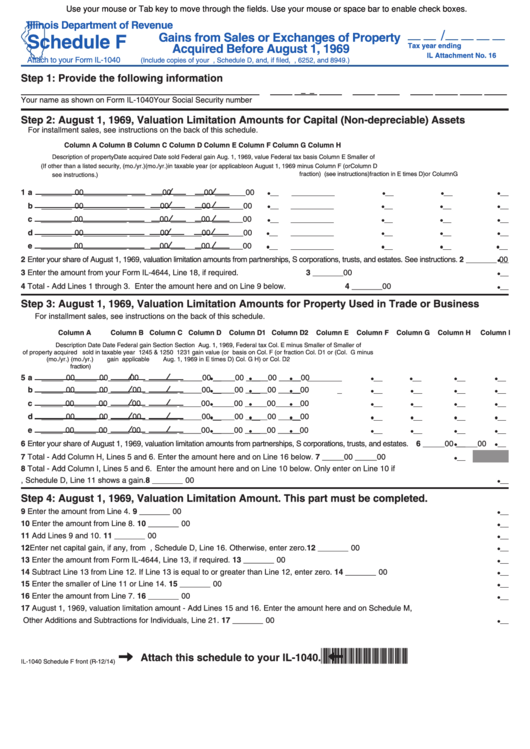

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

/

Schedule F

Tax year ending

Attach to your Form IL-1040

(Include copies of your U.S. 1040, Schedule D, and, if filed, U.S. Forms 4797, 6252, and 8949.)

Step 1: Provide the following information

–

–

Your name as shown on Form IL-1040

Your Social Security number

Step 2: August 1, 1969, Valuation Limitation Amounts for Capital (Non-depreciable) Assets

For installment sales, see instructions on the back of this schedule.

Column A

Column B

Column C

Column D

Column E

Column F

Column G

Column H

Description of property

Date acquired

Date sold

Federal gain

Aug. 1, 1969, value

Federal tax basis

Column E

Smaller of

(If other than a listed security,

(mo./yr.)

(mo./yr.)

in taxable year

(or applicable

on August 1, 1969

minus Column F (or

Column D

see instructions.)

fraction)

(see instructions)

fraction in E times D)

or Column G

1 a

_______ 00

__________

_______ 00

_______ 00

_______ 00

b

_______ 00

__________

_______ 00

_______ 00

_______ 00

c

_______ 00

__________

_______ 00

_______ 00

_______ 00

d

_______ 00

__________

_______ 00

_______ 00

_______ 00

e

_______ 00

__________

_______ 00

_______ 00

_______ 00

2 Enter your share of August 1, 1969, valuation limitation amounts from partnerships, S corporations, trusts, and estates. See instructions. 2 _______ 00

3 Enter the amount from your Form IL-4644, Line 18, if required.

3 _______ 00

4 Total - Add Lines 1 through 3. Enter the amount here and on Line 9 below.

4 _______ 00

Step 3: August 1, 1969, Valuation Limitation Amounts for Property Used in Trade or Business

For installment sales, see instructions on the back of this schedule.

Column A

Column B Column C Column D

Column D1 Column D2

Column E

Column F

Column G

Column H

Column I

Description

Date

Date

Federal gain

Section

Section

Aug. 1, 1969, Federal tax

Col. E minus

Smaller of

Smaller of

of property

acquired

sold

in taxable year 1245 & 1250

1231 gain

value (or

basis on

Col. F (or fraction Col. D1 or (Col. G minus

(mo./yr.)

(mo./yr.)

gain

applicable

Aug. 1, 1969

in E times D)

Col. G

H) or Col. D2

fraction)

5 a

_____ 00 _____ 00 _____ 00 ________ _____ 00 _____ 00

_____ 00 _____ 00

b

_____ 00 _____ 00 _____ 00 ________ _____ 00 _____ 00

_____ 00 _____ 00

c

_____ 00 _____ 00 _____ 00 ________ _____ 00 _____ 00

_____ 00 _____ 00

d

_____ 00 _____ 00 _____ 00 ________ _____ 00 _____ 00

_____ 00 _____ 00

e

_____ 00 _____ 00 _____ 00 ________ _____ 00 _____ 00

_____ 00 _____ 00

6 Enter your share of August 1, 1969, valuation limitation amounts from partnerships, S corporations, trusts, and estates.

6 _____ 00 _____ 00

7 Total - Add Column H, Lines 5 and 6. Enter the amount here and on Line 16 below.

7 _____ 00 _____ 00

8 Total - Add Column I, Lines 5 and 6. Enter the amount here and on Line 10 below. Only enter on Line 10 if

8 _______ 00

U.S. 1040, Schedule D, Line 11 shows a gain.

Step 4: August 1, 1969, Valuation Limitation Amount. This part must be completed.

9 Enter the amount from Line 4.

9 _______ 00

10 Enter the amount from Line 8.

10 _______ 00

11 Add Lines 9 and 10.

11 _______ 00

12 Enter net capital gain, if any, from U.S. Form 1040, Schedule D, Line 16. Otherwise, enter zero.

12 _______ 00

13 Enter the amount from Form IL-4644, Line 13, if required.

13 _______ 00

14 Subtract Line 13 from Line 12. If Line 13 is equal to or greater than Line 12, enter zero.

14 _______ 00

15 Enter the smaller of Line 11 or Line 14.

15 _______ 00

16 Enter the amount from Line 7.

16 _______ 00

17 August 1, 1969, valuation limitation amount - Add Lines 15 and 16. Enter the amount here and on Schedule M,

Other Additions and Subtractions for Individuals, Line 21.

17 _______ 00

*461401110*

Attach this schedule to your IL-1040.

IL-1040 Schedule F front (R-12/14)

1

1 2

2