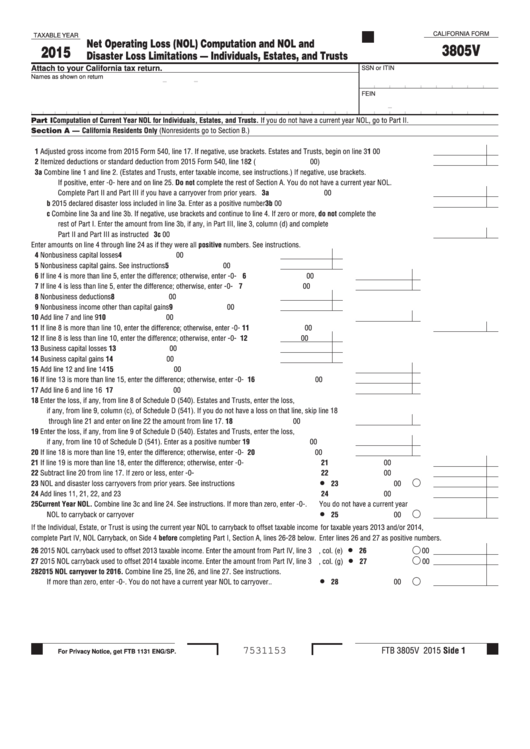

CALIFORNIA FORM

TAXABLE YEAR

Net Operating Loss (NOL) Computation and NOL and

3805V

2015

Disaster Loss Limitations — Individuals, Estates, and Trusts

Attach to your California tax return.

SSN or ITIN

Names as shown on return

-

-

FEIN

-

Part I Computation of Current Year NOL for Individuals, Estates, and Trusts. If you do not have a current year NOL, go to Part II.

Section A — California Residents Only (Nonresidents go to Section B.)

1

Adjusted gross income from 2015 Form 540, line 17. If negative, use brackets. Estates and Trusts, begin on line 3 . . . . . . . . . . .

1

00

2

Itemized deductions or standard deduction from 2015 Form 540, line 18 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 (

00)

3

a Combine line 1 and line 2. (Estates and Trusts, enter taxable income, see instructions.) If negative, use brackets.

If positive, enter -0- here and on line 25. Do not complete the rest of Section A. You do not have a current year NOL.

Complete Part II and Part III if you have a carryover from prior years.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3a

00

b 2015 declared disaster loss included in line 3a. Enter as a positive number. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3b

00

c Combine line 3a and line 3b. If negative, use brackets and continue to line 4. If zero or more, do not complete the

rest of Part I. Enter the amount from line 3b, if any, in Part III, line 3, column (d) and complete

Part II and Part III as instructed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3c

00

Enter amounts on line 4 through line 24 as if they were all positive numbers. See instructions.

4

Nonbusiness capital losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

00

5

Nonbusiness capital gains. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . 5

00

6

If line 4 is more than line 5, enter the difference; otherwise, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . 6

00

7

If line 4 is less than line 5, enter the difference; otherwise, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

00

8

Nonbusiness deductions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

00

9

Nonbusiness income other than capital gains . . . . . . . . . . . . . . . . . . . . . . . . . 9

00

10

Add line 7 and line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

00

11

If line 8 is more than line 10, enter the difference; otherwise, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

00

12

If line 8 is less than line 10, enter the difference; otherwise, enter -0- . . . . . . . 12

00

13

Business capital losses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

00

14

Business capital gains . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

00

15

Add line 12 and line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

00

16

If line 13 is more than line 15, enter the difference; otherwise, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . 16

00

17

Add line 6 and line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

00

18

Enter the loss, if any, from line 8 of Schedule D (540). Estates and Trusts, enter the loss,

if any, from line 9, column (c), of Schedule D (541). If you do not have a loss on that line, skip line 18

through line 21 and enter on line 22 the amount from line 17. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

00

19

Enter the loss, if any, from line 9 of Schedule D (540). Estates and Trusts, enter the loss,

if any, from line 10 of Schedule D (541). Enter as a positive number . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

00

20

If line 18 is more than line 19, enter the difference; otherwise, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . 20

00

21

If line 19 is more than line 18, enter the difference; otherwise, enter -0- . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

00

22

Subtract line 20 from line 17. If zero or less, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

00

23

NOL and disaster loss carryovers from prior years. See instructions. . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . .

23

00

24

Add lines 11, 21, 22, and 23. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

00

25

Current Year NOL. Combine line 3c and line 24. See instructions. If more than zero, enter -0-.

You do not have a current year

NOL to carryback or carryover . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . .

25

00

If the Individual, Estate, or Trust is using the current year NOL to carryback to offset taxable income

for taxable years 2013 and/or 2014,

complete Part IV, NOL Carryback, on Side 4 before completing Part I, Section A, lines 26-28 below.

Enter lines 26 and 27 as positive numbers.

26

2015 NOL carryback used to offset 2013 taxable income. Enter the amount from Part IV, line 3

, col. (e) . . . . . . . . . . . . . . . . . .

26

00

27

2015 NOL carryback used to offset 2014 taxable income. Enter the amount from Part IV, line 3

, col. (g) . . . . . . . . . . . . . . . . . .

27

00

28

2015 NOL carryover to 2016. Combine line 25, line 26, and line 27. See instructions.

If more than zero, enter -0-. You do not have a current year NOL to carryover... . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . .

28

00

FTB 3805V 2015 Side 1

7531153

For Privacy Notice, get FTB 1131 ENG/SP.

1

1 2

2 3

3 4

4