Form B-A-30 - Tax Bond For Cigarettes

ADVERTISEMENT

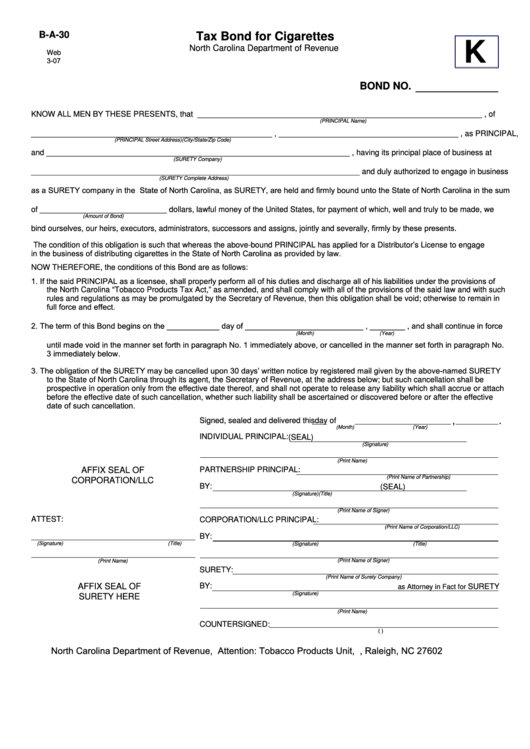

B-A-30

Tax Bond for Cigarettes

G.S. 105-113.13

K

North Carolina Department of Revenue

Web

3-07

BOND NO.

KNOW ALL MEN BY THESE PRESENTS, that _________________________________________________________________ , of

(PRINCIPAL Name)

_______________________________________________________ , _________________________________________ , as PRINCIPAL,

(PRINCIPAL Street Address)

(City/State/Zip Code)

and _____________________________________________________________________ , having its principal place of business at

(SURETY Company)

___________________________________________________________________________ and duly authorized to engage in business

(SURETY Complete Address)

as a SURETY company in the State of North Carolina, as SURETY, are held and firmly bound unto the State of North Carolina in the sum

of _____________________________ dollars, lawful money of the United States, for payment of which, well and truly to be made, we

(Amount of Bond)

bind ourselves, our heirs, executors, administrators, successors and assigns, jointly and severally, firmly by these presents.

The condition of this obligation is such that whereas the above-bound PRINCIPAL has applied for a Distributor’s License to engage

in the business of distributing cigarettes in the State of North Carolina as provided by law.

NOW THEREFORE, the conditions of this Bond are as follows:

1.

If the said PRINCIPAL as a licensee, shall properly perform all of his duties and discharge all of his liabilities under the provisions of

the North Carolina “Tobacco Products Tax Act,” as amended, and shall comply with all of the provisions of the said law and with such

rules and regulations as may be promulgated by the Secretary of Revenue, then this obligation shall be void; otherwise to remain in

full force and effect.

2.

The term of this Bond begins on the ____________ day of ___________________________ , ________ , and shall continue in force

(Month)

(Year)

until made void in the manner set forth in paragraph No. 1 immediately above, or cancelled in the manner set forth in paragraph No.

3 immediately below.

3.

The obligation of the SURETY may be cancelled upon 30 days’ written notice by registered mail given by the above-named SURETY

to the State of North Carolina through its agent, the Secretary of Revenue, at the address below; but such cancellation shall be

prospective in operation only from the effective date thereof, and shall not operate to release any liability which shall accrue or attach

before the effective date of such cancellation, whether such liability shall be ascertained or discovered before or after the effective

date of such cancellation.

.

,

Signed, sealed and delivered this

day of

(Month)

(Year)

INDIVIDUAL PRINCIPAL:

(SEAL)

(Signature)

(Print Name)

AFFIX SEAL OF

PARTNERSHIP PRINCIPAL:

(Print Name of Partnership)

CORPORATION/LLC

BY:

(SEAL)

(Signature)

(Title)

(Print Name of Signer)

ATTEST:

CORPORATION/LLC PRINCIPAL:

(Print Name of Corporation/LLC)

BY:

(Signature)

(Title)

(Signature)

(Title)

(Print Name)

(Print Name of Signer)

SURETY:

(Print Name of Surety Company)

AFFIX SEAL OF

BY:

SURETY

as Attorney in Fact for

(Signature)

SURETY HERE

(Print Name)

COUNTERSIGNED:

(N.C. REGISTERED AGENT OF SURETY)

North Carolina Department of Revenue, Attention: Tobacco Products Unit, P.O. Box 871, Raleigh, NC 27602

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2