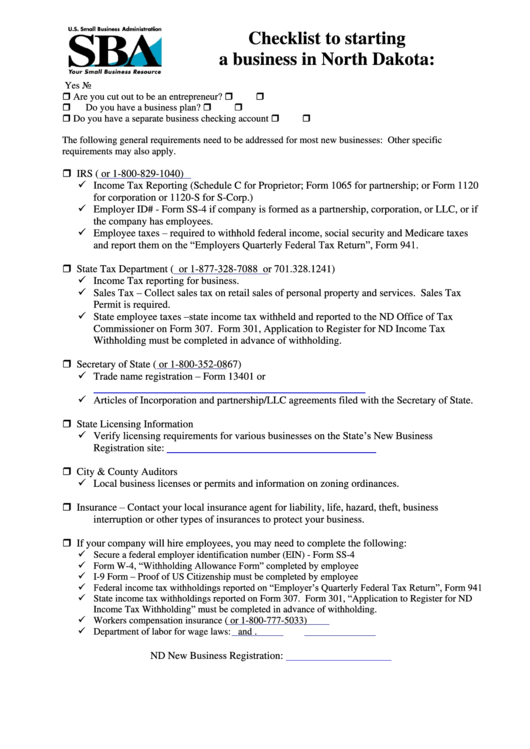

Checklist To Starting A Business In North Dakota

ADVERTISEMENT

Checklist to starting

a business in North Dakota:

Yes

No

Are you cut out to be an entrepreneur?

Do you have a business plan?

Do you have a separate business checking account

The following general requirements need to be addressed for most new businesses: Other specific

requirements may also apply.

IRS

(

or 1-800-829-1040)

Income Tax Reporting (Schedule C for Proprietor; Form 1065 for partnership; or Form 1120

for corporation or 1120-S for S-Corp.)

Employer ID# - Form SS-4 if company is formed as a partnership, corporation, or LLC, or if

the company has employees.

Employee taxes – required to withhold federal income, social security and Medicare taxes

and report them on the “Employers Quarterly Federal Tax Return”, Form 941.

State Tax Department

(

or 1-877-328-7088 or 701.328.1241)

Income Tax reporting for business.

Sales Tax – Collect sales tax on retail sales of personal property and services. Sales Tax

Permit is required.

State employee taxes –state income tax withheld and reported to the ND Office of Tax

Commissioner on Form 307. Form 301, Application to Register for ND Income Tax

Withholding must be completed in advance of withholding.

Secretary of State

(

or 1-800-352-0867)

Trade name registration – Form 13401 or

Articles of Incorporation and partnership/LLC agreements filed with the Secretary of State.

State Licensing Information

Verify licensing requirements for various businesses on the State’s New Business

Registration site:

City & County Auditors

Local business licenses or permits and information on zoning ordinances.

Insurance – Contact your local insurance agent for liability, life, hazard, theft, business

interruption or other types of insurances to protect your business.

If your company will hire employees, you may need to complete the following:

Secure a federal employer identification number (EIN) - Form SS-4

Form W-4, “Withholding Allowance Form” completed by employee

I-9 Form – Proof of US Citizenship must be completed by employee

Federal income tax withholdings reported on “Employer’s Quarterly Federal Tax Return”, Form 941

State income tax withholdings reported on Form 307. Form 301, “Application to Register for ND

Income Tax Withholding” must be completed in advance of withholding.

Workers compensation insurance

(

or 1-800-777-5033)

Department of labor for wage laws:

and

ND New Business Registration:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1