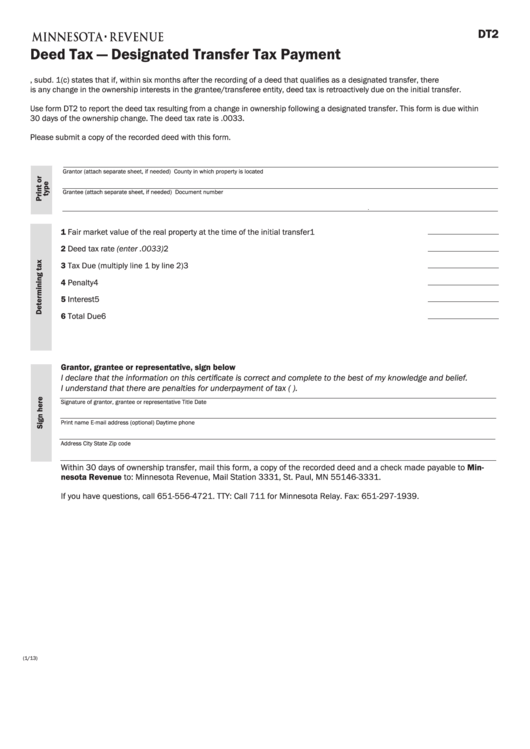

DT2

Deed Tax — Designated Transfer Tax Payment

M.S. 287.21, subd. 1(c) states that if, within six months after the recording of a deed that qualifies as a designated transfer, there

is any change in the ownership interests in the grantee/transferee entity, deed tax is retroactively due on the initial transfer.

Use form DT2 to report the deed tax resulting from a change in ownership following a designated transfer. This form is due within

30 days of the ownership change. The deed tax rate is .0033.

Please submit a copy of the recorded deed with this form.

Grantor (attach separate sheet, if needed)

County in which property is located

Grantee (attach separate sheet, if needed)

Document number

1 Fair market value of the real property at the time of the initial transfer . . . . . . . . . . . . . . . . . . . . . . . . . . .1

2 Deed tax rate (enter .0033) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2

3 Tax Due (multiply line 1 by line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3

4 Penalty . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4

5 Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .5

6 Total Due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6

Grantor, grantee or representative, sign below

I declare that the information on this certificate is correct and complete to the best of my knowledge and belief.

I understand that there are penalties for underpayment of tax (M.S. 287.31 and M.S. 287.325).

Signature of grantor, grantee or representative

Title

Date

Print name

E-mail address (optional)

Daytime phone

Address

City

State

Zip code

Within 30 days of ownership transfer, mail this form, a copy of the recorded deed and a check made payable to Min-

nesota Revenue to: Minnesota Revenue, Mail Station 3331, St. Paul, MN 55146-3331.

If you have questions, call 651-556-4721. TTY: Call 711 for Minnesota Relay. Fax: 651-297-1939.

(1/13)

1

1