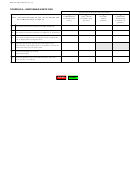

BOE-501-AB (S2B) REV. 6 (4-13)

Line 5.

Enter the number of gallons or units of fuel used in operations other than exempt local transit services or school

bus transit.

Note:

The sum of lines 4c and 5 must equal line 3.

Line 6.

Section 8655 of the Revenue and Taxation Code, imposes a tax of 1 cent per unit/gallon on the fuel used for

local transit services or school bus transit.

Line 7.

Enter the amount of tax computed on the units/gallons for which exemption is claimed in line 4c. Multiply line 4c

by line 6.

Line 8.

Tax rate on fuel used in non-exempt bus operations.

Line 9.

Enter the amount of tax computed by multiplying line 7 by the tax rate shown on line 8 for each type of fuel.

Line 10. Add lines 7 and 9.

Line 11. Enter the amount of the Use Fuel Tax paid to the vendor on fuel purchased in California. Do not include the

federal fuel tax or state and local sales and use taxes.

Line 12. Subtract line 11 from line 10 and enter the difference on line 12. If line 10 is larger than line 11, enter the amount

of tax due with this return. If line 11 is larger than line 10, indicate the credit by entering a minus sign (-).

Line 13. Combine columns A, B, C, and D of line 12 and enter the total on line 13. If the total on line 13 results in a credit,

enter the amount as a negative number. Do not claim credit on future returns; a refund will be processed.

Line 14. If you are paying your tax on line 13 after the due date shown on the front of this return, you will owe a penalty

of 10 percent of the amount of tax due. Enter the penalty by multiplying the tax due on line 13 by 0.10 and enter

here.

Line 15. If you are paying your tax on line 13 after the due date shown on the front of this return, you will owe interest.

The interest rate noted on the front of this return applies for each month, or fraction of a month, that your

payment is late. Enter the interest by multiplying the tax due on line 13 by the interest rate shown, then multiply

the result by the number of months, or fraction of a month, that have elapsed since the due date and enter here.

Line 16. Enter the total amount due and payable by adding lines 13, 14, and 15. If claiming a refund, enter the amount of

the refund claimed as a negative number.

Note - gallons vs. units: Fuel transactions are reported in terms of gallons, except for compressed natural gas

(CNG), which is reported as units. For tax reporting purposes, 100 cubic feet of natural gas measured at standard

pressure and temperature (14.73 pounds per square inch at 60 degrees Fahrenheit) will be shown as one unit.

If you need additional information, please contact the State Board of Equalization, Motor Carrier Office, P.O. Box 942879, Sacramento, CA

94279-0065. You may also visit the BOE website at or call the Taxpayer Information Section at 1-800-400-7115 (TTY:711);

from the main menu, select the option Special Taxes and Fees.

1

1 2

2 3

3 4

4