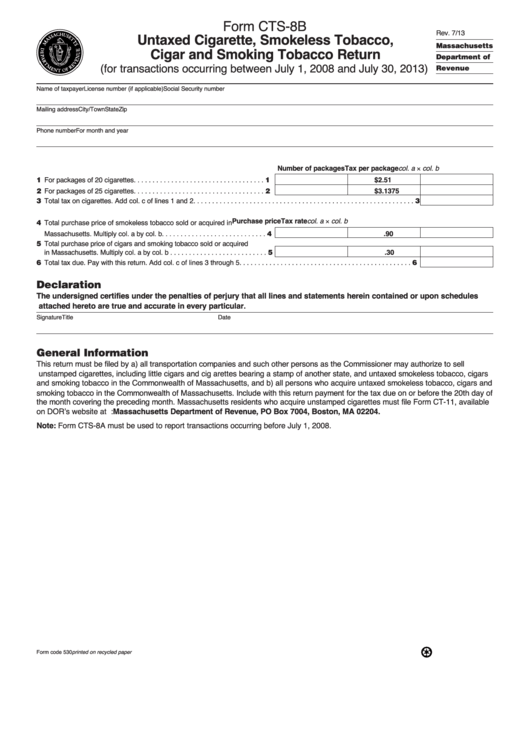

Form CTS-8B

Rev. 7/13

Untaxed Cigarette, Smokeless Tobacco,

Massachusetts

Cigar and Smoking Tobacco Return

Department of

(for transactions occurring between July 1, 2008 and July 30, 2013)

Revenue

Name of taxpayer

License number (if applicable)

Social Security number

Mailing address

City/Town

State

Zip

Phone number

For month and year

a.

b.

c. Total

col. a × col. b

Number of packages

Tax per package

1 For packages of 20 cigarettes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

$2.51

2 For packages of 25 cigarettes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

$3.1375

3 Total tax on cigarettes. Add col. c of lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

a.

b.

c. Total

col. a × col. b

Purchase price

Tax rate

4 Total purchase price of smokeless tobacco sold or acquired in

Massachusetts. Multiply col. a by col. b . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

.90

5 Total purchase price of cigars and smoking tobacco sold or acquired

in Massachusetts. Multiply col. a by col. b . . . . . . . . . . . . . . . . . . . . . . . . . . 5

.30

6 Total tax due. Pay with this return. Add col. c of lines 3 through 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Declaration

The undersigned certifies under the penalties of perjury that all lines and statements herein contained or upon schedules

attached hereto are true and accurate in every particular.

Signature

Title

Date

General Information

This return must be filed by a) all transportation companies and such other persons as the Commissioner may authorize to sell

unstamped cigarettes, including little cigars and cig arettes bearing a stamp of another state, and untaxed smokeless tobacco, cigars

and smoking tobacco in the Commonwealth of Massachusetts, and b) all persons who acquire untaxed smokeless tobacco, cigars and

smoking tobacco in the Commonwealth of Massachusetts. Include with this return payment for the tax due on or before the 20th day of

the month covering the preceding month. Massachusetts residents who acquire unstamped cigarettes must file Form CT-11, available

on DOR’s website at Mail to: Massachusetts Department of Revenue, PO Box 7004, Boston, MA 02204.

Note: Form CTS-8A must be used to report transactions occurring before July 1, 2008.

Form code 530

printed on recycled paper

1

1