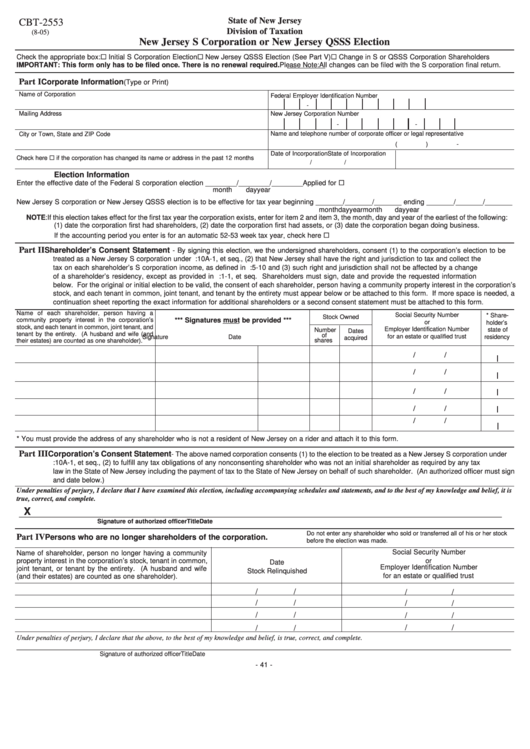

State of New Jersey

CBT-2553

Division of Taxation

(8-05)

New Jersey S Corporation or New Jersey QSSS Election

Check the appropriate box:

Initial S Corporation Election

New Jersey QSSS Election (See Part V)

Change in S or QSSS Corporation Shareholders

IMPORTANT: This form only has to be filed once. There is no renewal required.

Please Note: All changes can be filed with the S corporation final return.

Part I

Corporate Information

(Type or Print)

Name of Corporation

Federal Employer Identification Number

-

Mailing Address

New Jersey Corporation Number

-

-

Name and telephone number of corporate officer or legal representative

City or Town, State and ZIP Code

(

)

-

Date of Incorporation

State of Incorporation

Check here

if the corporation has changed its name or address in the past 12 months

/

/

Election Information

Enter the effective date of the Federal S corporation election ________/________/________

Applied for

month

day

year

New Jersey S corporation or New Jersey QSSS election is to be effective for tax year beginning _______/_______/_______ ending _______/_______/_______

month

day

year

month

day

year

NOTE: If this election takes effect for the first tax year the corporation exists, enter for item 2 and item 3, the month, day and year of the earliest of the following:

(1) date the corporation first had shareholders, (2) date the corporation first had assets, or (3) date the corporation began doing business.

If the accounting period you enter is for an automatic 52-53 week tax year, check here

Part II

Shareholder’s Consent Statement

- By signing this election, we the undersigned shareholders, consent (1) to the corporation’s election to be

treated as a New Jersey S corporation under N.J.S.A. 54:10A-1, et seq., (2) that New Jersey shall have the right and jurisdiction to tax and collect the

tax on each shareholder’s S corporation income, as defined in N.J.S.A. 54A:5-10 and (3) such right and jurisdiction shall not be affected by a change

of a shareholder’s residency, except as provided in N.J.S.A. 54A:1-1, et seq. Shareholders must sign, date and provide the requested information

below. For the original or initial election to be valid, the consent of each shareholder, person having a community property interest in the corporation’s

stock, and each tenant in common, joint tenant, and tenant by the entirety must appear below or be attached to this form. If more space is needed, a

continuation sheet reporting the exact information for additional shareholders or a second consent statement must be attached to this form.

Name of each shareholder, person having a

Social Security Number

* Share-

Stock Owned

community property interest in the corporation’s

*** Signatures must be provided ***

or

holder’s

stock, and each tenant in common, joint tenant, and

Employer Identification Number

Number

state of

Dates

tenant by the entirety. (A husband and wife (and

of

for an estate or qualified trust

Signature

Date

residency

acquired

shares

their estates) are counted as one shareholder).

/

/

/

/

/

/

/

/

/

/

* You must provide the address of any shareholder who is not a resident of New Jersey on a rider and attach it to this form.

Part III

Corporation’s Consent Statement

- The above named corporation consents (1) to the election to be treated as a New Jersey S corporation under

N.J.S.A. 54:10A-1, et seq., (2) to fulfill any tax obligations of any nonconsenting shareholder who was not an initial shareholder as required by any tax

law in the State of New Jersey including the payment of tax to the State of New Jersey on behalf of such shareholder. (An authorized officer must sign

and date below.)

Under penalties of perjury, I declare that I have examined this election, including accompanying schedules and statements, and to the best of my knowledge and belief, it is

true, correct, and complete.

X

____________________________________________________________________________________________________________________________

Signature of authorized officer

Title

Date

Do not enter any shareholder who sold or transferred all of his or her stock

Part IV

Persons who are no longer shareholders of the corporation.

before the election was made.

Social Security Number

Name of shareholder, person no longer having a community

property interest in the corporation’s stock, tenant in common,

or

Date

Employer Identification Number

joint tenant, or tenant by the entirety. (A husband and wife

Stock Relinquished

for an estate or qualified trust

(and their estates) are counted as one shareholder).

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

/

Under penalties of perjury, I declare that the above, to the best of my knowledge and belief, is true, correct, and complete.

_______________________________________________________________________________________________________________________________

Signature of authorized officer

Title

Date

- 41 -

1

1 2

2 3

3 4

4