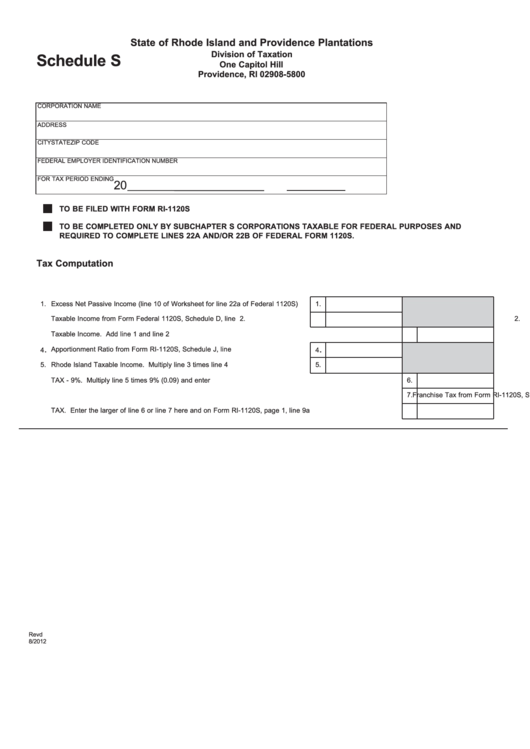

Schedule S - Rhode Island And Providence Plantations Tax Computation

ADVERTISEMENT

State of Rhode Island and Providence Plantations

Division of Taxation

Schedule S

One Capitol Hill

Providence, RI 02908-5800

CORPORATION NAME

ADDRESS

CITY

STATE

ZIP CODE

FEDERAL EMPLOYER IDENTIFICATION NUMBER

FOR TAX PERIOD ENDING

20

TO BE FILED WITH FORM RI-1120S

TO BE COMPLETED ONLY BY SUBCHAPTER S CORPORATIONS TAXABLE FOR FEDERAL PURPOSES AND

REQUIRED TO COMPLETE LINES 22A AND/OR 22B OF FEDERAL FORM 1120S.

Tax Computation

1.

Excess Net Passive Income (line 10 of Worksheet for line 22a of Federal 1120S).......

1.

2.

Taxable Income from Form Federal 1120S, Schedule D, line 20....................................

2.

3.

Taxable Income. Add line 1 and line 2 ...........................................................................................................................

3.

.

.

Apportionment Ratio from Form RI-1120S, Schedule J, line 5........................................

4

4

5.

Rhode Island Taxable Income. Multiply line 3 times line 4 ............................................

5.

6.

TAX - 9%. Multiply line 5 times 9% (0.09) and enter here..............................................................................................

6.

7.

Franchise Tax from Form RI-1120S, Schedule H, line 7 .................................................................................................

7.

8.

TAX. Enter the larger of line 6 or line 7 here and on Form RI-1120S, page 1, line 9a ..................................................

8.

Revd

8/2012

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1