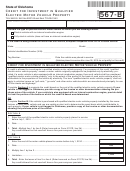

Form 338 - Arizona Credit For Investment In Qualified Small Businesses - 2014

ADVERTISEMENT

2014 Credit for Investment in

Arizona Form

Qualified Small Businesses

338

A partnership may pass the credit through to its individual

CONTACTS FOR QUALIFIED SMALL BUSINESS

partners. The total of the credits allowed all such owners

CAPITAL INVESTMENT TAX CREDIT PROGRAM

may not exceed the amount that would have been allowed a

Arizona Commerce Authority (ACA)

sole owner.

Application forms Program guidelines

The basis of any investment with respect to which you claim

a credit must be reduced by the amount of the credit claimed

Website:

with respect to the investment.

Program Manager:

(602) 845-1200

Qualified

Small

Business

Capital

Arizona Department of Revenue

Investment Program

For information or help, call one of the numbers listed:

The ACA administers the Qualified Small Business

Phoenix

(602) 255-3381

Capital Investment program. The ACA cannot allocate tax

From area codes 520 and 928, toll-free

(800) 352-4090

credits exceeding $20 million during the life of the

Tax forms, instructions, and other tax information

program. Tax credits are authorized on a first come, first

served basis. Income tax credits are equal to 30% or 35%

If you need tax forms, instructions, and other tax

of the investment amount and are claimed over a three

information,

go

to

the

department’s

website

at

year period.

To seek a tax credit under this program, you must submit an

Income Tax Procedures and Rulings

application for an Authorization of Tax Credits to the ACA.

These instructions may refer to the department’s income tax

To obtain an Authorization of Tax Credits, you must

procedures and rulings for more information. To view or

document that each investment and the small business meet

print these, go to our website and click on Legal Research

the eligibility requirements. The ACA will issue an

then click on Procedures or Rulings and select a tax type

Authorization of Tax Credits after determining eligibility of

from the drop down menu.

the investor. For more information about this credit, visit the

Publications and Brochures

ACA’s web site at: .

To view or print the department’s publications and

Line-by-Line Instructions

brochures, go to our website and click on Publications.

Enter the names and taxpayer identification numbers (TIN)

General Instructions

as shown on Arizona Form 140, 140PY, 140NR, 140X,

120S or 165. Fiscal year basis taxpayers must indicate the

For taxable years beginning from and after December 31,

period covered by the taxable year. Include the completed

2006 through December 31, 2024, Arizona law allows a

credit for investments made in qualified small businesses.

form with the tax return.

The amount of the credit is the amount determined and

All returns, statements, and other documents filed with the

authorized by the Arizona Commerce Authority (ACA).

Department of Revenue require a TIN. The TIN is either a

To claim this credit, you must include a copy of the ACA’s

correct social security number (SSN) or an Internal

Authorization of Tax Credits with your income tax return.

Revenue Service individual taxpayer identification number

(ITIN), or for a business, the employer identification

You must claim the credit on a timely filed return filed for

the tax year in which the credit is available. A timely filed

number (EIN). Taxpayers who fail to include a TIN may

return is a return that you file by the return’s original or

be subject to a penalty.

Be sure that all required

extended due date. If you fail to timely file a return claiming

identification numbers are written clearly.

Missing,

the credit for a taxable year, the credit expires for that

incorrect, or unclear identification numbers may cause

taxable year and there is no carryforward of the expired

delays in processing.

credit.

If the allowable tax credit is more than your tax liability or if

Part 1 – Current Year’s Credit

you have no tax liability, you may carry the unused credit

forward for up to the next three consecutive tax years.

Line 1

This credit is available to individuals only. A corporation,

Enter the amount of credit shown for the taxable year on the

including an S corporation, may not claim this credit.

ACA’s Authorization of Tax Credits. On line 1, enter only the

However, an S corporation may pass the credit through to its

credit available for the current taxable year. You must include a

individual shareholders.

copy of each ACA’s Authorization of Tax Credits with Form

338 when you file.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2