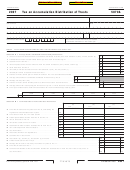

California Form 5870a - Tax On Accumulation Distribution Of Trusts - 2015 Page 3

ADVERTISEMENT

2015 Instructions for Form FTB 5870A

Tax on Accumulation Distribution of Trusts

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and to the California Revenue & Taxation Code (R&TC).

General Information

Complete Part I of form FTB 5870A to determine the

Line 2 – Enter the amount on line 1 that represents

amount of the tax due .

undistributed net income (UNI) of a trust considered

In general, for taxable years beginning on or after

to have been accumulated before you were born or

If you were an otherwise contingent beneficiary

January 1, 2015, California law conforms to the

reached age 21 . However, if the multiple trust rule

and did not receive Schedule J (541), compute

Internal Revenue Code (IRC) as of January 1, 2015 .

applies, see the instructions for line 4 .

your additional tax under the provisions of R&TC

However, there are continuing differences between

Sections 17745(b) and (d) . Complete Part II,

Line 4 – Except as noted below under “Special Rule

California and federal law . When California conforms

Section A or Section B, of form FTB 5870A to

for Multiple Trusts,” enter on line 4 the California

to federal tax law changes, we do not always adopt

determine the amount of additional tax due .

taxes (not including any alternative minimum tax)

all of the changes made at the federal level . For

charged for any earlier year on the trust income that

Do not use form FTB 5870A if you were a non-

more information, go to ftb.ca.gov and search for

are attributable to the net income reported on line 3 .

contingent beneficiary and you received an

conformity . Additional information can be found

See IRC Sections 666(b) and (c) .

accumulation distribution, but you did not receive

in FTB Pub . 1001, Supplemental Guidelines to

Schedule J (541) because the trust did not file

Special Rule for Multiple Trusts. If you received

California Adjustments, the instructions for California

Form 541 or pay the required California tax due .

accumulation distributions from two or more other

Schedule CA (540 or 540NR), and the Business

The entire trust accumulation income is taxable

trusts that were considered to have been made in any

Entity tax booklets .

in the year that you receive the distribution,

of the earlier taxable years from which the current

The instructions provided with California tax forms

and should be reported on Schedule CA (540),

accumulation distribution is considered to have been

are a summary of California tax law and are only

California Adjustments – Residents, or Schedule CA

made, do not include on line 4 the taxes attributable

intended to aid taxpayers in preparing their state

(540NR), California Adjustments – Nonresidents or

to the current accumulation distribution considered

income tax returns . We include information most

Part-Year Residents, line 21f, column C . See R&TC

to have been distributed in the same earlier taxable

useful to the greatest number of taxpayers in the

Section 17745(a) .

years . See IRC Section 667(c) .

limited space available . It is not possible to include all

California does not follow the federal rules for:

For this special rule, only count as trusts those trusts

requirements of the California Revenue and Taxation

for which the sum of this accumulation distribution

Code (R&TC) in the tax booklets . Taxpayers should

• Generation-skipping transfer tax imposed by IRC

and any earlier accumulation distributions from

not consider the tax booklets as authoritative law .

Section 2601 .

the trusts, which are considered under IRC

• The tax relating to estates imposed by IRC

If you received an accumulation distribution from

Section 666(a) to have been distributed in the same

Section 2001 or Section 2101 .

a foreign trust, use federal Form 4970, Tax on

earlier tax year, is $1,000 or more .

Accumulation Distribution of Trusts, as a worksheet .

Except as explained above, use the instructions for

Line 8 – You can determine the number of years

The partial tax from an accumulation distribution

federal Form 4970 to compute the partial tax .

which the UNI is deemed to have been distributed

of a foreign trust computed on federal Form 4970

Specific Line Instructions

by counting the throwback years for which there are

is reported on federal Form 3520, Annual Return to

entries on Schedule J (541), Part IV, line 26 through

Report Transactions With Foreign Trusts and Receipt

Part I

line 29 . These throwback rules apply even if you

of Certain Foreign Gifts . California does not conform

would not have been entitled to receive a distribution

to the federal provision relating to information

Nonresidents or part-year residents in preceding

in the earlier taxable year if the distribution had

returns required for foreign trusts with United States

five years: For any taxable year you were a

actually been made then .

beneficiaries, IRC Section 6048(c) .

nonresident or part-year resident in the accumulation

There can be more than four throwback years .

