Form 3803 - California Parents' Election To Report Child'S Interest And Dividends - 2014

ADVERTISEMENT

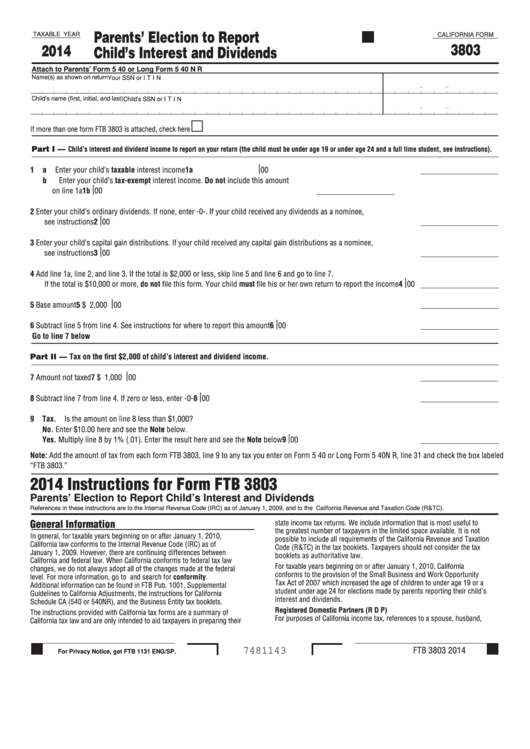

Parents’ Election to Report

TAXABLE YEAR

CALIFORNIA FORM

3803

2014

Child’s Interest and Dividends

Attach to Parents’ Form 5 40 or Long Form 5 40 N R

Name(s) as shown on return

Your SSN or I T I N

-

-

Child’s name (first, initial, and last)

Child’s SSN or I T I N

-

-

If more than one form FTB 3803 is attached, check here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Part I —

Child’s interest and dividend income to report on your return (the child must be under age 19 or under age 24 and a full time student, see instructions).

|

1

a Enter your child’s taxable interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1a

00

b Enter your child’s tax-exempt interest income . Do not include this amount

|

on line 1a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1b

00

2

Enter your child’s ordinary dividends . If none, enter -0- . If your child received any dividends as a nominee,

|

see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2

00

3

Enter your child’s capital gain distributions . If your child received any capital gain distributions as a nominee,

|

see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3

00

4

Add line 1a, line 2, and line 3 . If the total is $2,000 or less, skip line 5 and line 6 and go to line 7 .

|

If the total is $10,000 or more, do not file this form . Your child must file his or her own return to report the income . . . . . .4

00

|

5

Base amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .5

$ 2,000

00

|

6

Subtract line 5 from line 4 . See instructions for where to report this amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6

00

Go to line 7 below

Part II — Tax on the first $2,000 of child’s interest and dividend income.

|

7

Amount not taxed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7

$ 1,000

00

|

8

Subtract line 7 from line 4 . If zero or less, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .8

00

9

Tax. Is the amount on line 8 less than $1,000?

No. Enter $10 .00 here and see the Note below .

|

Yes. Multiply line 8 by 1% ( .01) . Enter the result here and see the Note below . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .9

00

Note: Add the amount of tax from each form FTB 3803, line 9 to any tax you enter on Form 5 40 or Long Form 5 40N R, line 31 and check the box labeled

“FTB 3803 .”

2014 Instructions for Form FTB 3803

Parents’ Election to Report Child’s Interest and Dividends

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2009, and to the California Revenue and Taxation Code (R&TC).

General Information

state income tax returns . We include information that is most useful to

the greatest number of taxpayers in the limited space available . It is not

In general, for taxable years beginning on or after January 1, 2010,

possible to include all requirements of the California Revenue and Taxation

California law conforms to the Internal Revenue Code (IRC) as of

Code (R&TC) in the tax booklets . Taxpayers should not consider the tax

January 1, 2009 . However, there are continuing differences between

booklets as authoritative law .

California and federal law . When California conforms to federal tax law

For taxable years beginning on or after January 1, 2010, California

changes, we do not always adopt all of the changes made at the federal

conforms to the provision of the Small Business and Work Opportunity

level . For more information, go to ftb.ca.gov and search for conformity .

Tax Act of 2007 which increased the age of children to under age 19 or a

Additional information can be found in FTB Pub . 1001, Supplemental

student under age 24 for elections made by parents reporting their child’s

Guidelines to California Adjustments, the instructions for California

interest and dividends .

Schedule CA (540 or 540NR), and the Business Entity tax booklets .

Registered Domestic Partners (R D P)

The instructions provided with California tax forms are a summary of

For purposes of California income tax, references to a spouse, husband,

California tax law and are only intended to aid taxpayers in preparing their

FTB 3803 2014

7481143

For Privacy Notice, get FTB 1131 ENG/SP.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2