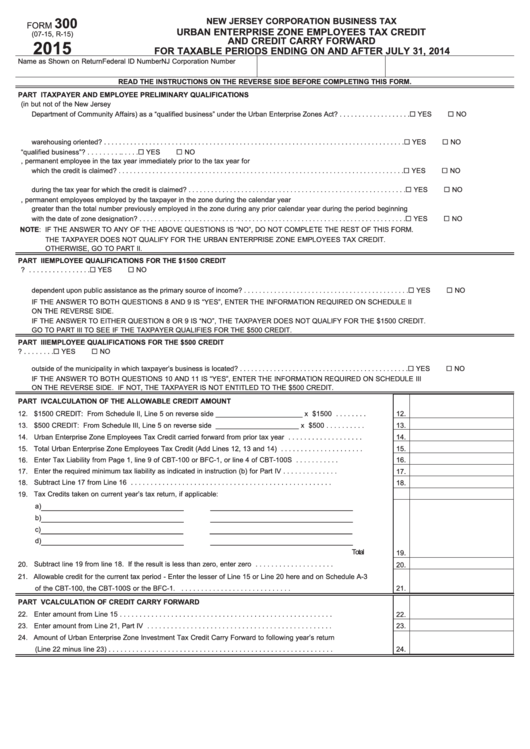

300

NEW JERSEY CORPORATION BUSINESS TAX

FORM

URBAN ENTERPRISE ZONE EMPLOYEES TAX CREDIT

(07-15, R-15)

AND CREDIT CARRY FORWARD

2015

FOR TAXABLE PERIODS ENDING ON AND AFTER JULY 31, 2014

Name as Shown on Return

Federal ID Number

NJ Corporation Number

READ THE INSTRUCTIONS ON THE REVERSE SIDE BEFORE COMPLETING THIS FORM.

PART I

TAXPAYER AND EMPLOYEE PRELIMINARY QUALIFICATIONS

1. Is the taxpayer certified by the New Jersey Urban Enterprise Zone Authority (in but not of the New Jersey

¨ YES

¨ NO

Department of Community Affairs) as a “qualified business” under the Urban Enterprise Zones Act? . . . . . . . . . . . . . . . . . . .

2. Enter your Urban Enterprise Zone city and permit number __________________________ _________________________

3. Is the taxpayer in the zone primarily a manufacturing concern or other business which is not retail sales or

¨ YES

¨ NO

warehousing oriented? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

¨ YES

¨ NO

4. Was the new employee hired on or after the date that the taxpayer was certified as a “qualified business”? . . . . . . . . . . . . . .

5. Was the new employee hired as a full-time, permanent employee in the tax year immediately prior to the tax year for

¨ YES

¨ NO

which the credit is claimed? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. Was the new employee employed as a full-time permanent employee for at least six continuous months by the taxpayer

¨ YES

¨ NO

during the tax year for which the credit is claimed? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7. Is the total number of full-time, permanent employees employed by the taxpayer in the zone during the calendar year

greater than the total number previously employed in the zone during any prior calendar year during the period beginning

¨ YES

¨ NO

with the date of zone designation? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

NOTE: IF THE ANSWER TO ANY OF THE ABOVE QUESTIONS IS “NO”, DO NOT COMPLETE THE REST OF THIS FORM.

THE TAXPAYER DOES NOT QUALIFY FOR THE URBAN ENTERPRISE ZONE EMPLOYEES TAX CREDIT.

OTHERWISE, GO TO PART II.

PART II

EMPLOYEE QUALIFICATIONS FOR THE $1500 CREDIT

¨ YES

¨ NO

8. Was the new employee a resident of any qualifying municipality in which a designated zone is located? . . . . . . . . . . . . . . . .

9. Was the new employee immediately prior to employment by the taxpayer either unemployed for at least 90 days or

¨ YES

¨ NO

dependent upon public assistance as the primary source of income? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

IF THE ANSWER TO BOTH QUESTIONS 8 AND 9 IS “YES”, ENTER THE INFORMATION REQUIRED ON SCHEDULE II

ON THE REVERSE SIDE.

IF THE ANSWER TO EITHER QUESTION 8 OR 9 IS “NO”, THE TAXPAYER DOES NOT QUALIFY FOR THE $1500 CREDIT.

GO TO PART III TO SEE IF THE TAXPAYER QUALIFIES FOR THE $500 CREDIT.

PART III

EMPLOYEE QUALIFICATIONS FOR THE $500 CREDIT

¨ YES

¨ NO

10. Was the new employee a resident of any qualifying municipality in which a designated enterprise zone is located? . . . . . . . .

11. Was the new employee immediately prior to employment by the taxpayer either unemployed or employed at a location

¨ YES

¨ NO

outside of the municipality in which taxpayer’s business is located? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

IF THE ANSWER TO BOTH QUESTIONS 10 AND 11 IS “YES”, ENTER THE INFORMATION REQUIRED ON SCHEDULE III

ON THE REVERSE SIDE. IF NOT, THE TAXPAYER IS NOT ENTITLED TO THE $500 CREDIT.

PART IV

CALCULATION OF THE ALLOWABLE CREDIT AMOUNT

12. $1500 CREDIT: From Schedule II, Line 5 on reverse side _______________________ x $1500 . . . . . . . .

12.

13. $500 CREDIT: From Schedule III, Line 5 on reverse side ______________________ x $500 . . . . . . . . . .

13.

14. Urban Enterprise Zone Employees Tax Credit carried forward from prior tax year . . . . . . . . . . . . . . . . . . .

14.

15. Total Urban Enterprise Zone Employees Tax Credit (Add Lines 12, 13 and 14) . . . . . . . . . . . . . . . . . . . . .

15.

16. Enter Tax Liability from Page 1, line 9 of CBT-100 or BFC-1, or line 4 of CBT-100S . . . . . . . . . . .

16.

17. Enter the required minimum tax liability as indicated in instruction (b) for Part IV . . . . . . . . . . . . . .

17.

18. Subtract Line 17 from Line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18.

19. Tax Credits taken on current year’s tax return, if applicable:

______________________________

______________________________

a)

______________________________

______________________________

b)

______________________________

______________________________

c)

______________________________

______________________________

d)

Total

19.

20. Subtract line 19 from line 18. If the result is less than zero, enter zero . . . . . . . . . . . . . . . . . . . .

20.

21. Allowable credit for the current tax period - Enter the lesser of Line 15 or Line 20 here and on Schedule A-3

of the CBT-100, the CBT-100S or the BFC-1. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21.

PART V

CALCULATION OF CREDIT CARRY FORWARD

22. Enter amount from Line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22.

23. Enter amount from Line 21, Part IV . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23.

24. Amount of Urban Enterprise Zone Investment Tax Credit Carry Forward to following year’s return

(Line 22 minus line 23) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24.

1

1 2

2