is less. ........................................................................................................

E

Carryover credit to next year: Line C less Line 5D (applicable only if

within 5-year carryover period). ................................................................ E __________________

*

PART 6 - PRECISION FERTILIZER AND PESTICIDE APPLICATION EQUIPMENT CREDIT

A

Enter 25% of current qualifying equipment cost or $3,750,

whichever is less. ................................................................................... A __________________

B

Carryover credit from prior year(s) (attach computation). ......................... B __________________

C

Add Lines A and B. ...................................................................................C __________________

D

Credit allowable this year: Line C or balance of maximum credit

,

,

00

.

6D

available, whichever is less. .......................................................................................................

E

Carryover credit to next year: Line C less Line 6D (applicable only if

within 5-year carryover period). ................................................................ E __________________

2601450 Rev. 07/14

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8