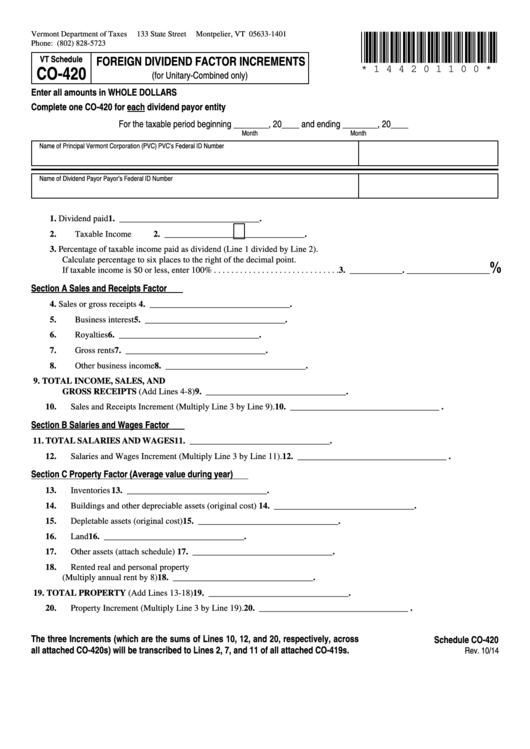

Schedule Co-420 - Vermont Foreign Dividend Factor Increments

ADVERTISEMENT

Vermont Department of Taxes

133 State Street

Montpelier, VT 05633-1401

*144201100*

Phone: (802) 828-5723

FOREIGN DIVIDEND FACTOR INCREMENTS

VT Schedule

CO-420

* 1 4 4 2 0 1 1 0 0 *

(for Unitary-Combined only)

Enter all amounts in WHOLE DOLLARS

Complete one CO-420 for each dividend payor entity

For the taxable period beginning ________, 20____ and ending ________, 20____

Month

Month

Name of Principal Vermont Corporation (PVC)

PVC’s Federal ID Number

Name of Dividend Payor

Payor’s Federal ID Number

1. Dividend paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1. ________________________________ .

2. Taxable Income . . . . . . . . . . . . . . . . . . . . . . . . . .

2. ________________________________ .

3. Percentage of taxable income paid as dividend (Line 1 divided by Line 2) .

%

Calculate percentage to six places to the right of the decimal point .

If taxable income is $0 or less, enter 100% . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3. ____________ . ___________________

Section A

Sales and Receipts Factor

4. Sales or gross receipts . . . . . . . . . . . . . . . . . . . . . . . . . 4. ________________________________ .

5. Business interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5. ________________________________ .

6. Royalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6. ________________________________ .

7. Gross rents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7. ________________________________ .

8. Other business income . . . . . . . . . . . . . . . . . . . . . . . . . 8. ________________________________ .

9. TOTAL INCOME, SALES, AND

GROSS RECEIPTS (Add Lines 4-8) . . . . . . . . . . . . .9. ________________________________ .

10. Sales and Receipts Increment (Multiply Line 3 by Line 9) . . . . . . . . . . . . . . . . .10. __________________________________ .

Section B

Salaries and Wages Factor

11. TOTAL SALARIES AND WAGES . . . . . . . . . . . . . 11. ________________________________ .

12. Salaries and Wages Increment (Multiply Line 3 by Line 11) . . . . . . . . . . . . . . .12. __________________________________ .

Section C

Property Factor (Average value during year)

13. Inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13. ________________________________ .

14. Buildings and other depreciable assets (original cost) 14. ________________________________ .

15. Depletable assets (original cost) . . . . . . . . . . . . . . . . .15. ________________________________ .

16. Land . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16. ________________________________ .

17. Other assets (attach schedule) . . . . . . . . . . . . . . . . . . 17. ________________________________ .

18. Rented real and personal property

(Multiply annual rent by 8) . . . . . . . . . . . . . . . . . . . . . 18. ________________________________ .

19. TOTAL PROPERTY (Add Lines 13-18) . . . . . . . . .19. ________________________________ .

20. Property Increment (Multiply Line 3 by Line 19) . . . . . . . . . . . . . . . . . . . . . . . .20. __________________________________ .

The three Increments (which are the sums of Lines 10, 12, and 20, respectively, across

Schedule CO-420

all attached CO-420s) will be transcribed to Lines 2, 7, and 11 of all attached CO-419s.

Rev. 10/14

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1