Instructions For Form 331 - Arizona Credit For Donation Of School Site - 2014

ADVERTISEMENT

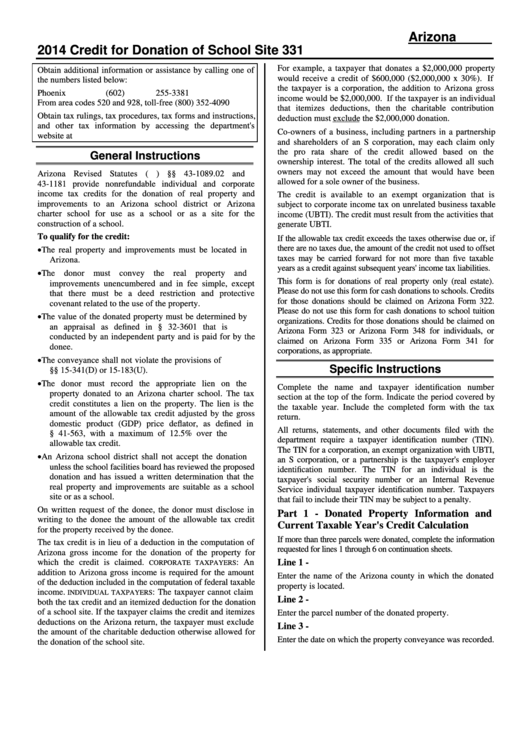

Arizona Form

2014 Credit for Donation of School Site

331

For example, a taxpayer that donates a $2,000,000 property

Obtain additional information or assistance by calling one of

would receive a credit of $600,000 ($2,000,000 x 30%). If

the numbers listed below:

the taxpayer is a corporation, the addition to Arizona gross

Phoenix

(602) 255-3381

income would be $2,000,000. If the taxpayer is an individual

From area codes 520 and 928, toll-free

(800) 352-4090

that itemizes deductions, then the charitable contribution

Obtain tax rulings, tax procedures, tax forms and instructions,

deduction must exclude the $2,000,000 donation.

and other tax information by accessing the department's

Co-owners of a business, including partners in a partnership

website at

and shareholders of an S corporation, may each claim only

the pro rata share of the credit allowed based on the

General Instructions

ownership interest. The total of the credits allowed all such

owners may not exceed the amount that would have been

Arizona Revised Statutes (A.R.S.) §§ 43-1089.02 and

allowed for a sole owner of the business.

43-1181 provide nonrefundable individual and corporate

income tax credits for the donation of real property and

The credit is available to an exempt organization that is

improvements to an Arizona school district or Arizona

subject to corporate income tax on unrelated business taxable

charter school for use as a school or as a site for the

income (UBTI). The credit must result from the activities that

construction of a school.

generate UBTI.

To qualify for the credit:

If the allowable tax credit exceeds the taxes otherwise due or, if

The real property and improvements must be located in

there are no taxes due, the amount of the credit not used to offset

taxes may be carried forward for not more than five taxable

Arizona.

years as a credit against subsequent years' income tax liabilities.

The donor must convey the real property and

This form is for donations of real property only (real estate).

improvements unencumbered and in fee simple, except

Please do not use this form for cash donations to schools. Credits

that there must be a deed restriction and protective

for those donations should be claimed on Arizona Form 322.

covenant related to the use of the property.

Please do not use this form for cash donations to school tuition

The value of the donated property must be determined by

organizations. Credits for those donations should be claimed on

an appraisal as defined in A.R.S. § 32-3601 that is

Arizona Form 323 or Arizona Form 348 for individuals, or

conducted by an independent party and is paid for by the

claimed on Arizona Form 335 or Arizona Form 341 for

donee.

corporations, as appropriate.

The conveyance shall not violate the provisions of A.R.S.

Specific Instructions

§§ 15-341(D) or 15-183(U).

The donor must record the appropriate lien on the

Complete the name and taxpayer identification number

property donated to an Arizona charter school. The tax

section at the top of the form. Indicate the period covered by

credit constitutes a lien on the property. The lien is the

the taxable year. Include the completed form with the tax

amount of the allowable tax credit adjusted by the gross

return.

domestic product (GDP) price deflator, as defined in

All returns, statements, and other documents filed with the

A.R.S. § 41-563, with a maximum of 12.5% over the

department require a taxpayer identification number (TIN).

allowable tax credit.

The TIN for a corporation, an exempt organization with UBTI,

An Arizona school district shall not accept the donation

an S corporation, or a partnership is the taxpayer's employer

unless the school facilities board has reviewed the proposed

identification number. The TIN for an individual is the

donation and has issued a written determination that the

taxpayer's social security number or an Internal Revenue

real property and improvements are suitable as a school

Service individual taxpayer identification number. Taxpayers

site or as a school.

that fail to include their TIN may be subject to a penalty.

On written request of the donee, the donor must disclose in

Part 1 - Donated Property Information and

writing to the donee the amount of the allowable tax credit

Current Taxable Year's Credit Calculation

for the property received by the donee.

If more than three parcels were donated, complete the information

The tax credit is in lieu of a deduction in the computation of

requested for lines 1 through 6 on continuation sheets.

Arizona gross income for the donation of the property for

which the credit is claimed.

: An

Line 1 -

CORPORATE TAXPAYERS

addition to Arizona gross income is required for the amount

Enter the name of the Arizona county in which the donated

of the deduction included in the computation of federal taxable

property is located.

income.

: The taxpayer cannot claim

INDIVIDUAL TAXPAYERS

Line 2 -

both the tax credit and an itemized deduction for the donation

of a school site. If the taxpayer claims the credit and itemizes

Enter the parcel number of the donated property.

deductions on the Arizona return, the taxpayer must exclude

Line 3 -

the amount of the charitable deduction otherwise allowed for

Enter the date on which the property conveyance was recorded.

the donation of the school site.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2