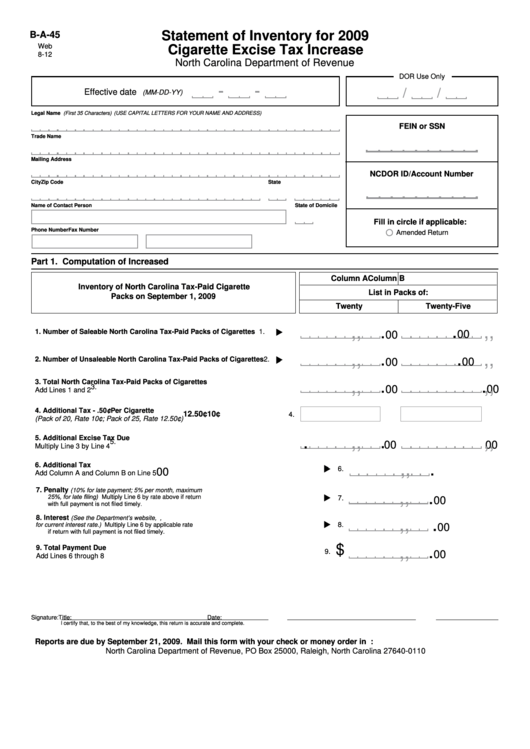

Statement of Inventory for 2009

B-A-45

Web

Cigarette Excise Tax Increase

8-12

North Carolina Department of Revenue

DOR Use Only

Effective date

(MM-DD-YY)

Legal Name (First 35 Characters)

(USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

FEIN or SSN

Trade Name

Mailing Address

NCDOR ID/Account Number

City

State

Zip Code

Name of Contact Person

State of Domicile

Fill in circle if applicable:

Phone Number

Fax Number

Amended Return

Part 1. Computation of Increased N.C. Cigarette Excise Tax

Column A

Column B

Inventory of North Carolina Tax-Paid Cigarette

List in Packs of:

Packs on September 1, 2009

Twenty

Twenty-Five

,

,

.

,

,

.

1. Number of Saleable North Carolina Tax-Paid Packs of Cigarettes

1.

00

00

,

,

.

,

,

.

2. Number of Unsaleable North Carolina Tax-Paid Packs of Cigarettes

2.

00

00

3. Total North Carolina Tax-Paid Packs of Cigarettes

.

.

,

,

,

,

3.

00

00

Add Lines 1 and 2

4. Additional Tax - .50¢ Per Cigarette

10¢

12.50¢

4.

(Pack of 20, Rate 10¢; Pack of 25, Rate 12.50¢)

,

,

.

,

,

.

5. Additional Excise Tax Due

5.

00

00

Multiply Line 3 by Line 4

,

,

.

6. Additional Tax

6.

00

Add Column A and Column B on Line 5

7. Penalty

(10% for late payment; 5% per month, maximum

,

,

.

25%, for late filing) Multiply Line 6 by rate above if return

7.

00

with full payment is not filed timely.

8. Interest

(See the Department’s website, ,

,

,

.

8.

for current interest rate.) Multiply Line 6 by applicable rate

00

if return with full payment is not filed timely.

$

.

9. Total Payment Due

,

,

9.

00

Add Lines 6 through 8

Signature:

Title:

Date:

I certify that, to the best of my knowledge, this return is accurate and complete.

Reports are due by September 21, 2009. Mail this form with your check or money order in U.S. currency from a domestic bank to:

North Carolina Department of Revenue, PO Box 25000, Raleigh, North Carolina 27640-0110

1

1 2

2