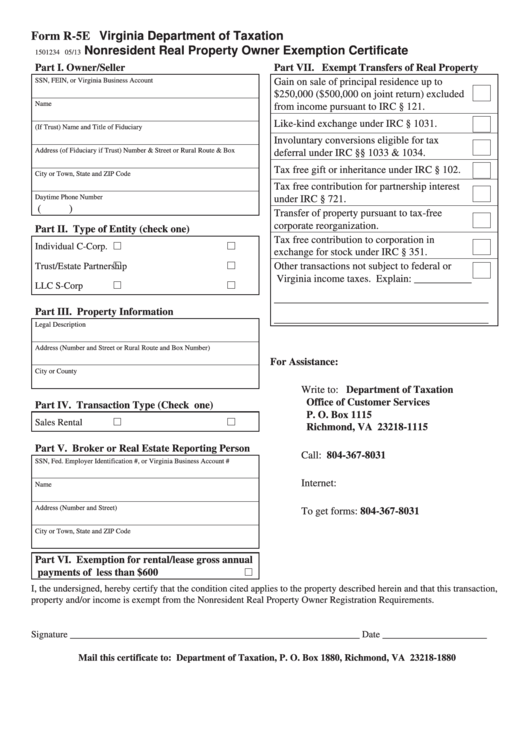

Virginia Department of Taxation

Form R-5E

Nonresident Real Property Owner Exemption Certificate

1501234 05/13

Part I. Owner/Seller

Part VII. Exempt Transfers of Real Property

SSN, FEIN, or Virginia Business Account

Gain on sale of principal residence up to

$250,000 ($500,000 on joint return) excluded

Name

from income pursuant to IRC § 121.

Like-kind exchange under IRC § 1031.

(If Trust) Name and Title of Fiduciary

Involuntary conversions eligible for tax

Address (of Fiduciary if Trust) Number & Street or Rural Route & Box

deferral under IRC §§ 1033 & 1034.

Tax free gift or inheritance under IRC § 102.

City or Town, State and ZIP Code

Tax free contribution for partnership interest

Daytime Phone Number

under IRC § 721.

(

)

Transfer of property pursuant to tax-free

corporate reorganization.

Part II. Type of Entity (check one)

Tax free contribution to corporation in

Individual

C-Corp.

exchange for stock under IRC § 351.

Trust/Estate

Partnership

Other transactions not subject to federal or

Virginia income taxes. Explain: ___________

LLC

S-Corp

_________________________________________

Part III. Property Information

_________________________________________

Legal Description

Address (Number and Street or Rural Route and Box Number)

For Assistance:

City or County

Write to:

Department of Taxation

Office of Customer Services

Part IV. Transaction Type (Check one)

P. O. Box 1115

Sales

Rental

Richmond, VA 23218-1115

Part V. Broker or Real Estate Reporting Person

Call:

804-367-8031

SSN, Fed. Employer Identification #, or Virginia Business Account #

Internet:

Name

Address (Number and Street)

To get forms: 804-367-8031

City or Town, State and ZIP Code

Part VI. Exemption for rental/lease gross annual

payments of less than $600 ...............

I, the undersigned, hereby certify that the condition cited applies to the property described herein and that this transaction,

property and/or income is exempt from the Nonresident Real Property Owner Registration Requirements.

Signature _____________________________________________________________ Date ______________________

Mail this certificate to: Department of Taxation, P. O. Box 1880, Richmond, VA 23218-1880

1

1