Maine Contributions To Family Development Account Reserve Funds Tax Credit Worksheet For Tax Year 2015

ADVERTISEMENT

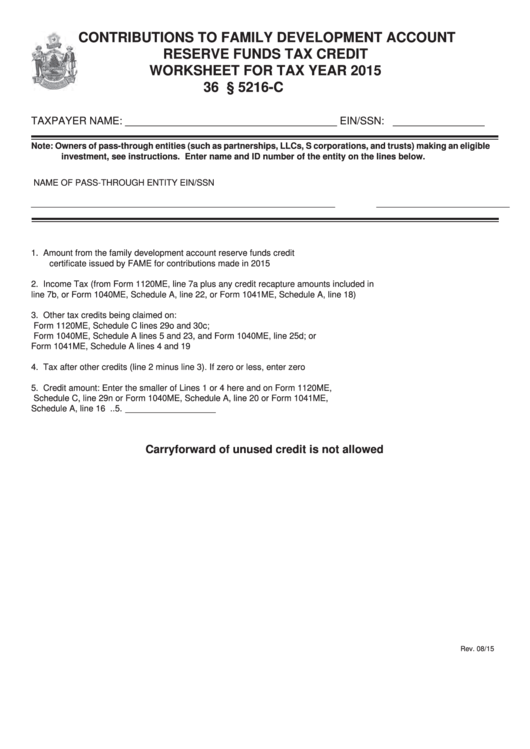

CONTRIBUTIONS TO FAMILY DEVELOPMENT ACCOUNT

RESERVE FUNDS TAX CREDIT

WORKSHEET FOR TAX YEAR 2015

36 M.R.S. § 5216-C

TAXPAYER NAME: _____________________________________ EIN/SSN: ________________

Note: Owners of pass-through entities (such as partnerships, LLCs, S corporations, and trusts) making an eligible

investment, see instructions. Enter name and ID number of the entity on the lines below.

NAME OF PASS-THROUGH ENTITY

EIN/SSN

________________________________________________________________

____________________________

1.

Amount from the family development account reserve funds credit

certifi cate issued by FAME for contributions made in 2015 ............................................... 1. ___________________

2.

Income Tax (from Form 1120ME, line 7a plus any credit recapture amounts included in

line 7b, or Form 1040ME, Schedule A, line 22, or Form 1041ME, Schedule A, line 18).... 2. ___________________

3.

Other tax credits being claimed on:

Form 1120ME, Schedule C lines 29o and 30c;

Form 1040ME, Schedule A lines 5 and 23, and Form 1040ME, line 25d; or

Form 1041ME, Schedule A lines 4 and 19 ........................................................................ 3. ___________________

4.

Tax after other credits (line 2 minus line 3). If zero or less, enter zero .............................. 4. ___________________

5.

Credit amount: Enter the smaller of Lines 1 or 4 here and on Form 1120ME,

Schedule C, line 29n or Form 1040ME, Schedule A, line 20 or Form 1041ME,

Schedule A, line 16 ............................................................................................................ 5. ___________________

Carryforward of unused credit is not allowed

Rev. 08/15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2