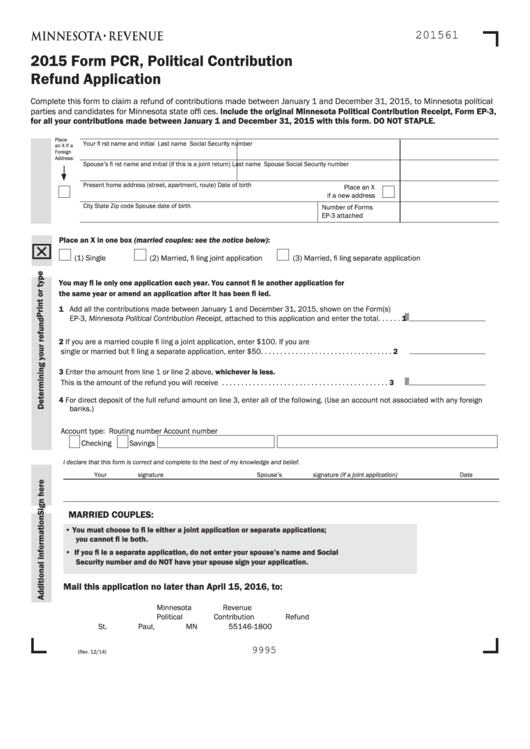

201561

2015 Form PCR, Political Contribution

Refund Application

Complete this form to claim a refund of contributions made between January 1 and December 31, 2015, to Minnesota political

parties and candidates for Minnesota state offi ces. Include the original Minnesota Political Contribution Receipt, Form EP-3,

for all your contributions made between January 1 and December 31, 2015 with this form. DO NOT STAPLE.

Place

Your fi rst name and initial

Last name

Social Security number

an X If a

Foreign

Address:

Spouse’s fi rst name and initial (if this is a joint return)

Last name

Spouse Social Security number

Present home address (street, apartment, route)

Date of birth

Place an X

if a new address

City

State

Zip code

Spouse date of birth

Number of Forms

EP-3 attached

Place an X in one box (married couples: see the notice below):

(1) Single

(2) Married, fi ling joint application

(3) Married, fi ling separate application

You may fi le only one application each year. You cannot fi le another application for

the same year or amend an application after it has been fi led.

1 Add all the contributions made between January 1 and December 31, 2015, shown on the Form(s)

EP-3, Minnesota Political Contribution Receipt, attached to this application and enter the total. . . . . . 1

2 If you are a married couple fi ling a joint application, enter $100. If you are

single or married but fi ling a separate application, enter $50. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Enter the amount from line 1 or line 2 above, whichever is less.

This is the amount of the refund you will receive . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 For direct deposit of the full refund amount on line 3, enter all of the following. (Use an account not associated with any foreign

banks.)

Account type:

Routing number

Account number

Checking

Savings

I declare that this form is correct and complete to the best of my knowledge and belief.

Your signature

Spouse’s signature (if a joint application)

Date

Daytime phone

MARRIED COUPLES:

• You must choose to fi le either a joint application or separate applications;

you cannot fi le both.

• If you fi le a separate application, do not enter your spouse’s name and Social

Security number and do NOT have your spouse sign your application.

Mail this application no later than April 15, 2016, to:

Minnesota Revenue

Political Contribution Refund

St. Paul, MN 55146-1800

9995

(Rev. 12/14)

1

1 2

2 3

3 4

4