STATE OF CALIFORNIA

BOE-501-AB (S2F) REV. 6 (4-13)

BOARD OF EQUALIZATION

INSTRUCTIONS FOR EXEMPT BUS OPERATOR USE FUEL TAX RETURN

User of Fuel Exempt Under Section 8655, of the Revenue and Taxation Code

Payments: You can make your payment by paper check, Online ACH Debit (ePay) or by credit card. To use ePay, go to our

website at , click on the eServices tab and log in to make a payment. To pay by credit card, go to our

website or call 1-855-292-8931. Mandatory EFT accounts must pay by EFT or ePay. Be sure to sign and mail your return.

GENERAL INFORMATION

Fuel users must file this return to report use of the following types of fuels (when used in the fuel tanks of motor vehicles):

Compressed natural gas (CNG)

Liquefied petroleum gas (LPG) and liquid natural gas (LNG)

Alcohol fuels containing not more than 15 percent gasoline or diesel fuel (for example, ethanol and methanol)

Kerosene, distillate, and stove oil

Any fuel used or suitable for use in motor vehicles, other than fuel subject to the diesel fuel tax or the motor

vehicle fuel tax (for example, gasoline and blended fuels with more than 15 percent gasoline are subject to the

motor vehicle fuel tax and, as a result, are not subject to use fuel tax).

TAX LIABILITY

You must have a user use fuel permit and file returns if you operate on California highways a vehicle that weighs, unladen,

over 7,000 pounds and is powered by fuels described above. Returns are also required of owners/operators of vehicles that

use the above fuels in commercial vehicles weighing less than 7,000 pounds and are paying the annual flat rate tax.

FILING REQUIREMENTS

Users of fuel subject to the use fuel tax must file returns. The return and payment is due on the last day of the month

following the end of the reporting period. Payments should be made payable to the State Board of Equalization. A return

must be filed for each period even though no fuel may have been used during the period. If no fuel was used write the word

"none" in line 3.

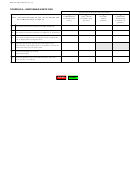

Line 1. Enter the total number of gallons or units of fuel which you used to operate vehicles both in and out of California.

Include fuel used by a lessee of your vehicles if you are responsible for furnishing the fuel, see Regulation 1304,

User. Report whole gallons or whole units only. Round off tenths of gallons to the nearest whole gallon. Round off

tenths of units to the nearest whole unit. "Bulk storage" includes fuel stored in drums, barrels, tanks or other

storage facilities, except fuel supply tanks of vehicles.

Line 2. Enter the number of gallons or units of fuel used in a nontaxable manner from line A6 of Schedule A. Only fuel

included in line 1 can be claimed on line 2.

Line 3. Subtract line 2 from line 1.

Line 4a. Enter the total number of gallons or units of fuel used in an exempt manner for qualifying local transit services by:

Any transit district, transit authority, or a city owning and operating a local transit system itself or through a

wholly owned non-profit corporation.

Any private entity providing transportation services under a contract or agreement other than a general franchise

agreement, with a public agency authorized to provide public transportation services.

Any passenger stage corporation subject to the jurisdiction of the PUC and providing transportation of persons

for hire when the motor vehicle is exclusively operated in urban or suburban areas or between cities in close

proximity. Do not include fuel used on any route which exceeds 50 miles one-way.

Any common carrier of passengers operating exclusively within the limits of a single city between fixed terminals

or over a regular route, 98 percent of whose operations are within the limits of a single city.

Line 4b. Enter the total number of gallons or units of fuel used in an exempt manner for school bus transit operations by:

Any school district, community college district, or county superintendent of schools owning, leasing or operating

buses for the purpose of transporting pupils to and from school and for other school activities or any private

entity providing such transportation services under a contract with the school district.

Line 4c. Enter the sum of lines 4a and 4b.

1

1 2

2 3

3 4

4