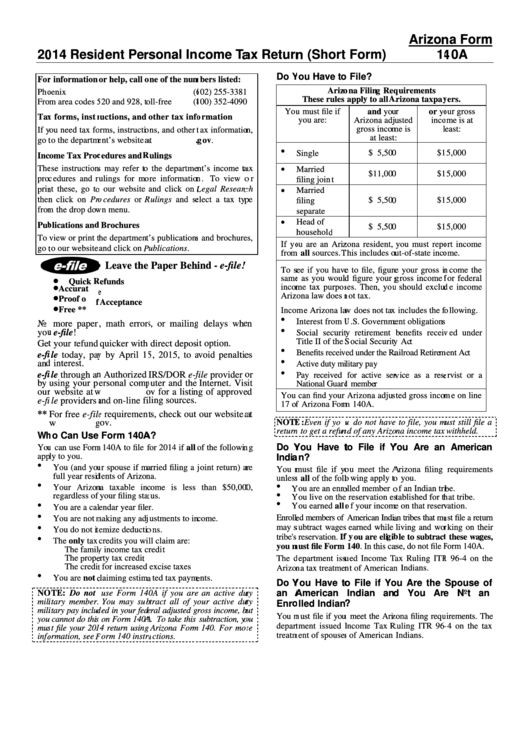

Instructions For Arizona Form 140a - Resident Personal Income Tax Return (Short Form) - 2014

ADVERTISEMENT

Arizon

na Form

20

014 Resid

dent Per

rsonal In

come Ta

ax Return

n (Short

Form)

14

40A

Do Y

You Have to

o File?

For

r information

or help, call o

one of the num

mbers listed:

Arizo

ona Filing Req

quirements

Pho

oenix

(6

602) 255-3381

These rules

apply to all A

Arizona taxpay

yers.

Fro

m area codes 5

520 and 928, to

oll-free

(8

800) 352-4090

You

u must file if

and you

ur

or yo

our gross

Tax

x forms, instr

ructions, and

other tax info

ormation

you are:

Arizona adju

usted

inco

ome is at

gross incom

me is

l

east:

If y

you need tax fo

orms, instructio

ons, and other t

tax information

n,

at least:

:

go t

to the departme

ent’s website a

at

gov.

$ 5,500

0

$1

5,000

Single

Inc

ome Tax Proc

cedures and R

Rulings

The

ese instructions

s may refer to

the departmen

nt’s income ta

ax

M

Married

$11,000

0

$1

5,000

proc

cedures and r

ulings for mo

ore information

n. To view o

or

f

filing joint

prin

nt these, go to

o our website

and click on L

Legal Researc

ch

M

Married

then

n click on Pro

ocedures or R

Rulings and se

elect a tax typ

pe

$ 5,500

0

$1

5,000

f

filing

from

m the drop dow

wn menu.

separate

H

Head of

Pub

blications and

d Brochures

$ 5,500

0

$1

5,000

h

household

To

view or print t

the department

t’s publications

s and brochure

s,

If yo

ou are an Ariz

zona resident,

you must repo

ort income

go t

to our website

and click on P

Publications.

from

m all sources. T

This includes ou

ut-of-state inco

ome.

Leave the

Paper Beh

ind - e-file!

To s

see if you have

e to file, figure

e your gross in

ncome the

same

e as you would

d figure your g

gross income f

for federal

Quick R

Refunds

incom

me tax purpos

ses. Then, you

u should exclud

de income

Accurate

e

Arizo

ona law does n

not tax.

Proof of

f Acceptance

Incom

me Arizona law

w does not tax

x includes the fo

following.

Free **

I

Interest from U

U.S. Governme

ent obligations

s

No

more paper

, math errors

s, or mailing

g delays whe

en

you

u e-file!

Social security

ty retirement b

benefits receiv

ved under

T

Title II of the S

Social Security

y Act

Get

t your refund

quicker with

direct deposi

it option.

B

Benefits receiv

ved under the Ra

ailroad Retirem

ment Act

e-fi

file today, pay

y by April 15

5, 2015, to a

avoid penaltie

es

and

d interest.

A

Active duty mi

ilitary pay

e-fi

file through an

n Authorized

IRS/DOR e-f

file provider o

or

P

Pay received

for active serv

vice as a rese

ervist or a

by

using your p

ersonal comp

puter and the

Internet. Vis

it

N

National Guard

d member

our

r website at w

go

ov for a listin

ng of approve

ed

You

can find your

Arizona adjus

sted gross incom

me on line

e-fi

ile providers a

and on-line fi

iling sources.

17 of

f Arizona Form

m 140A.

**

For free e-file

e requirement

ts, check out

our website a

at

NOTE

E: Even if you

u do not have

to file, you m

ust still file a

w

g

gov.

return

n to get a refun

nd of any Arizo

na income tax

withheld.

Wh

ho Can Use

Form 140A

A?

Do Y

You Have t

to File if Y

You Are an

American

You

u can use Form

m 140A to file f

for 2014 if all

of the followin

ng

app

ply to you.

India

an?

You (and you

ur spouse if ma

arried filing a j

joint return) ar

re

You m

must file if yo

ou meet the A

Arizona filing

requirements

full year resid

dents of Arizon

na.

unless

s all of the follo

owing apply to

o you.

Your Arizon

na taxable inc

come is less

than $50,000

0,

Y

You are an enro

olled member o

of an Indian trib

be.

regardless of

your filing stat

tus.

Y

You live on the

reservation es

tablished for th

hat tribe.

Y

You earned all o

of your income

e on that reserv

vation.

You are a cal

endar year file

er.

Enrolle

ed members of

American India

an tribes that mu

ust file a return

You are not m

making any adj

justments to in

come.

may s

subtract wages

earned while

living and wor

rking on their

You do not it

emize deductio

ons.

tribe's

reservation. If

f you are eligib

ble to subtract

t these wages,

The only tax

credits you wi

ll claim are:

you m

must file Form

140. In this cas

se, do not file F

Form 140A.

The family

y income tax c

credit

The prope

erty tax credit

The d

department issu

ued Income Ta

ax Ruling ITR

R 96-4 on the

The credit

t for increased

excise taxes

Arizon

na tax treatmen

nt of American

n Indians.

You are not c

claiming estima

ated tax payme

ents.

Do Y

You Have to

o File if Yo

ou Are the

Spouse of

NO

OTE: Do not

use Form 14

0A if you are

an active dut

ty

an A

American

Indian and

d You Are

e Not an

mili

itary member.

You may sub

btract all of y

our active dut

ty

Enro

olled Indian?

?

mili

itary pay includ

ded in your fede

eral adjusted g

gross income, bu

ut

You m

must file if you

u meet the Ariz

zona filing requ

uirements. The

you

cannot do this

s on Form 140A

A. To take this

subtraction, yo

ou

depart

tment issued I

Income Tax R

Ruling ITR 96-

-4 on the tax

mus

st file your 201

14 return using

g Arizona Form

m 140. For mor

re

treatm

ment of spouses

s of American

Indians.

info

ormation, see F

Form 140 instru

uctions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13