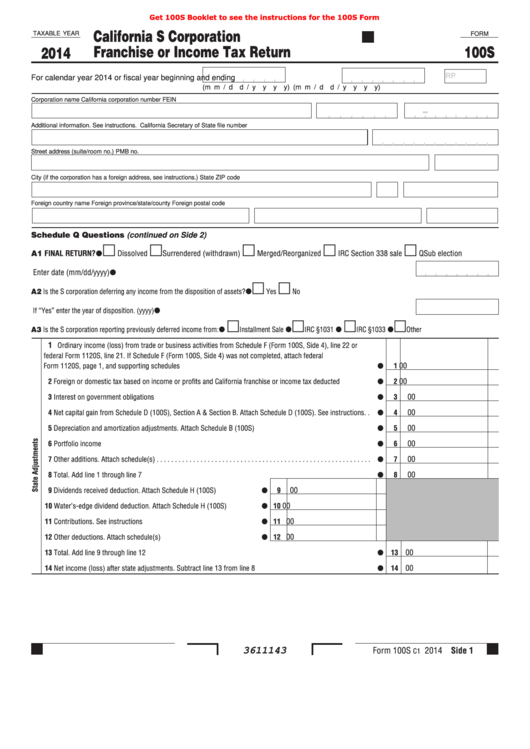

Get 100S Booklet to see the instructions for the 100S Form

California S Corporation

TAXABLE YEAR

FORM

Franchise or Income Tax Return

100S

2014

RP

For calendar year 2014 or fiscal year beginning

and ending

(m m / d d / y y y y)

(m m / d d / y y y y)

Corporation name

California corporation number

FEIN

Additional information. See instructions.

California Secretary of State file number

Street address (suite/room no.)

PMB no.

City (if the corporation has a foreign address, see instructions.)

State

ZIP code

Foreign country name

Foreign province/state/county

Foreign postal code

Schedule Q Questions (continued on Side 2)

A1 FINAL RETURN?

Surrendered (withdrawn)

Dissolved

Merged/Reorganized

IRC Section 338 sale

QSub election

Enter date (mm/dd/yyyy) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

A2 Is the S corporation deferring any income from the disposition of assets? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

If “Yes” enter the year of disposition . (yyyy) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

A3 Is the S corporation reporting previously deferred income from: . . . . . . . . . . . .

Installment Sale

IRC §1031

IRC §1033

Other

1

Ordinary income (loss) from trade or business activities from Schedule F (Form 100S, Side 4), line 22 or

federal Form 1120S, line 21 . If Schedule F (Form 100S, Side 4) was not completed, attach federal

00

Form 1120S, page 1, and supporting schedules . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

00

2 Foreign or domestic tax based on income or profits and California franchise or income tax deducted . . . . . . . .

2

00

3 Interest on government obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

4 Net capital gain from Schedule D (100S), Section A & Section B . Attach Schedule D (100S) . See instructions . .

4

00

5 Depreciation and amortization adjustments . Attach Schedule B (100S) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

6 Portfolio income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

7 Other additions . Attach schedule(s) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

8 Total . Add line 1 through line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

9 Dividends received deduction . Attach Schedule H (100S) . . . . . . . . . .

9

10 Water’s-edge dividend deduction . Attach Schedule H (100S) . . . . . . . .

10

00

00

11 Contributions . See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12 Other deductions . Attach schedule(s) . . . . . . . . . . . . . . . . . . . . . . . . . .

12

00

00

13 Total . Add line 9 through line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

14 Net income (loss) after state adjustments . Subtract line 13 from line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

00

Form 100S

2014 Side 1

C1

3611143

1

1 2

2 3

3 4

4 5

5 6

6