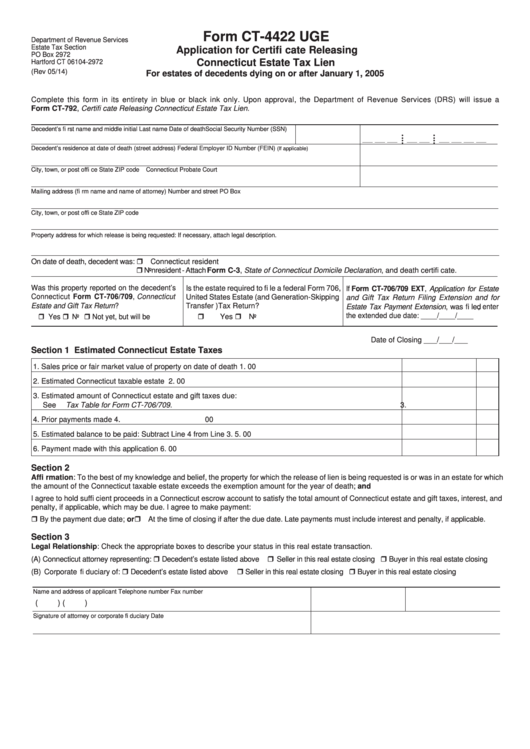

Form CT-4422 UGE

Department of Revenue Services

Estate Tax Section

Application for Certifi cate Releasing

PO Box 2972

Connecticut Estate Tax Lien

Hartford CT 06104-2972

(Rev 05/14)

For estates of decedents dying on or after January 1, 2005

Complete this form in its entirety in blue or black ink only. Upon approval, the Department of Revenue Services (DRS) will issue a

Form CT-792, Certifi cate Releasing Connecticut Estate Tax Lien.

Decedent’s fi rst name and middle initial

Last name

Date of death

Social Security Number (SSN)

• •

• •

__ __ __

__ __

__ __ __ __

•

•

•

•

Decedent’s residence at date of death (street address)

Federal Employer ID Number (FEIN)

(If applicable)

City, town, or post offi ce

State

ZIP code

Connecticut Probate Court

Mailing address (fi rm name and name of attorney)

Number and street

PO Box

City, town, or post offi ce

State

ZIP code

Property address for which release is being requested: If necessary, attach legal description.

On date of death, decedent was: Connecticut resident

Nonresident - Attach Form C-3, State of Connecticut Domicile Declaration, and death certifi cate.

Was this property reported on the decedent’s

Is the estate required to fi le a federal Form 706,

If Form CT-706/709 EXT, Application for Estate

Connecticut Form CT-706/709, Connecticut

United States Estate (and Generation-Skipping

and Gift Tax Return Filing Extension and for

Estate and Gift Tax Return?

Transfer )Tax Return?

Estate Tax Payment Extension, was fi led, enter

Yes

N o

Not yet, but will be

the extended due date: ____/____/____

Yes

N o

Date of Closing ___/___/___

Section 1

Estimated Connecticut Estate Taxes

1. Sales price or fair market value of property on date of death

1.

00

2. Estimated Connecticut taxable estate

2.

00

3. Estimated amount of Connecticut estate and gift taxes due:

See Tax Table for Form CT-706/709.

3.

00

4. Prior payments made

4.

00

5. Estimated balance to be paid: Subtract Line 4 from Line 3.

5.

00

6. Payment made with this application

6.

00

Section 2

Affi rmation: To the best of my knowledge and belief, the property for which the release of lien is being requested is or was in an estate for which

the amount of the Connecticut taxable estate exceeds the exemption amount for the year of death; and

I agree to hold suffi cient proceeds in a Connecticut escrow account to satisfy the total amount of Connecticut estate and gift taxes, interest, and

penalty, if applicable, which may be due. I agree to make payment:

By the payment due date; or

At the time of closing if after the due date. Late payments must include interest and penalty, if applicable.

Section 3

Legal Relationship: Check the appropriate boxes to describe your status in this real estate transaction.

Decedent’s estate listed above Seller in this real estate closing Buyer in this real estate closing

(A) Connecticut attorney representing:

Decedent’s estate listed above Seller in this real estate closing Buyer in this real estate closing

(B) Corporate fi duciary of:

Name and address of applicant

Telephone number

Fax number

(

)

(

)

Signature of attorney or corporate fi duciary

Date

1

1 2

2