Form Et-85 - New York State Estate Tax Certification

ADVERTISEMENT

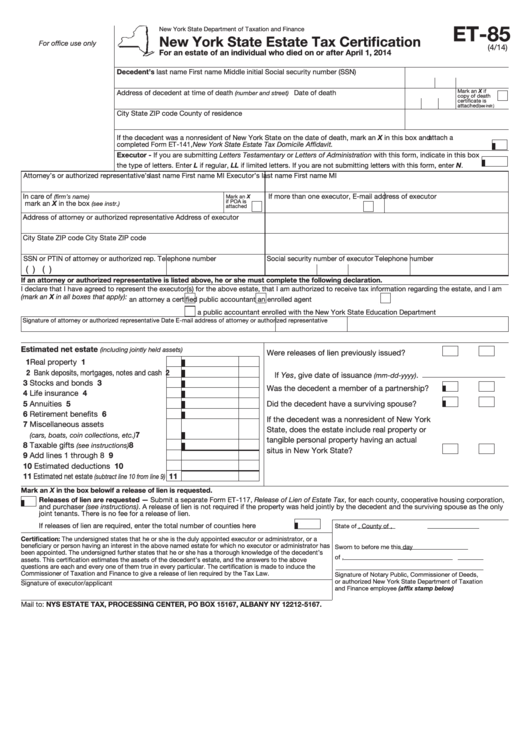

ET-85

New York State Department of Taxation and Finance

New York State Estate Tax Certification

For office use only

(4/14)

For an estate of an individual who died on or after April 1, 2014

Decedent’s last name

First name

Middle initial

Social security number (SSN)

Mark an X if

Address of decedent at time of death

Date of death

(number and street)

copy of death

certificate is

attached

(see instr.)

City

State

ZIP code

County of residence

If the decedent was a nonresident of New York State on the date of death, mark an X in this box and attach a

completed Form ET-141, New York State Estate Tax Domicile Affidavit.

Executor - If you are submitting Letters Testamentary or Letters of Administration with this form, indicate in this box

the type of letters. Enter L if regular, LL if limited letters. If you are not submitting letters with this form, enter N. ..........

Attorney’s or authorized representative’s last name

First name

MI

Executor’s last name

First name

MI

In care of

If more than one executor,

E-mail address of executor

(firm’s name)

Mark an X

if POA is

mark an X in the box

(see instr.)

attached

Address of attorney or authorized representative

Address of executor

City

State

ZIP code

City

State

ZIP code

SSN or PTIN of attorney or authorized rep.

Telephone number

Social security number of executor

Telephone number

(

)

(

)

If an attorney or authorized representative is listed above, he or she must complete the following declaration.

I declare that I have agreed to represent the executor(s) for the above estate, that I am authorized to receive tax information regarding the estate, and I am

(mark an X in all boxes that apply):

an attorney

a certified public accountant

an enrolled agent

a public accountant enrolled with the New York State Education Department

Signature of attorney or authorized representative

Date

E-mail address of attorney or authorized representative

Estimated net estate

(including jointly held assets)

Were releases of lien previously issued? ..............

Yes

No

1 Real property .....................................

1

2 Bank deposits, mortgages, notes and cash

2

If Yes, give date of issuance

.

(mm-dd-yyyy)

3 Stocks and bonds .............................

3

Was the decedent a member of a partnership? ....

Yes

No

4 Life insurance ....................................

4

5 Annuities ............................................

5

Did the decedent have a surviving spouse? .........

Yes

No

6 Retirement benefits ...........................

6

If the decedent was a nonresident of New York

7 Miscellaneous assets

State, does the estate include real property or

......

7

(cars, boats, coin collections, etc.)

tangible personal property having an actual

8 Taxable gifts

8

.............

(see instructions)

situs in New York State? .......................................

Yes

No

9 Add lines 1 through 8 ........................

9

10 Estimated deductions ....................... 10

11 Estimated net estate

11

(subtract line 10 from line 9)

Mark an X in the box below if a release of lien is requested.

Releases of lien are requested — Submit a separate Form ET-117, Release of Lien of Estate Tax, for each county, cooperative housing corporation,

and purchaser (see instructions). A release of lien is not required if the property was held jointly by the decedent and the surviving spouse as the only

joint tenants. There is no fee for a release of lien.

If releases of lien are required, enter the total number of counties here ....................

State of

, County of

,

Certification: The undersigned states that he or she is the duly appointed executor or administrator, or a

beneficiary or person having an interest in the above named estate for which no executor or administrator has

Sworn to before me this

day

been appointed. The undersigned further states that he or she has a thorough knowledge of the decedent’s

of

,

assets. This certification estimates the assets of the decedent’s estate, and the answers to the above

questions are each and every one of them true in every particular. The certification is made to induce the

Commissioner of Taxation and Finance to give a release of lien required by the Tax Law.

Signature of Notary Public, Commissioner of Deeds,

or authorized New York State Department of Taxation

Signature of executor/applicant

and Finance employee (affix stamp below)

Mail to: NYS ESTATE TAX, PROCESSING CENTER, PO BOX 15167, ALBANY NY 12212-5167.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1