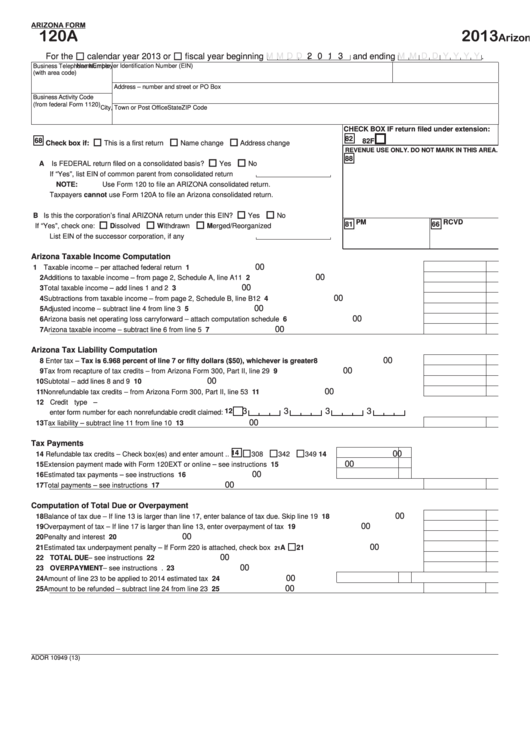

ARIZONA FORM

120A

2013

Arizona Corporation Income Tax Return (Short Form)

For the

calendar year 2013 or

fiscal year beginning

M M D D

2 0 1 3 and ending

M M D D Y Y Y Y

.

Business Telephone Number

Name

Employer Identification Number (EIN)

(with area code)

Address – number and street or PO Box

Business Activity Code

(from federal Form 1120)

City, Town or Post Office

State

ZIP Code

CHECK BOX IF return filed under extension:

82

68

82F

Check box if:

This is a first return

Name change

Address change

REVENUE USE ONLY. DO NOT MARK IN THIS AREA.

88

A Is FEDERAL return filed on a consolidated basis? ........................

Yes

No

If “Yes”, list EIN of common parent from consolidated return ........

NOTE: Use Form 120 to file an ARIZONA consolidated return.

Taxpayers cannot use Form 120A to file an Arizona consolidated return.

B Is this the corporation’s final ARIZONA return under this EIN? .....

Yes

No

81 PM

66 RCVD

If “Yes”, check one:

Dissolved

Withdrawn

Merged/Reorganized

List EIN of the successor corporation, if any .................................

Arizona Taxable Income Computation

00

1 Taxable income – per attached federal return ................................................................................................................

1

00

2 Additions to taxable income – from page 2, Schedule A, line A11 ..................................................................................

2

00

3 Total taxable income – add lines 1 and 2 ........................................................................................................................

3

00

4 Subtractions from taxable income – from page 2, Schedule B, line B12 ........................................................................

4

00

5 Adjusted income – subtract line 4 from line 3 .................................................................................................................

5

00

6 Arizona basis net operating loss carryforward – attach computation schedule ..............................................................

6

00

7 Arizona taxable income – subtract line 6 from line 5 ......................................................................................................

7

Arizona Tax Liability Computation

00

8 Enter tax – Tax is 6.968 percent of line 7 or fifty dollars ($50), whichever is greater ..............................................

8

00

9 Tax from recapture of tax credits – from Arizona Form 300, Part II, line 29 ....................................................................

9

00

10 Subtotal – add lines 8 and 9 ...........................................................................................................................................

10

00

11 Nonrefundable tax credits – from Arizona Form 300, Part II, line 53 ..............................................................................

11

12 Credit type –

3

3

3

3

12

enter form number for each nonrefundable credit claimed:

00

13 Tax liability – subtract line 11 from line 10 ......................................................................................................................

13

Tax Payments

14 Refundable tax credits – Check box(es) and enter amount .. 14

00

308

342

349

14

00

15 Extension payment made with Form 120EXT or online – see instructions ........................

15

00

16 Estimated tax payments – see instructions .......................................................................

16

00

17 Total payments – see instructions ...................................................................................................................................

17

Computation of Total Due or Overpayment

00

18 Balance of tax due – If line 13 is larger than line 17, enter balance of tax due. Skip line 19 ..........................................

18

00

19 Overpayment of tax – If line 17 is larger than line 13, enter overpayment of tax ............................................................

19

00

20 Penalty and interest ........................................................................................................................................................

20

00

21 Estimated tax underpayment penalty – If Form 220 is attached, check box ......................................................

A

21

21

00

22 TOTAL DUE – see instructions .................................................................. Non-EFT payment must accompany return.

22

00

23 OVERPAYMENT – see instructions ................................................................................................................................

23

00

24 Amount of line 23 to be applied to 2014 estimated tax ......................................................

24

00

25 Amount to be refunded – subtract line 24 from line 23 ...................................................................................................

25

ADOR 10949 (13)

1

1 2

2