Report the accumulation distributions from foreign

years listed in Part I, Section B, skip line 14 through

trusts and from certain domestic trusts on form

line 22 . Complete Long Form 540NR, California

Line 11 – From the number of years entered on

FTB 5870A, Tax on Accumulation Distribution

Nonresident or Part-Year Resident Income Tax Return,

line 8, subtract any year in which the distribution

of Trusts, and attach it to your return . See IRC

up to line 74, total tax . Make your adjustments on

from Schedule J (541), Part IV, column (a) is less

Section 665(c) .

the accumulation years listed, eliminating the highest

than the amount on line 10 of form FTB 5870A . If the

and lowest taxable income years . Include in the total

distribution for each throwback year is more than

Although California conforms to the federal provision

adjusted gross income for Long Form 540NR the

line 10, then enter the same number on line 11 as

repealing the throwback rules, California may still apply

amount from form FTB 5870A, Part I, line 12, plus all

you entered on line 8 .

R&TC Section 17745(b) . This provision states that if the

other income of the beneficiary as if the beneficiary

trust did not pay tax on current or accumulated income

Line 13 – Enter your taxable income for years 2010

was a California resident for the entire year .

of the trust because the resident beneficiary’s interest

through 2014, even if the trust had accumulated

in the trust was contingent, this income will be taxable

Get FTB Pub . 1100, Taxation of Nonresidents

income less than five years after the beneficiary

when it is distributed or distributable to the beneficiary .

and Individuals Who Change Residency, and FTB

became 21 years old . Use the taxable income as

Pub . 1031, Guidelines for Determining Resident

originally reported, amended, or as changed by the

For any taxable year in which an otherwise contingent

Status, for more information .

Franchise Tax Board (FTB) . Include in the taxable

beneficiary receives a distribution, the beneficiary is

income, amounts considered distributed as a result

non-contingent to the extent of the distribution and

If you were a California resident at the trust’s year

of prior accumulation distributions whether from

the trust may have a filing requirement under R&TC

end, include the amount from form FTB 5870A,

the same or another trust, and whether made in an

Section 18505 for that taxable year . Get the instructions

Part I, line 12, in California adjusted gross income

earlier year or the current year .

for Form 541, California Fiduciary Income Tax Return,

on Form 540, California Resident Income Tax Return

for more information .

line 17 . If you were a nonresident at the trust’s year

For taxable years 2010 through 2014, enter the

end, include the California source income amount

amount of your taxable income, but not less than

Purpose

from form FTB 5870A, Part I, line 12 in California

zero .

adjusted gross income on Long Form 540NR,

Use form FTB 5870A to figure the additional tax

Line 17 – Compute the tax (not including any

line 32 . You may need to contact the trust for

under IRC Section 667 or R&TC Sections 17745(b)

alternative minimum tax) on the income on line 16

additional information regarding sourced income .

and (d) on an accumulation distribution made by

using the tax rates in effect for the earlier year shown

In either instance, include all other income of the

a foreign trust and certain domestic trusts in the

in each of the three columns . Use the California tax

beneficiary from periods of California residency and

current year .

tables included in the personal income tax booklets

all other California source income from periods of

for prior years .

If IRC Section 667 and R&TC Section 17745(b) both

nonresidency .

appear to apply to the same distribution, calculate

Line 18 – Enter your tax (not including any

Enter the amount from Long Form 540NR, line 74

the tax on the distribution using R&TC Section 17745

alternative minimum tax) as originally reported,

on form FTB 5870A, Part I, Section B, line 23 . Follow

and Part II only . See R&TC Section 17779 .

amended, or as changed by the FTB before reduction

the instructions for completing the rest of form

for any credits for the particular earlier year shown in

If you were a noncontingent beneficiary and you

FTB 5870A .

each of the three columns .

received Schedule J (541), Trust Allocation of

Line 1 – Enter the amount distributed in the current

an Accumulation Distribution, and the trust filed

year that represents the undistributed net income of

Form 541, and paid the tax, compute your additional

a trust considered to have been distributed in earlier

tax under the provisions of IRC Section 667 .

years .

FTB 5870A Instructions 2015 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4