Form Dr-1 - Appeals Form

Download a blank fillable Form Dr-1 - Appeals Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Dr-1 - Appeals Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

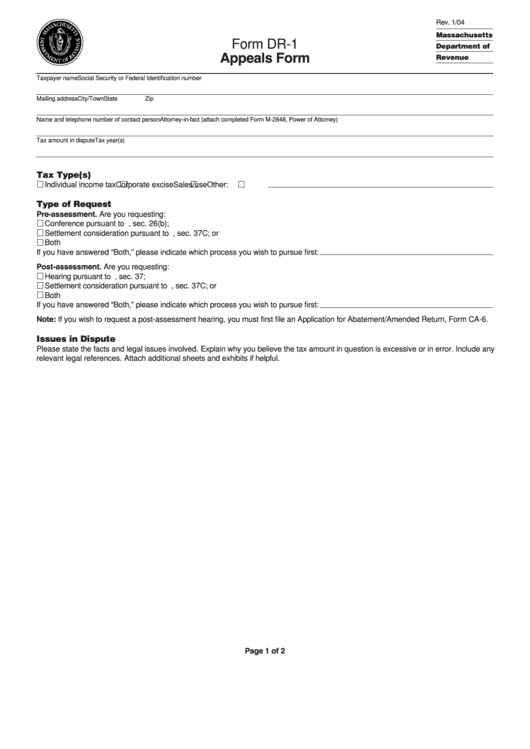

Rev. 1/04

Massachusetts

Form DR-1

Department of

Appeals Form

Revenue

Taxpayer name

Social Security or Federal Identification number

Mailing address

City/Town

State

Zip

Name and telephone number of contact person

Attorney-in-fact (attach completed Form M-2848, Power of Attorney)

Tax amount in dispute

Tax year(s)

Tax Type(s)

Individual income tax

Corporate excise

Sales/use

Other:

Type of Request

Pre-assessment. Are you requesting:

Conference pursuant to G.L. c. 62C, sec. 26(b);

Settlement consideration pursuant to G.L. c. 62C, sec. 37C; or

Both

If you have answered “Both,” please indicate which process you wish to pursue first:

Post-assessment. Are you requesting:

Hearing pursuant to G.L. c. 62C, sec. 37;

Settlement consideration pursuant to G.L. c. 62C, sec. 37C; or

Both

If you have answered “Both,” please indicate which process you wish to pursue first:

Note: If you wish to request a post-assessment hearing, you must first file an Application for Abatement/Amended Return, Form CA-6.

Issues in Dispute

Please state the facts and legal issues involved. Explain why you believe the tax amount in question is excessive or in error. Include any

relevant legal references. Attach additional sheets and exhibits if helpful.

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2