Print

Clear

*150650110002*

2015

D-65 Partnership Return

Government of the

District of Columbia

of Income

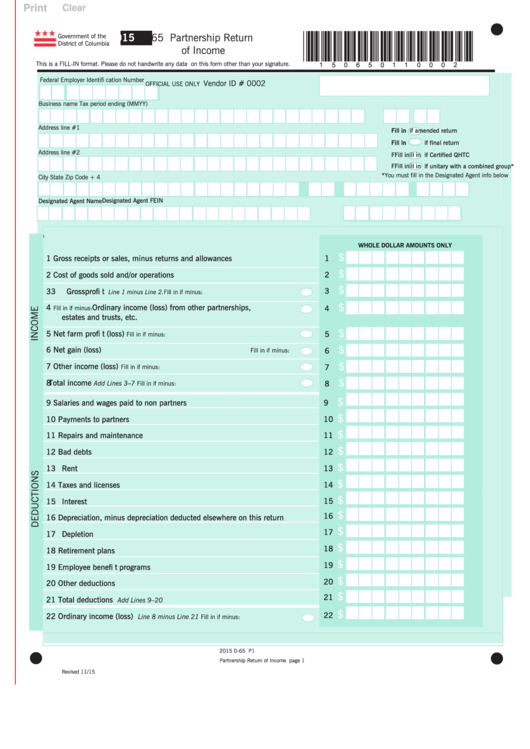

This is a FILL-IN format. Please do not handwrite any data on this form other than your signature.

Federal Employer Identifi cation Number

Vendor ID # 0002

OFFICIAL USE ONLY

Business name

Tax period ending (MMYY)

Address line #1

Fill in

Fill in

if amended return

Fill in

Fill in

if final return

Address line #2

F F ill in

ill in

if Certified QHTC

F F ill in

ill in

if unitary with a combined group*

*You must fill in the Designated Agent info below

City

State

Zip Code + 4

Designated Agent FEIN

Designated Agent Name

WHOLE DOLLAR AMOUNTS ONLY

$

1

Gross receipts or sales, minus returns and allowances

1

$

2

Cost of goods sold and/or operations

2

$

3 3

Gross profi t

3

Line 1 minus Line 2.

Fill in if minus:

$

4

Ordinary income (loss) from other partnerships,

4

Fill in if minus:

estates and trusts, etc.

$

5

Net farm profi t (loss)

5

Fill in if minus:

$

6

Net gain (loss)

6

Fill in if minus:

$

7

Other income (loss)

7

Fill in if minus:

$

8 8

Total income

8

Add Lines 3–7

Fill in if minus:

$

9

Salaries and wages paid to non partners

9

$

10 Payments to partners

10

$

11 Repairs and maintenance

11

$

12 Bad debts

12

$

13 Rent

13

$

14

14 Taxes and licenses

$

15 Interest

15

$

16

16 Depreciation, minus depreciation deducted elsewhere on this return

$

17

17 Depletion

$

18

18 Retirement plans

$

19

19 Employee benefi t programs

$

20

20 Other deductions

$

21

21 Total deductions

Add Lines 9–20

$

22

22 Ordinary income (loss)

Line 8 minus Line 21

Fill in if minus:

2015 D-65 P1

Partnership Return of Income page 1

Revised 11/15

1

1 2

2