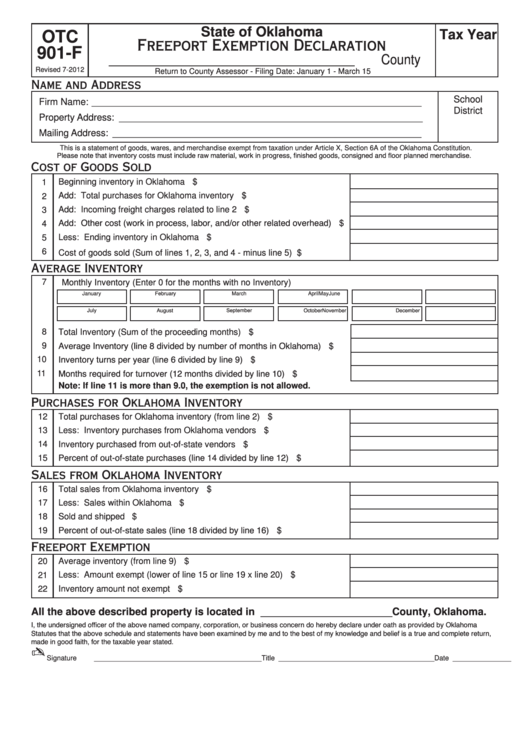

State of Oklahoma

Tax Year

OTC

Freeport Exemption Declaration

901-F

________________________________ County

Revised 7-2012

Return to County Assessor - Filing Date: January 1 - March 15

Name and Address

School

Firm Name: _______________________________________________________________

District

Property Address: __________________________________________________________

Mailing Address: ___________________________________________________________

This is a statement of goods, wares, and merchandise exempt from taxation under Article X, Section 6A of the Oklahoma Constitution.

Please note that inventory costs must include raw material, work in progress, finished goods, consigned and floor planned merchandise.

Cost of Goods Sold

Beginning inventory in Oklahoma ..................................................................

$

1

Add: Total purchases for Oklahoma inventory ..............................................

$

2

Add: Incoming freight charges related to line 2 ............................................

$

3

Add: Other cost (work in process, labor, and/or other related overhead) .....

$

4

Less: Ending inventory in Oklahoma ............................................................

$

5

6

Cost of goods sold (Sum of lines 1, 2, 3, and 4 - minus line 5) ....................

$

Average Inventory

7

Monthly Inventory (Enter 0 for the months with no Inventory)

February

January

March

April

May

June

September

October

November

December

July

August

8

Total Inventory (Sum of the proceeding months) ...........................................

$

Average Inventory (line 8 divided by number of months in Oklahoma) .........

9

$

Inventory turns per year (line 6 divided by line 9) ..........................................

10

$

Months required for turnover (12 months divided by line 10) ........................

11

$

Note: If line 11 is more than 9.0, the exemption is not allowed.

Purchases for Oklahoma Inventory

12

Total purchases for Oklahoma inventory (from line 2) ...................................

$

13

Less: Inventory purchases from Oklahoma vendors ....................................

$

14

Inventory purchased from out-of-state vendors .............................................

$

Percent of out-of-state purchases (line 14 divided by line 12).......................

15

$

Sales from Oklahoma Inventory

16

Total sales from Oklahoma inventory ............................................................

$

17

Less: Sales within Oklahoma .......................................................................

$

18

Sold and shipped out-of-state........................................................................

$

Percent of out-of-state sales (line 18 divided by line 16) ...............................

19

$

Freeport Exemption

Average inventory (from line 9) .....................................................................

$

20

Less: Amount exempt (lower of line 15 or line 19 x line 20) .........................

$

21

Inventory amount not exempt ........................................................................

$

22

All the above described property is located in _______________________ County, Oklahoma.

I, the undersigned officer of the above named company, corporation, or business concern do hereby declare under oath as provided by Oklahoma

Statutes that the above schedule and statements have been examined by me and to the best of my knowledge and belief is a true and complete return,

made in good faith, for the taxable year stated.

✍

Signature ___________________________________________ Title ________________________________________Date _______________

1

1 2

2