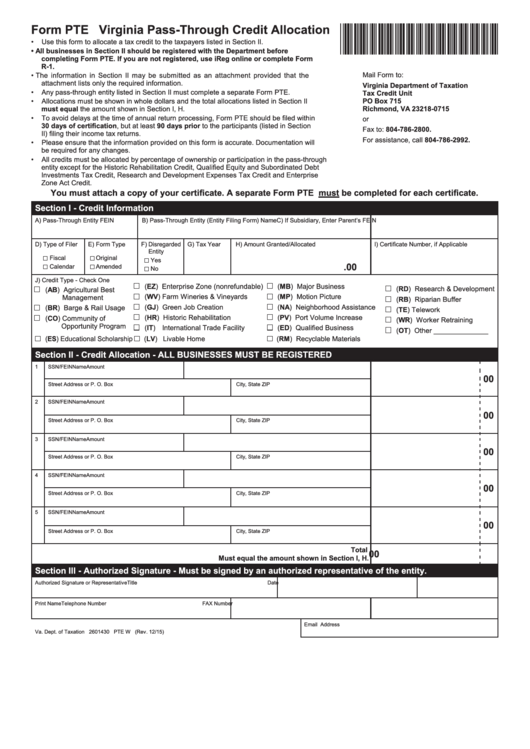

Form PTE Virginia Pass-Through Credit Allocation

*VA0PTC115888*

• Use this form to allocate a tax credit to the taxpayers listed in Section II.

•

All businesses in Section II should be registered with the Department before

completing Form PTE. If you are not registered, use iReg online or complete Form

R-1.

Mail Form to:

• The information in Section II may be submitted as an attachment provided that the

attachment lists only the required information.

Virginia Department of Taxation

• Any pass-through entity listed in Section II must complete a separate Form PTE.

Tax Credit Unit

PO Box 715

• Allocations must be shown in whole dollars and the total allocations listed in Section II

must equal the amount shown in Section I, H.

Richmond, VA 23218-0715

• To avoid delays at the time of annual return processing, Form PTE should be filed within

or

30 days of certification, but at least 90 days prior to the participants (listed in Section

Fax to: 804-786-2800.

II) filing their income tax returns.

For assistance, call 804-786-2992.

• Please ensure that the information provided on this form is accurate. Documentation will

be required for any changes.

• All credits must be allocated by percentage of ownership or participation in the pass-through

entity except for the Historic Rehabilitation Credit, Qualified Equity and Subordinated Debt

Investments Tax Credit, Research and Development Expenses Tax Credit and Enterprise

Zone Act Credit.

You must attach a copy of your certificate. A separate Form PTE must be completed for each certificate.

Section l - Credit Information

A) Pass-Through Entity FEIN

B) Pass-Through Entity (Entity Filing Form) Name

C) If Subsidiary, Enter Parent’s FEIN

D) Type of Filer

E) Form Type

F) Disregarded

G) Tax Year

H) Amount Granted/Allocated

I) Certificate Number, if Applicable

Entity

Fiscal

Original

Yes

.00

Calendar

Amended

No

J) Credit Type - Check One

(EZ) Enterprise Zone (nonrefundable)

(MB) Major Business

(RD) Research & Development

(AB) Agricultural Best

(WV) Farm Wineries & Vineyards

(MP) Motion Picture

Management

(RB) Riparian Buffer

(GJ) Green Job Creation

(NA) Neighborhood Assistance

(BR) Barge & Rail Usage

(TE) Telework

(HR) Historic Rehabilitation

(PV) Port Volume Increase

(CO) Community of

(WR) W orker Retraining

Opportunity Program

(IT) International Trade Facility

(ED) Qualified Business

(OT) Other ______________

(ES) Educational Scholarship

(LV) Livable Home

(RM) Recyclable Materials

Section ll - Credit Allocation - ALL BUSINESSES MUST BE REGISTERED

1

SSN/FEIN

Name

Amount

00

Street Address or P. O. Box

City, State ZIP

2

SSN/FEIN

Name

Amount

00

Street Address or P. O. Box

City, State ZIP

3

SSN/FEIN

Name

Amount

00

Street Address or P. O. Box

City, State ZIP

4

SSN/FEIN

Name

Amount

00

Street Address or P. O. Box

City, State ZIP

5

SSN/FEIN

Name

Amount

00

Street Address or P. O. Box

City, State ZIP

Total

00

Must equal the amount shown in Section l, H.

Section lll - Authorized Signature - Must be signed by an authorized representative of the entity.

Authorized Signature or Representative

Title

Date

Print Name

Telephone Number

FAX Number

Email Address

Va. Dept. of Taxation 2601430 PTE W (Rev. 12/15)

1

1