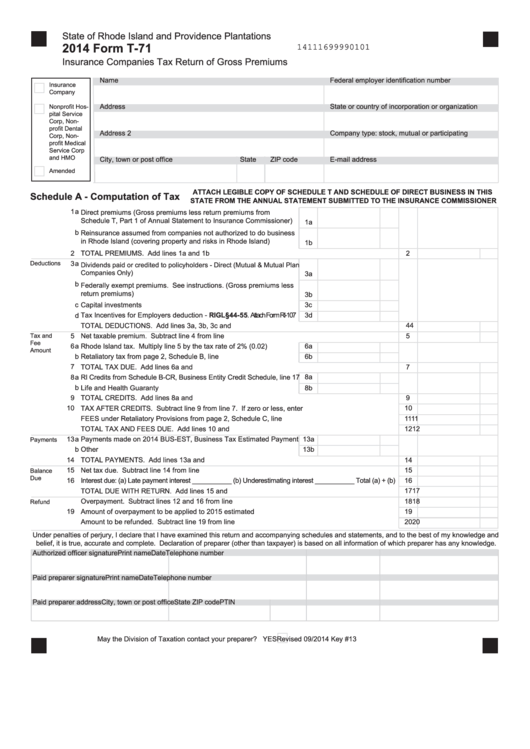

State of Rhode Island and Providence Plantations

2014 Form T-71

14111699990101

Insurance Companies Tax Return of Gross Premiums

Name

Federal employer identification number

Insurance

Company

Address

State or country of incorporation or organization

Nonprofit Hos-

pital Service

Corp, Non-

profit Dental

Address 2

Company type: stock, mutual or participating

Corp, Non-

profit Medical

Service Corp

and HMO

City, town or post office

State

ZIP code

E-mail address

Amended

ATTACH LEGIBLE COPY OF SCHEDULE T AND SCHEDULE OF DIRECT BUSINESS IN THIS

Schedule A - Computation of Tax

STATE FROM THE ANNUAL STATEMENT SUBMITTED TO THE INSURANCE COMMISSIONER

1

a

Direct premiums (Gross premiums less return premiums from

Schedule T, Part 1 of Annual Statement to Insurance Commissioner)....

1a

b

Reinsurance assumed from companies not authorized to do business

in Rhode Island (covering property and risks in Rhode Island)............... 1b

2

TOTAL PREMIUMS. Add lines 1a and 1b .................................................................................................

2

Deductions

3

a

Dividends paid or credited to policyholders - Direct (Mutual & Mutual Plan

Companies Only).........................................................................................

3a

b

Federally exempt premiums. See instructions. (Gross premiums less

return premiums)..................................................................................... 3b

c

Capital investments deduction................................................................

3c

Tax Incentives for Employers deduction - RIGL §44-55. Attach Form RI-107

d

3d

4

TOTAL DEDUCTIONS. Add lines 3a, 3b, 3c and 3d.................................................................................

4

5

Tax and

Net taxable premium. Subtract line 4 from line 2.......................................................................................

5

Fee

6

a

Rhode Island tax. Multiply line 5 by the tax rate of 2% (0.02)................

6a

Amount

b

Retaliatory tax from page 2, Schedule B, line 3......................................

6b

7

TOTAL TAX DUE. Add lines 6a and 6b......................................................................................................

7

8

a

RI Credits from Schedule B-CR, Business Entity Credit Schedule, line 17

8a

b

Life and Health Guaranty Fee..................................................................

8b

9

TOTAL CREDITS. Add lines 8a and 8b.....................................................................................................

9

10

TAX AFTER CREDITS. Subtract line 9 from line 7. If zero or less, enter zero.........................................

10

11

FEES under Retaliatory Provisions from page 2, Schedule C, line 3.......................................................... 11

12

TOTAL TAX AND FEES DUE. Add lines 10 and 11...................................................................................

12

13

a

Payments made on 2014 BUS-EST, Business Tax Estimated Payment

13a

Payments

Other payments.......................................................................................

b

13b

14

TOTAL PAYMENTS. Add lines 13a and 13b..............................................................................................

14

15

Net tax due. Subtract line 14 from line 12..................................................................................................

15

Balance

Due

16

Interest due: (a) Late payment interest ___________ (b) Underestimating interest ___________ Total (a) + (b)

16

17

TOTAL DUE WITH RETURN. Add lines 15 and 16.................................................................................... 17

Overpayment. Subtract lines 12 and 16 from line 14.................................................................................

18

18

Refund

19

Amount of overpayment to be applied to 2015 estimated tax.....................................................................

19

20

Amount to be refunded. Subtract line 19 from line 18................................................................................ 20

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and

belief, it is true, accurate and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Authorized officer signature

Print name

Date

Telephone number

Paid preparer signature

Print name

Date

Telephone number

Paid preparer address

City, town or post office

State

ZIP code

PTIN

May the Division of Taxation contact your preparer? YES

Revised 09/2014

Key #13

1

1 2

2