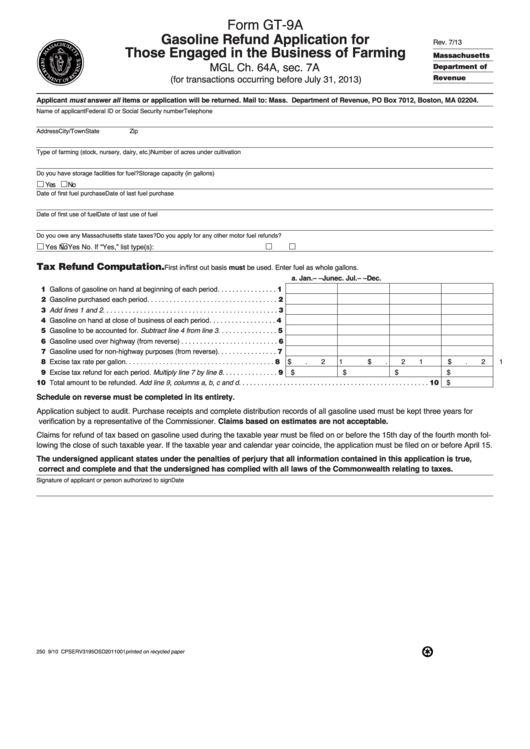

Form GT-9A

Gasoline Refund Application for

Rev. 7/13

Those Engaged in the Business of Farming

Massachusetts

MGL Ch. 64A, sec. 7A

Department of

Revenue

(for transactions occurring before July 31, 2013)

Applicant must answer all items or application will be returned. Mail to: Mass. Department of Revenue, PO Box 7012, Boston, MA 02204.

Name of applicant

Federal ID or Social Security number

Telephone

Address

City/Town

State

Zip

Type of farming (stock, nursery, dairy, etc.)

Number of acres under cultivation

Do you have storage facilities for fuel?

Storage capacity (in gallons)

Yes

No

Date of first fuel purchase

Date of last fuel purchase

Date of first use of fuel

Date of last use of fuel

Do you owe any Massachusetts state taxes?

Do you apply for any other motor fuel refunds?

Yes

No

Yes

No. If “Yes,” list type(s):

Tax Refund Computation.

First in/first out basis must be used. Enter fuel as whole gallons.

a. Jan.–Mar.

b. Apr.– June

c. Jul.–Sep.

d. Oct.–Dec.

11 Gallons of gasoline on hand at beginning of each period. . . . . . . . . . . . . . . . 1

12 Gasoline purchased each period. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

13 Add lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

14 Gasoline on hand at close of business of each period . . . . . . . . . . . . . . . . . . 4

15 Gasoline to be accounted for. Subtract line 4 from line 3 . . . . . . . . . . . . . . . . 5

16 Gasoline used over highway (from reverse) . . . . . . . . . . . . . . . . . . . . . . . . . . 6

17 Gasoline used for non-highway purposes (from reverse). . . . . . . . . . . . . . . . 7

18 Excise tax rate per gallon . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

$

.21

$

.21

$

.21

$

.21

19 Excise tax refund for each period. Multiply line 7 by line 8 . . . . . . . . . . . . . . . 9

$

$

$

$

10 Total amount to be refunded. Add line 9, columns a, b, c and d . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

$

Schedule on reverse must be completed in its entirety.

Application subject to audit. Purchase receipts and complete distribution records of all gasoline used must be kept three years for

verification by a representative of the Commissioner. Claims based on estimates are not acceptable.

Claims for refund of tax based on gasoline used during the taxable year must be filed on or before the 15th day of the fourth month fol-

lowing the close of such taxable year. If the taxable year and calendar year coincide, the application must be filed on or before April 15.

The undersigned applicant states under the penalties of perjury that all information contained in this application is true,

correct and complete and that the undersigned has complied with all laws of the Commonwealth relating to taxes.

Signature of applicant or person authorized to sign

Date

250 9/10 CPSERV3195OSD2011001

printed on recycled paper

1

1 2

2